October 2015

FLIPPIE CLOETE, Unit for Environmental Science and Management, North-West University

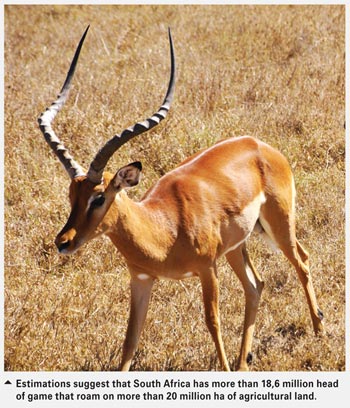

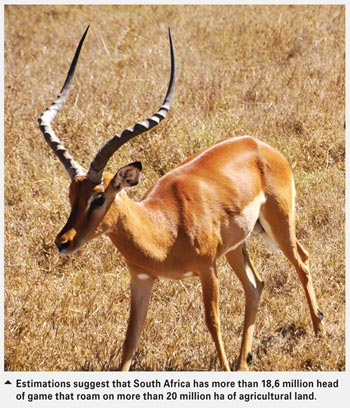

The tremendous growth and development of the game ranching industry is clearly visible throughout South Africa. Not only are fences and other supporting infrastructure springing up all over the country, but estimations suggest that South Africa has more than 18,6 million head of game (Du Toit, 2007) that roam on more than 20 million ha of agricultural land.

The tremendous growth and development of the game ranching industry is clearly visible throughout South Africa. Not only are fences and other supporting infrastructure springing up all over the country, but estimations suggest that South Africa has more than 18,6 million head of game (Du Toit, 2007) that roam on more than 20 million ha of agricultural land.

Though, to date, growth and development within the different segments have largely been uneven and driven primarily by the profitability of the respective segments and/or activities within the different segments. For example, in the early- to late-1990s, innovation and development were focused on the consumptive and non-consumptive utilisation of wildlife.

During this period, the industry prospered on the back of economic and ecological benefits that were realised through hunting, eco-tourism and related activities. Since the early- to mid-2000s, the focus shifted towards the breeding of higher value and/or colour and morphological variants.

More recently, the breeding of exceptional genetic quality animals (irrespective of whether it is higher value, colour and/or morphological variants or plain game) have also come to the fore. As a result, developments during the past decade have been primarily focused on supporting the live breeding segment, i.e. research and development in terms of breeding practices, veterinary services, pharmaceuticals, capture and translocation, supplement feeding and auction platforms.

Economic contribution

Currently, the economic contribution from the live game breeding and supported industries is estimated to be well in excess of R10 billion, notably more than the contribution from hunting (Cloete et al., 2015).

The value of game animals sold on formal auctions alone has increased from R93 million in 2005 to more than R1,8 billion in 2014 – an estimated average annual increase of 26% over the past nine years. However, it is unlikely that the growth rate of the past will be repeated in the future.

Current prices and the successive profitability of live breeding, especially in terms of higher value and/or colour and morphological variants, are likely to decline in future; once supply exceeds demand. Although live breeding will remain central in terms of economic contribution and the successive growth of the game ranching industry, it is expected that the growth rate and the successive contribution from the specific segment will be lower in future.

Notable growth was also reported by the hunting segment of the game ranching industry since the mid-2000s – growing from an estimated R3,1 billion in 2005 to R6,3 billion in 2013 (Van der Merwe and Saayman, 2005; 2013).

From a local (biltong) hunting perspective, the growth in economic value was mainly due to an increase in related spending (i.e. food, fuel, accommodation and ammunition) and not so much as a result of an increase in animal prices or in terms of the number of animals hunted.

From 2005 to 2013, related spending by biltong hunters has increased threefold (300%) compared to an increase of 25% in terms of the spending on animals. On the contrary, the number of animals hunted by local hunters declined by 12% from 2005 to 2013.

Trophy hunting

A similar trend was visible in terms of trophy hunting with a 37% decline in the number of animals hunted from 2007 to 2012. The latter is coupled with a notable decline in the number of foreign hunters visiting South Africa, from just over 16 000 foreign hunters in 2007 (before the economic crisis) to around 9 000 foreign hunters in 2012 (Phasa, undated).

Factors such as the changes in the firearms act of 2004 and the successive growth in the Namibian hunting industry as well as the economic crisis all contributed towards the decline. However, it is unclear whether other factors such as perceptions and/or social pressure resulting from negative media attention and the shift in ranching practices had an influence on the decline, and if so, to what extent? It is clearly something that needs the attention of the industry with a continuous decline in the number of foreign hunters that will hamper the growth potential of not only the segment, but the industry as a whole.

Utilisation of game animals

Based on the available data, it is estimated that the consumptive utilisation of game animals in South Africa is unlikely to exceed 70% of the annual progeny, which suggests a healthy population growth rate.

Game numbers are constantly on the increase and so is the number of hectares dedicated to game ranching. However, this emphasises the need for future development in terms of not only ensuring the growth of well-established consumptive markets, but also establishing new consumptive market opportunities to ensure game ranching remains an economically viable land use option.

New market development

Utilising the opportunities presented by game meat is most probably the key in terms of new market development and/or expansion in the quest to ensure the continuous growth and sustainability of the game ranching industry in South Africa.

Although a notable percentage of the red meat consumed in South Africa is game meat, the market is largely undeveloped and many consumers consume game meat unknowingly. Future growth expectations rely heavily on developments in terms of game meat.

At the same time, cohesive growth and development will be central in terms of ensuring the future sustainability of the industry. The different segments of the game ranching industry cannot function in isolation and unlike the past, the success of the future will depend on how successful the industry can grow the different segments proportionally to each other. The latter will require that future growth and development be guided by the principles of long-term sustainability and not by potential short-term gains that may be at the cost of other segments in the industry.

Game ranching in South Africa is unique, not only in terms of species diversity, but also in terms of our institutional environment, i.e. South Africa is one of only a few countries in the world where condition ownership of wildlife is vested with private landowners, which presents game ranchers with a comparative advantage second to none – there is no reason why game ranching cannot become or remain one of the leading agricultural land use options in the years to come.

With the aforementioned in mind, the growth potential of the industry is ample; however, it will be difficult to sustain the robust growth rates of the past. The industry is likely to report a more moderate growth rate in the years to come.

References

Cloete, P.C., Van der Merwe, P. & Saayman, M. 2015. In Press. Profitability of the game ranching industry in South Africa, Second edition. Pretoria: Caxton Publishers.

Du Toit, J.G. 2007. Role of the private sector in the wildlife industry. Pretoria: Wildlife Ranching SA/Du Toit Wilddienste.

Professional Hunters Association of South Africa (Phasa). Undated. Professional hunting statistics, Unpublished Statistics.

Van der Merwe, P. & Saayman, M. 2005. Market profile and economic impact of biltong hunters in South Africa, Institute for Tourism and Leisure Studies, North-West University, Potchefstroom.

Van der Merwe, P. & Saayman, M. 2013. Market profile and economic impact of biltong hunters in South Africa. Unit for Tourism, Research Economics, Environs & Society. North-West University, Potchefstroom.

Publication: October 2015

Section: Focus on