Since the year 2000, the South African government has implemented a diesel rebate system for primary producers to ease the financial burden of high fuel costs. Administered by the South African Revenue Service (SARS), eligible businesses can reclaim part of the general fuel levy and the Road Accident Fund (RAF) levy paid. This rebate primarily benefits the agriculture, forestry, fisheries, and mining sectors.

How the diesel rebate works

The diesel rebate offers 40% of the general fuel levy and 100% of the RAF levy, providing financial relief to agricultural producers by refunding a portion of fuel costs. Producers can claim this rebate on 80% of eligible diesel use.

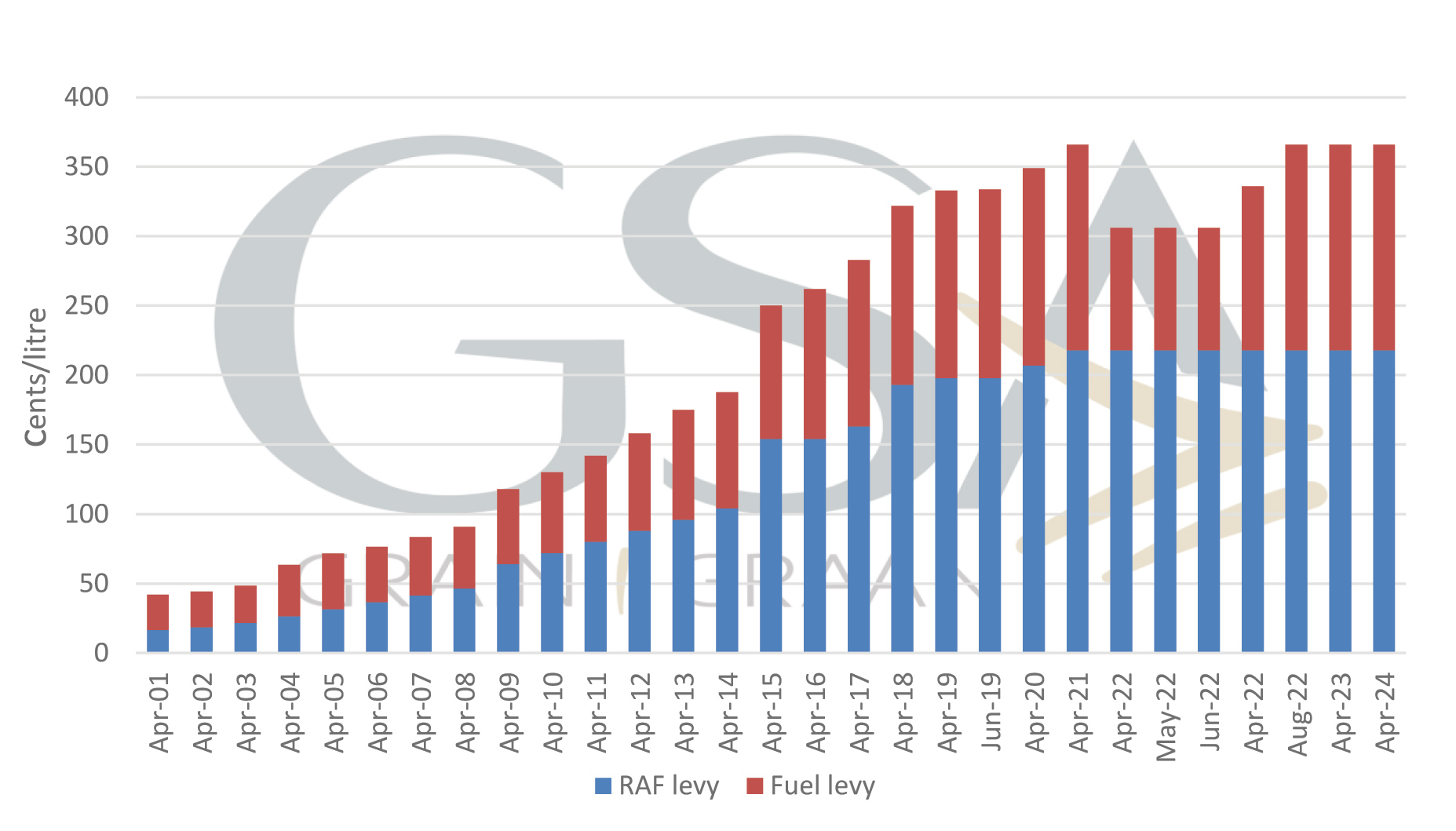

This rebate has increased from 121,1 cents/litre in 2010 to 366 cents/litre today. Despite a decrease in the average diesel price over the past few years, the rebate has remained unchanged at 366 cents/litre since 2023. This is due to the way the rebate is structured and calculated.

