May 2015

14 April 2015

WANDILE SIHLOBO, economist, Industry Services, Grain SA

There’s a need for increased investments in the South African groundnut industry

Over the past ten years, the South African population showed positive growth. The middle-class has grown and displayed changes in their diets; focussing on more high protein foods such as chicken and meat, consequently increasing the demand for feed (yellow maize and soybeans).

However, these changes have not benefited the groundnut (peanuts) industry. The South African edible groundnut consumption has been decreasing over time, while the market for peanut butter has maintained a relatively stable consumption trend.

The significant decrease in edible groundnut consumption is due to “consumer price sensitivity”, which is indicative of the degree to which consumers’ behaviours are affected by the price of a product. In this article, we briefly explore the groundnut market from a production, consumption and export market perspective.

Production perspective

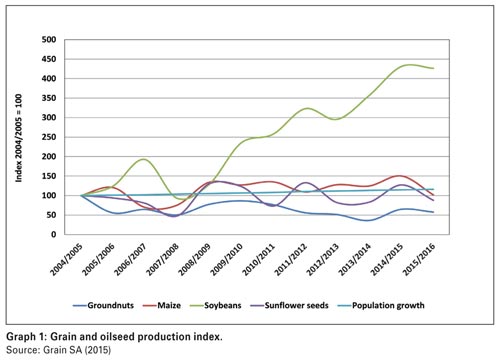

The past ten years has seen a decrease in South Africa’s groundnut production (see Graph 1). However, the previous season showed a slight recovery.

In 2014/2015 South Africa’s groundnut production amounted to 74 500 tons, which is 80% higher than the previous season. This increase was due to an increase in area planted; from 46 900 hectares to 52 125 hectares. However, this was still 35% lower than the 2004/2005 production, which was planted on 71 500 hectares.

In 2015/2016, the groundnut area planted increased by 11% year-on-year, but production is set to fall by 11% year-on-year, due to current drought conditions.

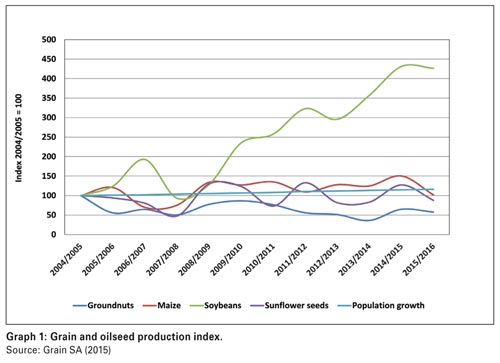

When compared to maize, soybeans and sunflower seed, groundnut production was the only crop that showed a significant production decrease in the past ten years. Out of all the abovementioned crops, soybeans are the only crop that showed exceptional growth, owing to the additional demand created by new crushing plants. Over this same period groundnut yields, relative to other commodities, have been decreasing (see Graph 2), with soybeans and sunflower seed following a similar trend, though to a lesser extent. In contrast, maize continues to show increasing yield gains due to seed varieties, beneficial climatic conditions and other production factors.

Consumption perspective

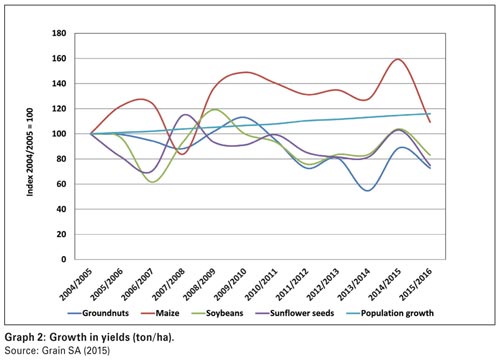

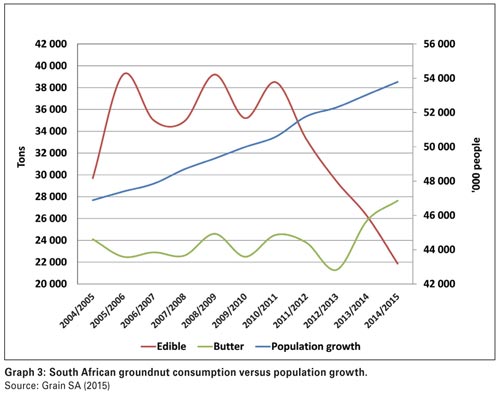

From 2004/2005 to 2015/2016, the South African population grew by 16%, now estimated at 54 million people. This growth, coupled with the increasing middle-class, affected the demand for food and maize; soybean and sunflower yields catered or provided for the increasing domestic consumption. However, the groundnut market is experiencing the opposite. Graph 3 illustrates South Africa’s groundnut consumption against population growth.

