April 2015

17 March 2015

WESSEL LEMMER, senior economist: Industry Services, Grain SA

The impact of drought and early deliveries on the supply of maize

– for the March/February reporting period

Role-players in the grain industry was shocked on 26 February by the National Crop Estimates Committee’s prediction that the drought may lead to a decline of 31% in maize production compared to the previous year’s bumper crop.

High retail prices may impact the ultimate consumption of maize, early deliveries during March and April 2016 can decrease the need for imports and follow-up crop estimates may also significantly impact the demand for additional or less imports. In this article we give a perspective on the possible outcomes.

Impact on staple foods and animal feeds

The Supply and Demand Estimates Committee, under the auspices of the National Agricultural Marketing Council (NAMC), followed with a press release on 4 March stating: “The current drought conditions that is widespread in South Africa’s grain production areas can severely impact on the availability of one of South Africa’s major staple foods, namely white maize, as well as on yellow maize that is crucial in the livestock industry. The availability of maize in turn affects prices of maize and hence the price of maize meal and animal feeds.”

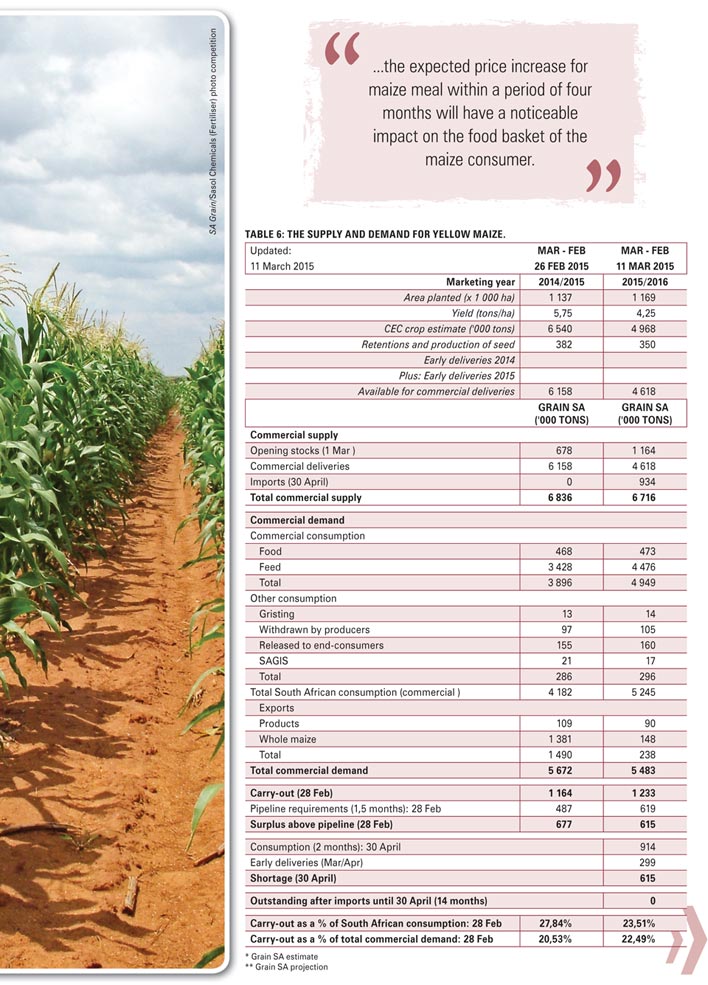

Significant imports needed

The Supply and Demand Estimates Committee estimated that South Africa will have to import approximately 600 000 tons of yellow maize from March 2015 to April 2016. According to the Committee it is possible that the current estimated imports of yellow maize could increase to around 900 000 tons. “There are some concerns regarding white maize stocks, which, according to the estimates will be 34 days (one month), but cognisance should be taken that around 350 000 tons were estimated to be used in the industrial and animal feed market. If this situation changes, i.e. it is used for human consumption, the situation will improve, but will translate into additional imports of yellow maize.

“Thus, it is possible that the current estimated imports of yellow maize could increase to around 900 000 tons. However, market dynamics, especially the availability of international yellow maize stocks and the interplay between white and yellow maize prices, will determine the level of substitution taking place.”

NAMC assumptions

The NAMC’s estimate is based on the underlying assumption that:

- South Africa typically operates on a 45 days pipeline in terms of available stocks.

