agricultural economist, Grain SA

luan@grainsa.co.za

08/08/2019

Hegemony’ is a term which is defined as ‘leadership or dominance, especially by one state or social group over others’. Synonyms for hegemony include words such as dominance, supremacy, authority, control and power.

When speaking about the US-China trade war, the biggest question is whether the trade war is economically driven or a race towards global hegemony. It is well known that the Chinese economy has grown rapidly over the past few years. Together with this good economic growth, the Chinese president Xi Jinping, has claimed that by 2049 China would be fully developed, rich and powerful.

Trade war timeline

Although the impact of the trade war largely started to be felt from around early 2018 when the United States (US) first imposed tariffs on imported Chinese goods, the build-up thereof already began a few years earlier. In 2016, during the US presidential election campaign, Donald Trump already laid out plans to counter ‘unfair trade practices’ from China if he was elected as president.

This was some of the first references to the possibility of a ‘trade war’ between these two countries. Early in 2017, after Trump was inaugurated as president, more focus was placed on the implementation of these plans. During April 2017 Trump and Xi Jinping met and agreed to a 100-day plan for trade talks.

For the rest of 2017 a lot of discussion took place, but the two nations could not reach consensus and the first tariffs on Chinese imports were imposed by the US in early 2018. From thereon, during 2018, it was mostly a tit-for-tat with imposing tariffs between the US and China. The import tariff of 25% on US soybean imports to China was imposed in June 2018.

Soybean trade flow

In the agricultural industry, and more specifically the grain and oilseed industry, the soybean market is the market mostly affected by the trade war.

These two countries are not only the two largest role-players in the soybean industry, but also exact opposites in terms of production and consumption. On average the US is the largest soybean producer in the global context (Brazil will produce more soybeans than the US this year), while China is the largest consumer of soybeans. The soybean trade between these two nations is therefore largely affected as China needs to import soybeans from the US in order to meet their local requirements, while the US needs a market to dispose of their surplus soybean production.

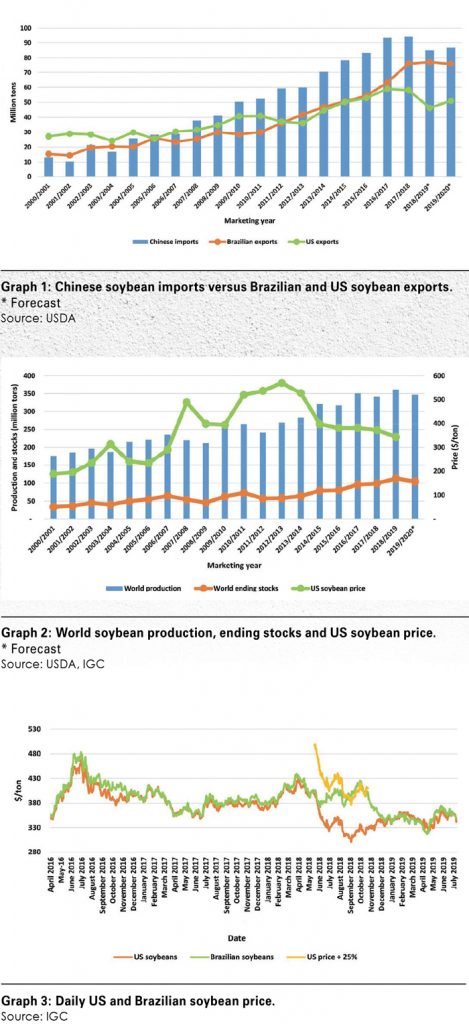

Graph 1 shows the yearly Chinese soybean imports, as well as the yearly US and Brazilian soybean exports. It is clear from Graph 1 that Chinese soybean imports have almost doubled every five to seven years since the 2000/2001 season. Most of the Chinese soybeans were sourced from the US, while Brazil also contributed.

Keeping the trade war timeline in mind, one can deduct that the first reference Trump made towards the ‘unfair trade practices’ from China, was in the middle of the 2015/2016 marketing season. Trump was elected as president during the 2016/2017 marketing season and more focus was put on ‘remedial actions’.

Graph 1 clearly indicates the sharp increase in the Brazilian soybean exports since the 2015/2016 season, while the US soybean exports almost remained unchanged from the 2016/2017 to the 2017/2018 season.

The Chinese imports declined by around 9 million tons from the 2017/2018 season to the 2018/2019 season, while the US soybean exports declined by around 11,8 million tons over the same period. This can mainly be attributed to the trade war.

Global soybean context

Graph 2 indicates the world soybean production, ending stocks and the US soybean price since the 2000/2001 season. World soybean production showed good growth since the early 2000s and increased from around 180 million tons to 350 million tons currently.

Together with the increase in the world production, there was also an increase in the world consumption with the biggest increase recorded in China. However, production increased at a faster rate than consumption, leading to an increase in the world soybean ending stocks. The higher world ending stocks placed the international soybean prices under pressure.

Graph 2 shows that the US soybean prices have been close to a ten-year low for the past four years. The trade war has resulted in even higher stock levels during the 2018/2019 season – especially in the US – which kept the US prices under pressure.

World soybean prices

Graph 3 depicts the daily US and Brazilian soybean prices since April 2016. It is evident from Graph 3 that under normal circumstances the US and Brazilian soybean prices trade fairly close to one another.

Given the timeline of the US-China trade war, the impact can clearly be seen in terms of the price movements.

During June 2018, the Chinese government retaliated with tariffs on imports of US goods after further extensions of the tariffs which were imposed by the US.

The June tariffs imposed by China included a 25% import tariff on US soybean imports. This caused a gap to open up between the US and Brazilian soybean prices. China halted imports of US soybeans and shifted the soybean imports to the Brazilian market. The US soybean prices decreased, while the Brazilian soybean prices found support at the same time.

Graph 3 is a perfect explanation of the functioning of the tariffs in the free market environment. The price difference between US and Brazilian soybeans widened up to a point where the US price plus 25% was relatively the same as the Brazilian soybean price. On the first of December 2018 the US and China agreed on a 90-day halt to new tariffs. China also agreed to start buying products from the US again which included soybeans.

From there on the US and Brazilian soybean prices started to normalise again with very little difference between the two origins.

In conclusion

In conclusion

The trade war between the US and China, the two largest economies in the world, does not only have an impact on these two countries. It has a broader spill-over effect to the global economic environment. When the two giants in world economic terms are fighting, the rest of the world economy suffers. This is especially true for smaller, developing economies such as South Africa.

This ongoing war has thus far resulted in lower economic growth rates in both the US and China. China is a large trading partner for South Africa, specifically in terms of the hard commodities. The lower economic growth rate in China reduces hard commodity exports to that country, negatively affecting the South African business.

The trade war has also led to more uncertainty in the global economic environment. During times of uncertainty investors withdraw their funds from developing economies first.

Despite the predominantly negative effects resulting from the ongoing trade war, it is important to identify the possible opportunities for a country such as South Africa as well. As mentioned earlier, China is the largest consumer of soybeans. With the ongoing trade dispute between them and the US, they will constantly be seeking new suppliers of soybeans.

This provides a golden opportunity for South Africa to expand export opportunities to China (which are already well in progress) as well as local production.

Disclaimer

As far as possible, everything has been done to ensure the accuracy of this information. However, Grain SA accepts no responsibility for any damage or loss that may be suffered due to the use of this information.