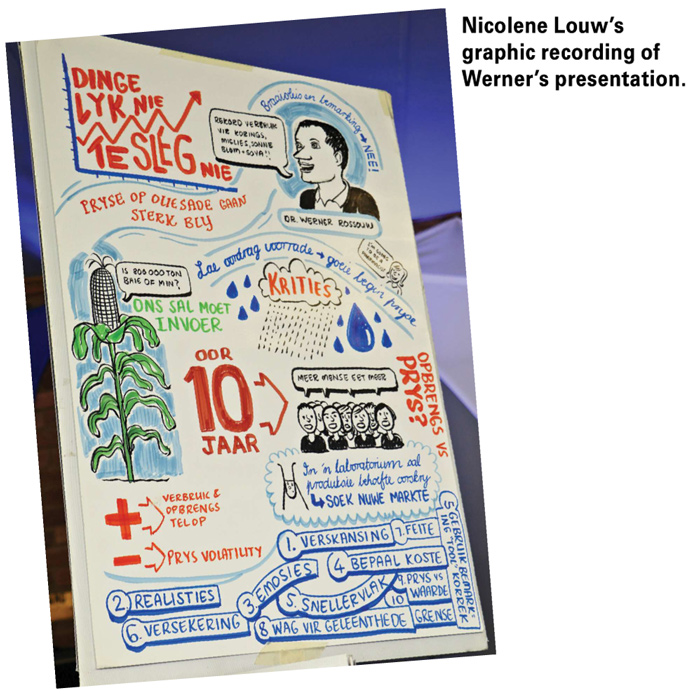

Dr Werner Rossouw, a grain trader and director of Silostrat, addressed the Grain SA Congress on lessons to be learned in the grain trading environment. He had Congress delegates hanging on his every word during his presentation.

Current season 2018/2019

He began by sharing the good news that local demand for grain crops would be attaining record highs by the end of this season (April 2019). Projections suggest a record consumption of all grain commodities produced.

Maize

Record consumption at 11 045 285 tons this season (compared to 6 594 000 tons local consumption in 1997/1998).

Wheat

Consumption of 3,3 million tons (compared to 2,4 million tons at the end of the nineties).

Sunflower

This season has seen a record internal consumption of 906 249 tons (end of February 2019).

Soybeans

Soybeans

By the end of the nineties South Africa was pressing 212 300 tons soybeans. The latest consumption statistics by 2018/2019 reached record highs of 1 343 349 tons (season ending February 2019).

Interesting facts

A quick glance over all the grain commodities reveals the following interesting facts:

Wheat

Wheat prices look set to remain at import parity. There are sufficient world stocks leading to a sideways international market. Rand volatility will impact prices and current prices compare well to historical prices.

Oil seeds

- South Africa consumes 1,4 million tons of edible oil each year. This is spread between sunflowers and soybeans = 850 000 metric ton; palm oil = 400 000 metric ton and 150 000 metric ton (other oil seeds).

- Record crush volumes combined with a smaller crop resulted in low ending stocks.

- Record crush numbers on soybeans and lower crush on sunflowers led to imports of sunflower seed, oil and oil cake. Prices should remain strong with limited upside.

Maize

Dr Rossouw highlighted the rainfall figures at five Silostrat depots in the western Free State as a percentage of the past five years (measured 1 September 2018 to 28 February 2019):

- Welkom – 49%

- Bultfontein – 72%

- Hertzogville – 59%

- Hoopstad – 55%

- Bothaville – 56%.

He went on to warn that the rainfall predictions for the weekend of 9 to 10 March were critical for this year’s harvest. Apart from Bultfontein, all these depots have had less rain so far in the season than during the 2015/2016 drought. In summary, the demand for maize is good. Yields may still vary and impact ending stocks of 30 April 2019. White maize should trade consistently at >R200 above yellow maize to prevent white maize flowing into the feed market.

Low carry-over stocks on all commodities should ensure that prices will be good from the outset into the new season.

