May 2017

HESNA RHEEDER and JAN COETSEE, PricewaterhouseCoopers

Many trusts are established for bona fide estate planning purposes. These may include protection of assets from creditors, protection against spendthrift beneficiaries, flexibility, and continuity or in aid of benevolent purposes (public benefit organisations) to name a few.

Typically, the estate planner would transfer growth assets to the trust on a loan account. The trust, often set up as a discretionary trust, would then invest these assets. By doing this the founder has pegged his estate value at the value of the outstanding loan. The said loan is the only asset that will attract estate duty in the event of the founder’s death.

All future growth is accrued within the trust and because a trust is not a natural person (but rather a legal person or entity) for estate duty purposes, no estate duty can be levied on assets held by a trust. The Estate Duty Act only deals with assets that were owned by the deceased or which are deemed to be part of the deceased’s estate.

Additionally, by funding the trust through an interest-free loan agreement, potential donations tax is avoided. Eradicating these benefits, it would seem, is the main driver behind the new Section 7C to the Income Tax Act.

The new rule

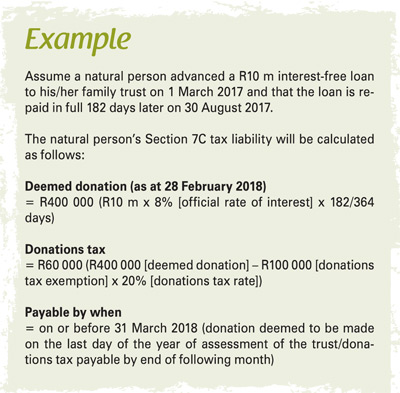

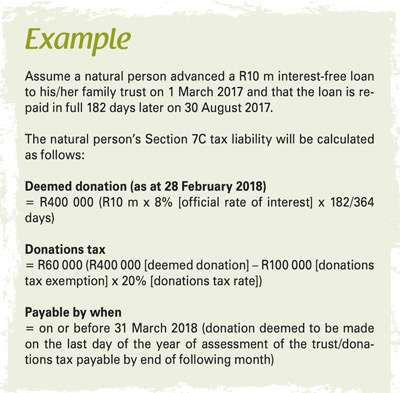

The Taxation Laws Amendment Bill 2016 introduced a new antiavoidance measure in the context of low-interest or interest-free loans made to trusts. The purpose is to address the avoidance of donations tax and estate duty through the transfer of assets to trust on loan account. The new Section 7C of the Income Tax Act will deem the interest foregone to be a deemed donation and the donor will be liable for donations tax on the deemed donation.

The intention is to subject the transfer of assets to either donationstax (life-time transfers) or estate duty (transfers on death), not both. Section 7C, therefore, addresses this and ensures that the benefit of an interest-free or low-interest loan to a trust is subjected to donations tax.

Application

Section 7C will generally apply where a natural person or a connected person in relation to that natural person foregoes interest on a loan made by that person to a trust. In terms of the section, interest will be regarded as having been foregone when, during a year of assessment, either no interest is incurred by the trust on the loan, or the interest incurred on the loan is incurred by the trust at a rate lower than the official rate (currently 8%).

The amount of interest foregone will therefore be calculated as the difference between the amounts of interest that would have been incurred had interest been incurred at the official rate and the amount of interest actually incurred by the trust.

Effect

The amount of any interest foregone as described above will be treated as a donation made to that trust on the last day of the trust’s year of assessment. As a donation, that amount will be subject to donations tax, which is levied at a rate of 20%.

However, the R100 000 annual donation tax exemption will still be available to be utilised in respect of the deemed donation, together with any other donations (including casual gifts).

The new section is effective from 1 March 2017 and applies to any loan made to a trust in the prescribed circumstance, irrespective of when the loan was advanced (i.e. irrespective of whether the loan was advanced before, on, or after 1 March 2017).

Exemptions

The purpose of Section 7C is to target a specific type of mischief, i.e. the transfer of wealth by a natural person to a trust. Trusts are, however, used for a variety of other purposes where such mischief is not an issue.

Section 7C therefore makes provisions for a number of exemptions from the application of the deeming provisions:

- PBO trusts: Public Benefit Organisations.

- Section 30C trusts: These trusts are created to assist with the funding of small businesses, also known as small business funding entities.

- Vesting trusts: The loan, advance or credit was provided to the trust by a person for reason of or in return for a vested interest held by that person in receipts and accruals and assets of that trust and:

- The beneficiaries of the trust hold in aggregate a vested interest in all the receipts, accruals and assets of the trust.

- No beneficiary can in terms of the trust deed hold or acquire an interest in the trust other than a vested interest as envisaged above.

- The vested interest of the beneficiary is determined solely with reference and in proportion to the assets, services or funding contributed by that beneficiary to the trust.

- None of the vested interests are subject to a discretionary power conferred on any person in terms of which that interest can be varied or revoked.

- Special trusts: A trust solely for the benefit of one or more persons who are persons with a disability, where such disability incapacitates such a person or persons from earning sufficient income for their maintenance or from managing their own financial affairs.

- Primary resident trusts: The loan was wholly or partly used for purposes of funding the acquisition of an asset, which asset was used, throughout the year of assessment, by the person granting the loan or the spouse of that person as a primary residence and the amount owed relates to the part of the loan, advance or credit, that funded the acquisition of that asset.

- Transfer pricing, Section 31: If transfer pricing is applicable no deeming of donation will apply – no ‘double taxation’ on the same event.

- Shariah financing: Financing structures that are Shariah compliant.

- Deemed dividend, Section 64E(4): Where the loan was made to the trust by a company and is deemed to be a dividend by the company to the trust.

The implementation of the new Section 7C will have negative consequences for interest-free loans to trusts. We strongly advise that individuals who find themselves within the ambit of Section 7C to seek professional advice before making any hasty decisions.

Each case must be judged on its own merits and facts to establish an appropriate plan of action. Any aggressive structuring in an attempt to minimise the negative consequences of Section 7C must be weighed against the General Anti-Avoidance Rule (GAAR).

Trusts are still valuable estate planning vehicles, but careful consideration must be given on how to ‘fund’ trusts going forward. Lastly, tax should not be seen as the primary driver in any estate planning endeavour; rather, cognisance should be given to the fiscal consequences of the chosen structure and appropriate measures must be put in place to address any liquidity constraints.

For more information contact Ms Hesna Rheeder at hesna.rheeder@pwc.com or Mr Jan Coetsee at jan.coetsee@pwc.com.

This article is provided by PricewaterhouseCoopers Tax Services (Pty) Ltd for information only, and does not constitute the provision of professional advice of any kind. The information provided herein should not be used as a substitute for consultation with professional advisers. Before making any decision or taking any action, you should consult a professional adviser who has been provided with all the pertinent facts relevant to your particular situation.

No responsibility for loss occasioned to any person acting or refraining from acting as a result of using the information in this article can be accepted by PricewaterhouseCoopers Tax Services (Pty) Ltd, PricewaterhouseCoopers Inc or any of the directors, partners, employees, sub-contractors or agents of Pricewaterhouse- Coopers Tax Services (Pty) Ltd, PricewaterhouseCoopers Inc or any other PwC entity.

© 2017 PricewaterhouseCoopers (PwC), a South African firm, PwC is part of the PricewaterhouseCoopers International Limited (PwCIL) network that consists of separate and independent legal entities that do not act as agents of PwCIL or any other member firm, nor is PwCIL or the separate firms responsible or liable for the acts or omissions of each other in any way. No portion of this document may be reproduced by any process without the written permission of PwC.

Publication: May 2017

Section: Focus on