- The major factor that is affecting white maize demand is that it will mainly be utilised in the human market, whereas a significant portion was allocated to the animal feed market during the past season.

- Yellow maize demand continues to increase on the back of a growing demand for animal feed.

- White maize exports remain more or less the same based on regional demand, but there is a significant drop in the exports of yellow maize (in particular deep sea exports).

Access to objective information is crucial

Grain SA fully supports the work of the Grain and Oilseeds Supply and Demand Estimates Liaison Committee (comprising stakeholders in the grain industry) and the Grain and Oilseeds Supply and Demand Estimates Committee.

As stated, the drought has an impact on food security and the socio-political economic climate of South Africa. It is very important to have access to objective and reliable information, as the relentless price volatility experienced is mainly passed on to the producer. Objective information is now very important as different versions of supply and demand estimates circles around in industry and may create confusion among producers and may impact their marketing decisions.

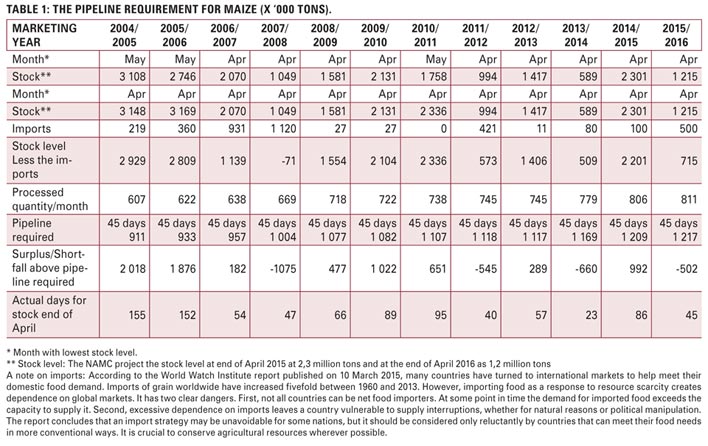

The historical pipeline requirement

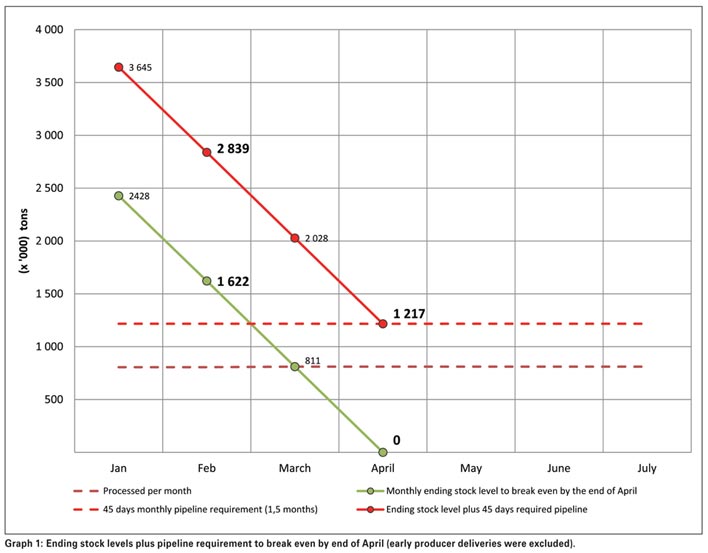

South Africa operates on a 45 days pipeline. The 45 days pipeline number is useful to determine if it is going to be necessary to import maize in the projected supply and demand for the following year.

It is indicated for example in Table 1 that the shortfall required above the pipeline will necessitate the importation of about 1 075 000 tons in the 2007/2008 marketing year. An actual number of 1 120 000 tons of maize were imported.

A similar situation occurred in 2011/2012 and is expected to occur in 2015/2016. Since 2007/2008 it seems as if processors are more comfortable lately with a tight pipeline requirement. For instance, during the 2013/2014 marketing year it was expected that 660 000 tons of maize should be imported, but imports of only 80 000 tons realised.

