CEO,

Grain SA jannie@grainsa.co.za

The other day I listened to an employee who was complaining about a company whose share price had dropped drastically and that even had to suspend trading. In the recent past we have experienced the Steinhoff saga. Many of the agricultural trusts, Agri SA and even Grain SA had invested in Steinhoff and had to deal with the consequences. Some had to deal with major consequences, and others – like Grain SA – with very few.

Yet we are left with a bitter aftertaste. A couple of our listed agriculture-related companies are currently battling with various serious issues. Some of the reasons relate to what is the truth and what is not. The share price of both these companies dropped by about 75%. That is substantial! One of them even ceased trading on the JSE. Chaos.

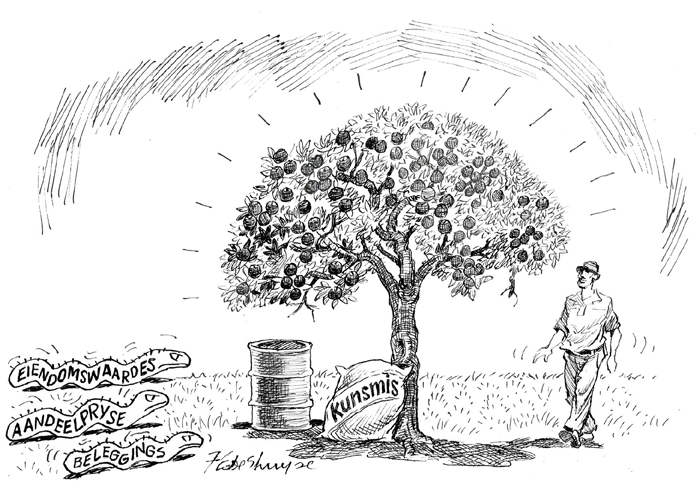

I have not made an in-depth study of the reasons, but it is not difficult to follow the articles in the media in order to understand that the property value in the books of one such company was grossly overvalued. That included their agricultural and other property. The substantial loss in the value of the shares sounds to me like self-imposed expropriation without compensation. However, as we know, the pension money of many innocent people is invested in these shares. Even producers’ surpluses (if there is such a thing!) could have been invested.

We are intensely focused on the government’s expropriation without compensation, but we overlook those who apply it right under our noses. Investors and staff are very much disillusioned. Spare a thought for those people who give everything, day and night, to build and maintain the company’s reputation, just to be disillusioned by people who destroy the value in bad faith or due to ignorance.

Producers are constantly encouraged to diversify by taking up shares in the value chain (inputs and processors). These examples are scary and even make you anxious: Who is next?

How does this affect agriculture and perhaps even your business? We have seen that a ‘reliable’ supplier can one day just stop supplying products and services. Is your business so diversified that you will be able to adapt if one of your input providers no longer exists tomorrow? This applies to all of them – not only those you know are in trouble at the moment.

How does this affect agriculture and perhaps even your business? We have seen that a ‘reliable’ supplier can one day just stop supplying products and services. Is your business so diversified that you will be able to adapt if one of your input providers no longer exists tomorrow? This applies to all of them – not only those you know are in trouble at the moment.

Another example is that a possible buyer of your grain may no longer be able to honour his procurement contracts. These scenarios may be exaggerated, but they are all possible.

Then it gets closer to your farm: How are your properties valued? Are you as the owner directly involved, or is this a function that you delegate to the accounting services? The lessons I have learnt from this are that you as producer must be involved and must check carefully how your input providers, buyers and even your bookkeeper and auditors are faring. It may not be just the government that is on the lookout to see where they can seize something…

Finally, each of us should know what our own and the true value of our loved ones and our support systems is. Do not overvalue yourself when you become involved in conversations – particularly around the fire at a braai and in front of the bank manager. It may just be a costly mistake.

You should also not underestimate the value of your labour force. They are the ones who get up early and late at night to help you farm or put out a fire. After almost 34 years of married life I have also realised what the value of my spouse is. She is there during the good times and the bad. To me her value is far greater than that of pearls. That is a fact.