Looking forward to the next ten years

Local consumption

Taking population growth trends into consideration, Dr Rossouw says projections reflect an increased demand for maize over the next ten years and it is likely to reach 12 651 333 tons p/a by 2027/2028. This is up from 11 000 000 tons consumed at present.

Production

South African maize yield/ha has increased steadily from 1997/1998 from 2,4 t/ha to 5,4 t/ha in 2017/2018 with a steady average over 20 years of 3,98 t/ha. The average yield per hectare has climbed significantly in recent years:

- The last 15 years years’ average: 4,43 t/ha

- The last ten years years’ average: 4,75 t/ha

- The past five years years’ average: 4,97 t/ha (including the three best harvests in our history namely, 2014, 2017 and 2018 – but also two of the worst – 2015 and 2016)

- The past three years’ yield average: 5,26 t/ha.

In ideal conditions, projections based on these figures suggest that together with improved genetics and better farming practices one can anticipate a steady increase in yield of 0,14 t/ha each year. Projected yields over the next ten years then are:

- 2019/2020: 5,70 t/ha

- 2024/2025: 6,40 t/ha

- 2028/2029: 6,96 t/ha.

Production less than local demand

Over the past 23 years (since the implementation of the free market system in the country), South Africa has only seen five seasons where less maize was produced than was needed to meet local demand. It is likely that 2018/2019 will be another season in which we produce less than local demand. Notably three of these seasons have occurred in the last five years.

Area planted under maize

Area planted under maize

The ten-year average planting of maize is 2 525 785 ha. The ten-year estimates as projected suggest that at continued pace of growth and in ideal conditions, maize production on hectares planted will consistently exceed local demand.

We will only produce less than local demand if we drastically reduce hectares planted under maize or if the season is unfavourable due to drought. This is a critical consideration and gives impetus to the urgency to find new markets for our maize.

Impact of crop size on price

In ‘normal’ years prices are in the bottom half of parity price range. In years where there have been reduced planting and/or lower yields, prices have climbed to the top half of parity price range.

Positive news for producers today

On the positive side, according to Dr Rossouw, demand for all grain commodities is climbing steadily, there is low carry-over stocks on all commodities and yields are increasing.

Concerns

However, some concerns are that price volatility is high and will stay high and that the long-term profitability of producers are uncertain.

10 tips for producers towards profitability

- There is a difference between hedging and speculating. Does your strategy increase risk or reduce it?

- Have realistic expectations. Research done by the University of Illinois in the USA has shown that 67% of producers sell their maize in the lower third of the price range; but that two thirds of the buyers buy their maize in the top third of the price range. Be realistic: One should not always aim for the top price every time. It’s important to realise that consistently achieving an average to above average price is good enough.

- The biggest threat to effective hedging is emotion. Be very careful how you gather information on social media, do proper research and check the facts.

- Know your cost of production – too many producers don’t really know what the crop has cost them just to produce it.

- Calculate your ‘trigger level’. Trigger levels protect profits. This is a calculated price of total costs – letting you know when to start hedging.

- Make use of market instruments to help you reduce your risks.

- Obtain accurate marketing information – react to facts not opinions heard around the fire at a braai.

- Markets always give opportunities to both buyers and sellers…if you are willing to wait.

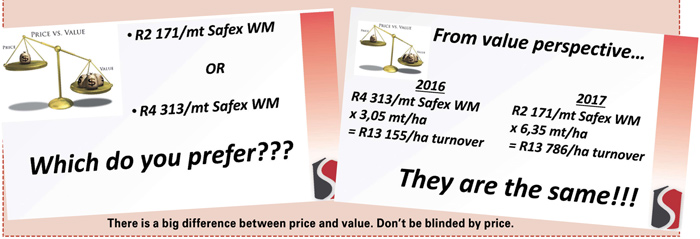

- There is a big difference between price and value. Don’t be blinded by price.

- Know (and react to) fundamental price ranges. Be informed about import and export parity and other instruments of the market like Safex.