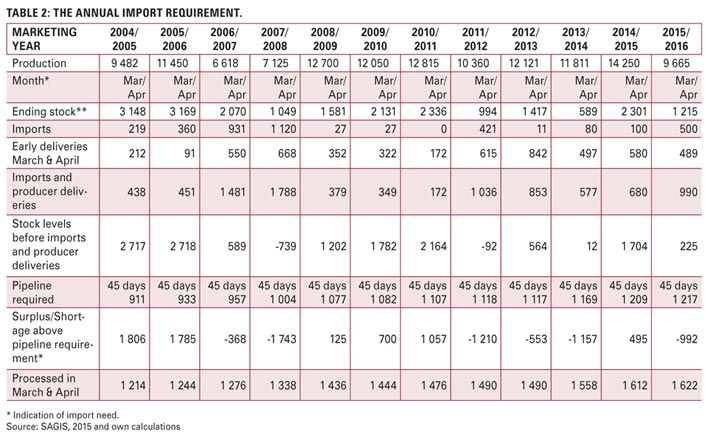

What is the impact of early deliveries during March and April on stock levels at the end of April?

The early deliveries of maize for March and April varied between 91 000 tons and 842 000 tons over the past ten years.

The marketing years suffering the lowest stock levels include 2007/2008, 2011/2012 and 2013/2014.

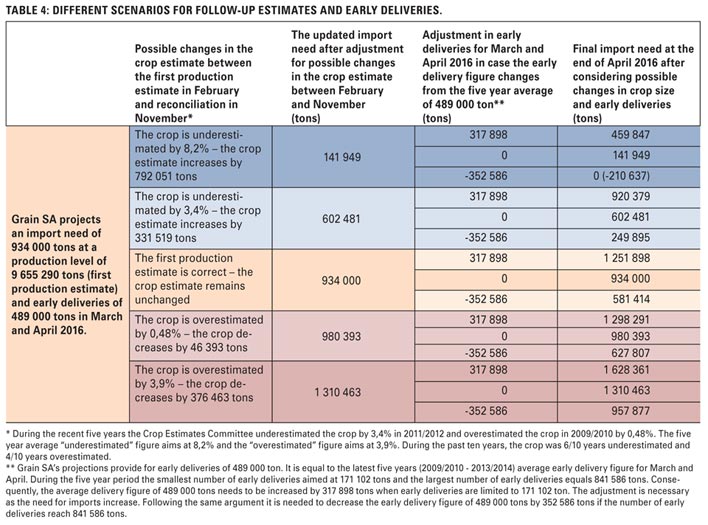

Early deliveries and imports made a significant contribution to stock levels. The early deliveries during drought or lower production seasons were 212 000 tons (2004/2005), 550 000 tons (2006/2007) and 668 000 tons (2007/2008). Grain SA used a five-year average early delivery figure of 490 000 tons for March and April 2015/2016 in determining the import need of 934 000 tons.

The early deliveries went as low as 91 000 tons in 2005/2006 and increased as high as 842 000 tons in 2012/2013. There is no significant correlation between the early delivery figure and the ultimate production volumes for the same marketing year or production season for the past ten years. The early delivery figure for March and April each year is thus a total uncertainty.

Imports of 934 000 tons are expected with an early delivery figure of 489 000 tons. Therefore, if the early deliveries reach only 91 000 tons it is expected that imports may aim at 1 332 000 tons. If early deliveries reach a figure of 842 000 tons, imports may aim at only 581 000 tons.