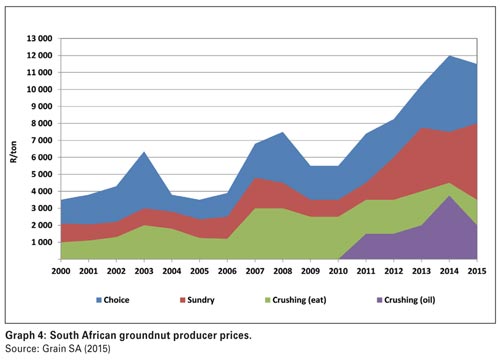

In South Africa, groundnuts are mainly consumed in two forms, as edible nuts as well as processed peanut butter. The peanut butter market consumption has been fairly stable throughout the years, just below 24 000 tons per year. This market grew significantly in 2014/2015, reaching 27 641 tons – a 15% growth from 2004/2005 consumption. The edible groundnut market was fairly stable between 2004/2005 and 2010/2011. It declined significantly with 47% between 2011/2012 and 2014/2015 largely due to increased prices in the domestic edible market (see Graph 4).

From 2000 to 2010, groundnut producer prices traded below R8 000/ton. At the same time the domestic consumption of groundnuts was fairly stable. Prices started increasing in 2010, mainly driven by international price movements on the back of a growing global appetite.

International groundnut prices (US Runner 40/50, Rotterdam prices) increased by 45% between 2000 and 2010; from 4/ton to 284/ton. At the same time, the domestic “choice grade” producer price increased by 57%, from R3 500/ton to R5 500/ton (see Graph 4). Moreover, increasing production costs also added to these price increases.

From 2010 to March 2015, international groundnut prices (US Runner 40/50, Rotterdam prices) increased by 5%. The international markets responded positively to these price increases. According to Oilworld (2015), from 2010 to 2014, global groundnut production increased by 4%. In 2015, global production is expected to decrease, owing to unfavourable climatic conditions in China and India.

From 2010 to March 2015 the domestic prices (choice grade) increased by 109%, from R5 500/ton to R11 500/ton. Producer prices (sundry grade) increased from R3 500/ton to R8 000/ton. Producer prices (crush grade) increased from R2 500/ton to R3 500/ton.

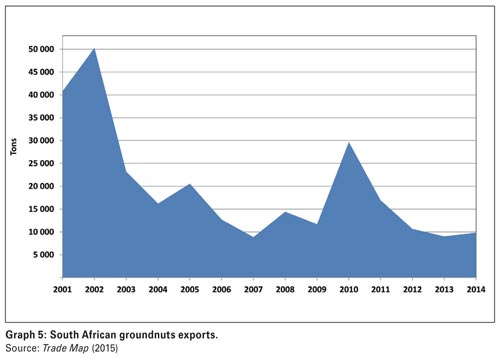

It is important to note that the South African groundnut industry has not directly benefited in the global demand compared to other producing countries. From 2010 to 2014, South Africa’s groundnut exports decreased by 67%, from 29 655 tons in 2010 to 9 844 tons in 2014, according to Trade Map (2015) data (see Graph 5).

South African export perspective

The leading South African markets were Mozambique, Japan, Netherlands, Belgium, Egypt, United Kingdom, Norway and Swaziland.

Exports to these countries were not consistent due to erratic domestic production coupled with international competition.

On the other hand, there has been a 17% decrease on the imported groundnut quantities, from 12 534 tons in 2001 to 10 395 tons in 2014. Over this period, the leading suppliers were Namibia, India, Mozambique, United States, Zambia, Malawi and China.

Conclusion

The South African groundnut industry is confronting a downward consumption trend due to a significant decrease in consumption. South African consumers are highly price-elastic; hence there have been relatively stable groundnut imports (lower prices). In addition, the South African groundnut industry has not performed well internationally due to price competition and erratic production.

International buyers are seen to prefer consistent suppliers, highlighting the need for investment in local/South African high yielding cultivars which will result in the ability of producers to take advantage of the international demand for groundnuts. Finally, higher yields per hectare may allow for more affordable domestic prices in the edible market.

Publication: May 2015

Section: On farm level