October 2017

Michelle Mokone, agricultural economist, Grain SA

Over the years, South African whole barley has remained a very small player in the export market and has been almost insignificant due to the fact that it is a niche market. The barley industry is very concentrated mainly due to the fact that the majority of barley is currently used for brewing purposes within South Africa. There has however been export movement for malted barley, but volumes remain relatively small.

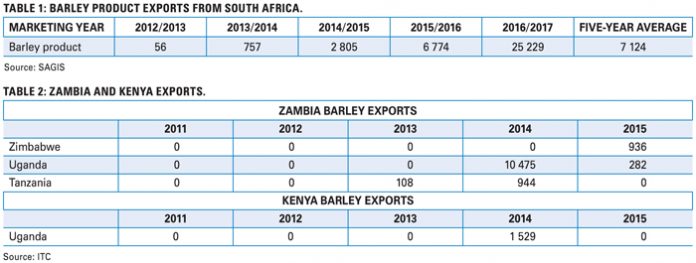

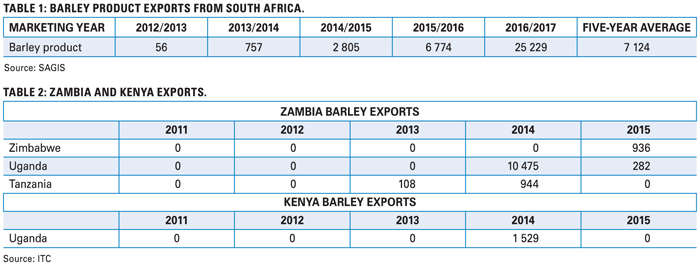

In the past five years, malted barley ex-ports averaged 7 124 tons (Table 1), while whole barley exports indicate a clear picture of a dead export demand. In the same period under review, South Africa’s barley imports averaged 56 000 tons, ultimately making the country a net importer of barley.

About half of global barley production is used for feed, followed by malting and finally human consumption. Only a portion of the malted barley planted each year has the specific qualities needed to be selected for malt, therefore quality is quite stringent.

As barley in South Africa is mainly used for brewing, it can be seen as a niche market and for small producing countries; this tends to tighten export market opportunities. It is against this background that this article seeks to uncover reasons for a stagnant demand for malted barley and to discover the possibility of creating export opportunities for the crop.

Global export market

Over the past five years, global barley exports averaged 31,6 million tons. The top five leading exporters of barley are France, Australia, Argentina, Germany and Russia. Collectively, they account for more than half of the global export market, at 63%.

Among countries in the African continent, Zambia and Kenya are within the top 50 exporters of whole barley, each ranking

40th and 43rd, respectively. Zambia and Kenya are, however, very small players within the global export market, with five-year average figures amounting to 3 258 tons and 1 140 tons, respectively. In fact, both countries do not have a consistent track record of barley exports. The main importers of Zambian barley were Uganda and Tanzania. However, both countries posted declines in their imported quantities during the 2015/2016 marketing year (Table 2).

Within the African continent, Libya is the leading importer of barley and is among the top 15 importers of the crop. On average, Libya imports 583 624 tons of barley annually, with Ukraine as the leading exporter of barley. In the 2016/2017 marketing year, Libya increased barley imports from Ukraine twice in comparison with the previous season, with a share of Ukraine barley export of 18,8%. Historically, Namibia sourced whole barley from South Africa, with the last export sale recorded in the 2013/2014 marketing year at just 24 tons. In 2015, Namibia’s barley imports from the world declined by 98% year-on-year. Owing to the decline in Namibian imports was a successful project by Namibian Breweries Limited (NBL) to source home-grown barley by increasing production.

The Namibian government availed 380 ha of existing irrigation land to the project, specifically for the production of barley. Should the project yield good quality crop, NBL aims to increase year-on-year plantings by 1 500 ha per annum with the goal to gradually replace imports of about 40 000 tons of malted barley. The world’s top five leading barley importers are China, Saudi Arabia, Netherlands, Belgium and Iran. In 2016, they accounted for almost half of the global imports of 27,5 million tons, at 49%.

Local production versus import and export

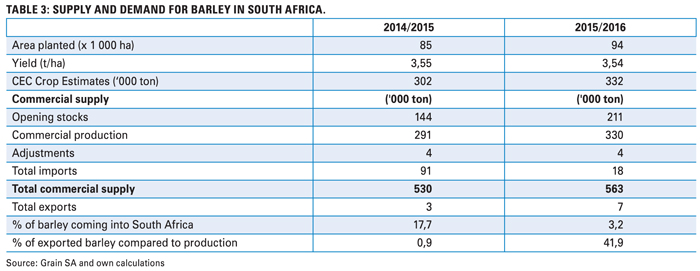

In the 2014/2015 marketing season, South Africa’s imports accounted for 17% of total supply (see Table 3), while in 2015/2016, imports accounted for only 3,2% of the total supply, outweighed by higher opening stocks and commercial production of 211 000 tons and 330 000 tons, respectively.

Of the total barley produced in 2015, 2% of malted barley was exported, which was 133% more than the value exported in the year prior. South African imports have more than doubled annually from 2012 to date, while the exports remained in tight range and relatively volatile due to inconsistency in import demand from importing countries such as Namibia. Despite relative increase in barley production over the years, this has still resulted in a shortfall of barley, mainly because of quality requirements. It is also important to note that South Africa does not produce significant volumes of exportable surplus because the industry only has one buyer. It is therefore produced under a contract.

Despite relative increase in barley production over the years, this has still resulted in a shortfall of barley, mainly because of quality requirements. It is also important to note that South Africa does not produce significant volumes of exportable surplus because the industry only has one buyer. It is therefore produced under a contract.

Conclusion

It is evident that the global barley export market is generally very concentrated. This means that global barley exports are going to fewer countries and mainly within the deep-sea market. Africa has a small demand for barley imports, while Libya has a strong demand. Sellers to this country, such as Ukraine, have a geographical advantage over other countries within the continent.

South Africa’s barley production has been growing, but remains below increasing national demand, which has seen the country relying on imports to meet local demand; while also fulfilling its quality requirements. Meanwhile, the country’s exports remain relatively low, due to constrained production and limited import demand, particularly from its neighbouring countries.

Since South African barley production is done on a contract basis, the opportunity to unlock the country’s barley export potential would require a guaranteed market which would create a scope to expand production.

Publication: October 2017

Section: Focus on