Change in marketing years

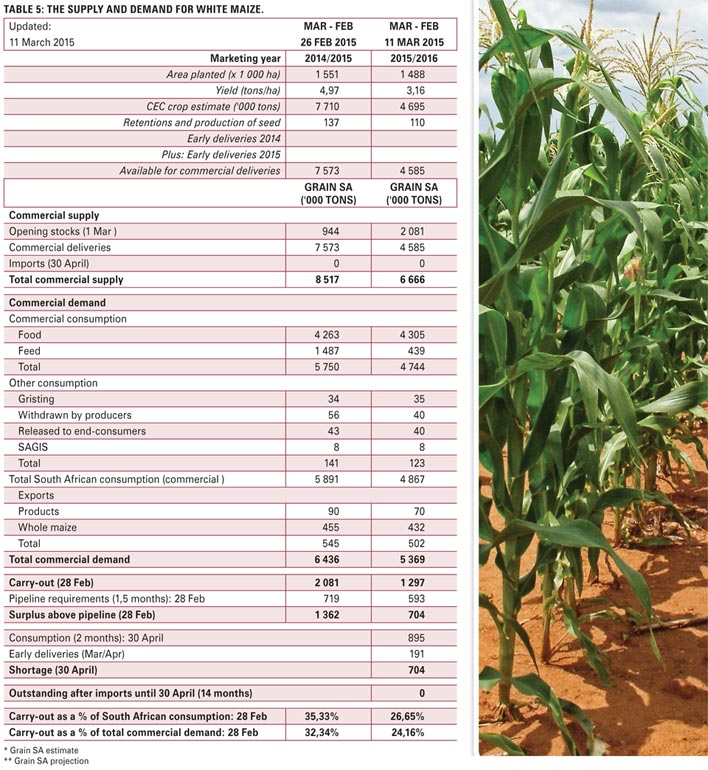

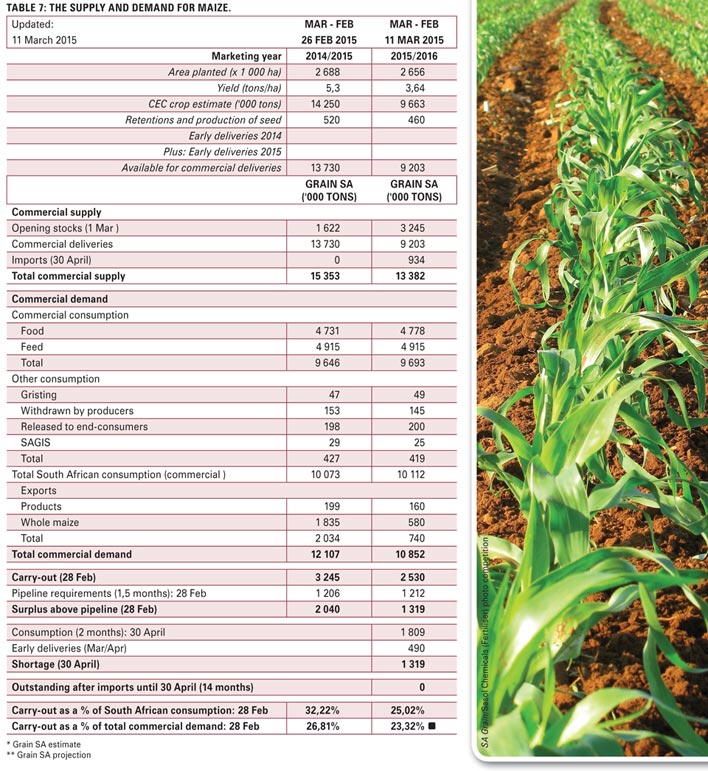

Grain SA took the decision to report on supply and demand factors over a marketing period which stretches from March to February instead of May to April. (See also our Supply and Demand estimates in Table 5, Table 6 and Table 7.) The main purpose of the change is to eliminate the impact of uncertain early deliveries during March and April on the supply and demand of maize.

However, the following needs to be understood:

- By changing the reporting period, early deliveries still remain. It does not disappear.

- The pipeline requirement of 45 days, as defined by millers, stays the same. It does not increase by two months or 60 days because of the change in the reporting period.

- The 45 days pipeline requirement is very important in determining the import needs of the country. As soon as it seems that the projected stock levels will be insufficient to cover the 45 days required pipeline, imports are considered by role-players and prices trend towards import parity.

- Take note that stock levels were the lowest during April, but on occasion even May. Therefore the available stocks were measured against a breakeven point above the pipeline requirement of 45 days on 30 April of each year.

- The pipeline requirement of 45 days needs to break even with consumption on 30 April at 0. Therefore the pipeline requirement of 45 days on the 28th of February needs to break even with the remaining consumption for two additional months until breaking even on 30 April.

- Lastly, early deliveries during March and April decrease the pipeline requirement of 45 days to break even at the end of April.

It can be graphically illustrated as shown in Graph 1.

Population growth and maize demand

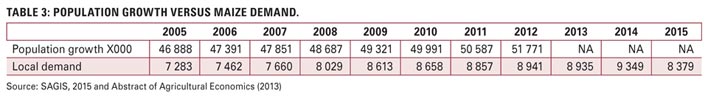

The Abstract of Agricultural Economics database indicates that South Africa’s population growth increases by 1,3% per year. SAGIS data indicate a growth in consumption of about 2,8% per year. See Table 3.

According to the NAMC, for every 1% increase in the price of maize, the price of maize meal only increases by 0,33%. The price increase in maize meal also took place with a lag of four months after the price of maize starts to increase.

Prices of maize meal start to recover after about eight months since the price of maize started to decline. Therefore it can be expected that the increase in maize prices during February will lead to higher maize meal prices from June onwards. The limitation on available white maize for the feed market was substituted with possible yellow maize imports.

According to a study by the NAMC, the price of maize meal increases by 0,33% for every 1% increase in the price of maize. The average white maize price during January aimed at R2 019/ton.

The average price in February increased to R2 553/ton due to the drought. The difference represents an increase of about R534/ton or 26%. Based on these assumptions, the price of maize meal is projected to increase between 8% and 9%. The minimum wage increase was 6%. It is clear that the expected price increase for maize meal within a period of four months will have a noticeable impact on the food basket of the maize consumer.

Yellow maize is mainly used partially as an ingredient in animal feeds. The yellow maize price increased from R2 026/ton in January to R2 317/ton (+14%) in February – an increase of R291/ton. If the same is true for maize meal in the feed industry, it can be expected that the price of maize meal will increase between 4% and 5% delivered to the animal feed manufacturer.

Yellow maize meal is a partial ingredient in many feed rations; in some cases up to 60%, which means that the increase for the animal feeds industry may for example be between 2% to 3% for certain feed formulations. The increase in yellow maize meal prices may not be as severe as the increase in white maize meal prices is for the primary white maize meal consumer.

According to Table 3 the population grew by 1,49% p.a. between 2005 and 2012. Maize consumption increased over the same period with 3,25%. Due to the drought conditions, maize prices are fairly high and the consumption of white maize was raised with only one percentage point year on year in the Grain SA Supply and Demand.

Grain SA changed the reporting of the supply and demand information of maize from 1 May to 30 April each year to 1 March until 28 February. This was mainly done upon request of members to eliminate the guesswork about early deliveries. Due to the fact that the month during which the lowest stock levels occur is April, the import need up until the end of April still needs to be determined. Early deliveries therefore remain important. Maize delivered early during March and April, decreases the pipeline requirement accordingly and consequently the need for imports.

The expected early deliveries during March and April will alter the need for imports later in the marketing year and it will only become clear as the growing season progresses. This number fluctuated during the past ten years between 91 000 tons and 842 000 tons.

We estimate that imports at the end of February to supply sufficient feedstock until the end of April need to be supplied by imports of 934 000 tons. Given the possibility of producer deliveries which may range between 91 000 tons and 842 000 tons, the import requirement until the end of April 2016 may be anywhere between 1 332 000 tons and 581 000 tons.

Can changes in future crop estimates and early deliveries alter the need for imports?

The first estimate was published on 26 February 2015. There is normally an estimate for each month from February until the Final Estimate in September. The eight estimates are finally concluded by a reconciliation of the crop estimate with the actual producer deliveries during November.

The average deviation in the crop estimate from the first estimate of the season until the reconciliation in November should also be considered to determine how it can impact the need for imports. An increase in the production estimate will limit further imports, while a decrease in production will increase the need to import. During the past ten years the total maize crop was underestimated in six out of ten years. The probability to underestimate the final crop size is therefore higher.

Table 4 gives the different scenarios for possible imports at future changes in production estimates and different early delivery figures. The outcomes are based on actual historic data for the past five years. It is therefore quite likely to occur.

Conclusion

Imports during the rest of the 2015/2016 marketing year will largely be dependent on the size of the new season maize crop and its development. The follow-up crop estimates until November will receive a great deal of attention. We do not expect big differences in consumption.

Role-players will focus on the future crop estimates as it may alter the need for imports if the estimates change. As soon as the first intentions to plant are known, it can be expected that the focus will shift to the size of the expected early deliveries during March 2016 and April 2016.

The extent of early deliveries will be of special importance for importers. If the number of early deliverable tons of maize is sizable enough, it may offer some relief for high prices. If early deliveries however fail to meet some of the need for imports, the latter may increase substantially at the end of the marketing year.

Publication: April 2015

Section: On farm level