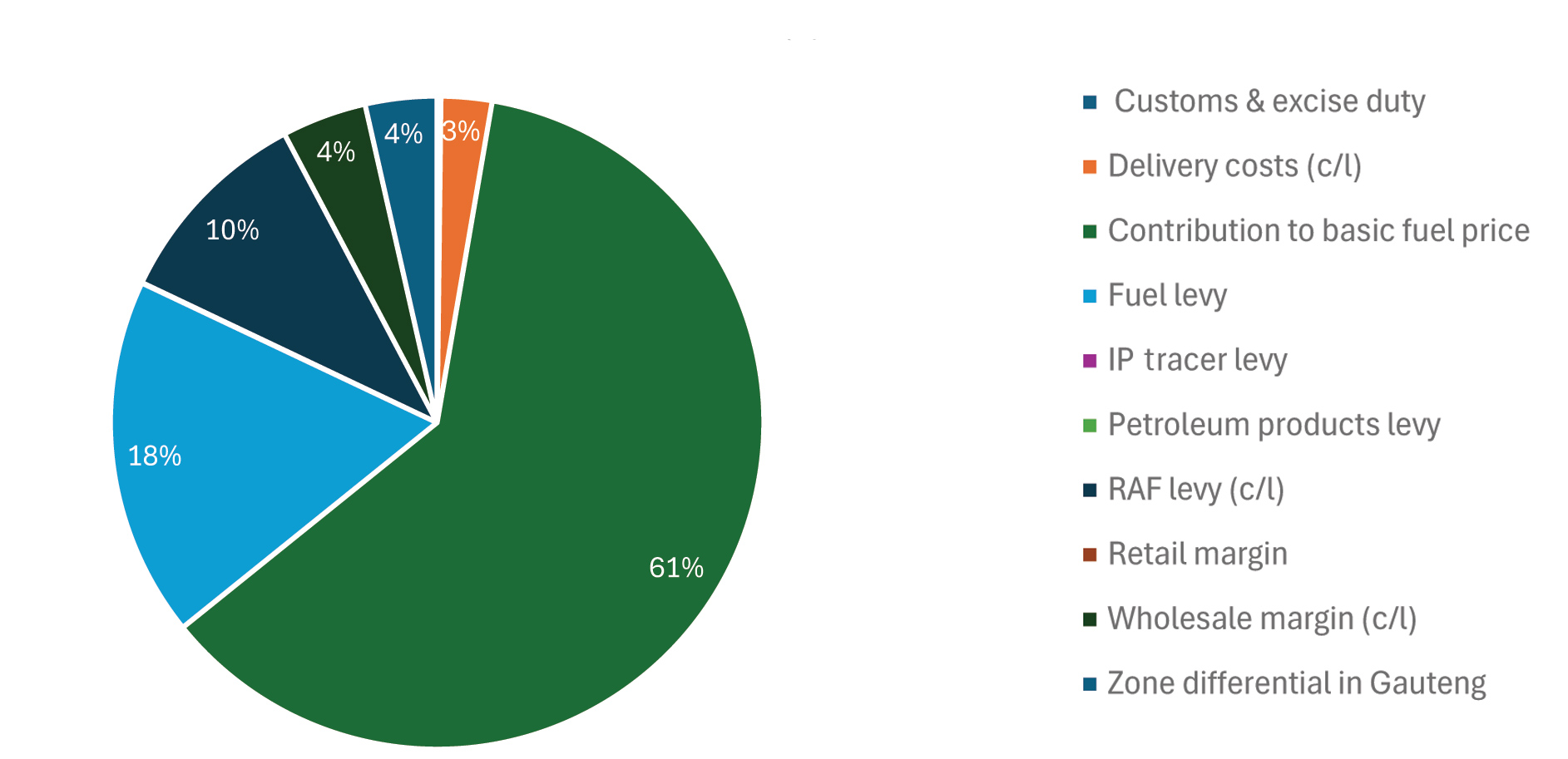

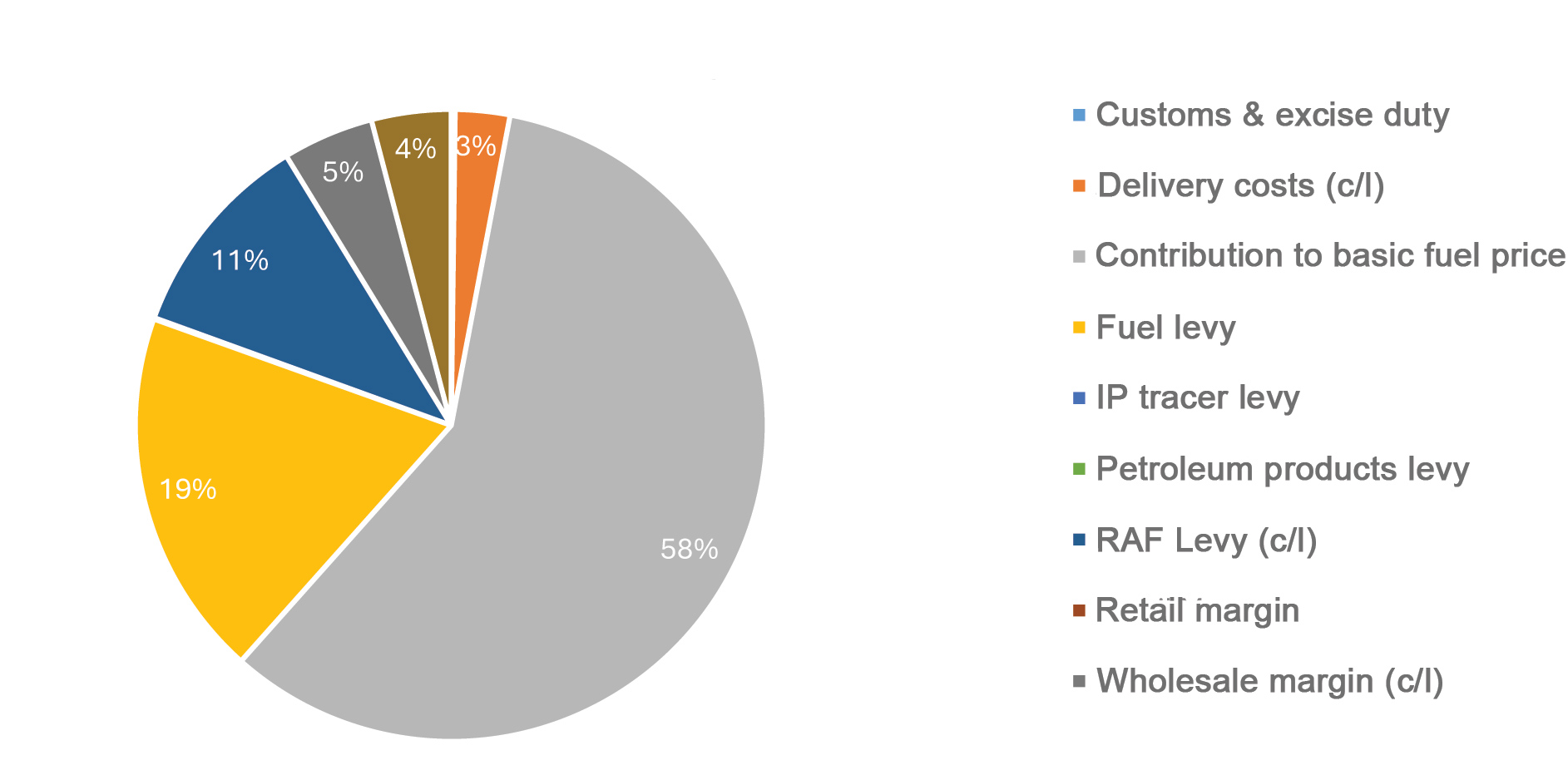

Figures 2 and 3 compare the current diesel price composition to the previous year. It shows that the RAF levy now constitutes a larger part of the diesel price than in February last year, while the contribution of the basic fuel price, or the landed cost of diesel in South Africa, has declined. This is because the RAF and other fuel levies remained fixed and are not based on the landed cost of diesel.

The rebate programme offers vital relief by covering 100% of the RAF levy and 40% of taxes and excise duties on diesel used for agricultural purposes, applied to 80% of a producer’s eligible usage.

Fixed levies simplify refund calculations for businesses and SARS by allowing amounts to be based on actual diesel consumption rather than fluctuating market prices. This predictability is crucial for producers’ budgeting and financial planning.

Ultimately, this initiative supports essential production industries, helping them operate sustainably and efficiently deliver food products. As one of the few benefits for producers, it should be valued.

How to qualify for the diesel rebate?

For producers to claim and access the diesel rebate, they must meet specific requirements and follow a structured process.

Only VAT-registered businesses can claim the diesel rebate through the VAT 201 return. The rebate reduces VAT payable or increases refunds if in a refund position. VAT compliance is essential as outstanding payments may hinder claims. The rebate covers primary production activities, such as transporting produce and inputs to the farm. Producers must keep records for at least five years, as SARS may audit logs and purchase records. Once eligible, they must register with SARS by submitting the correct application form to link the rebate to their VAT account.

- For a single qualifying entity, the producer must submit the VAT101D form.

https://www.sars.gov.za/wp-content/uploads/Ops/Forms/VAT101D-Application-for-Registration-of-Diesel-Refund-External-Form.pdf - For branches of a qualifying entity, use the VAT102D form; each branch must be registered separately.

https://www.sars.gov.za/wp-content/uploads/Ops/Forms/VAT102D-Application-for-Registration-of-Diesel-Refund-External-Form.pdf

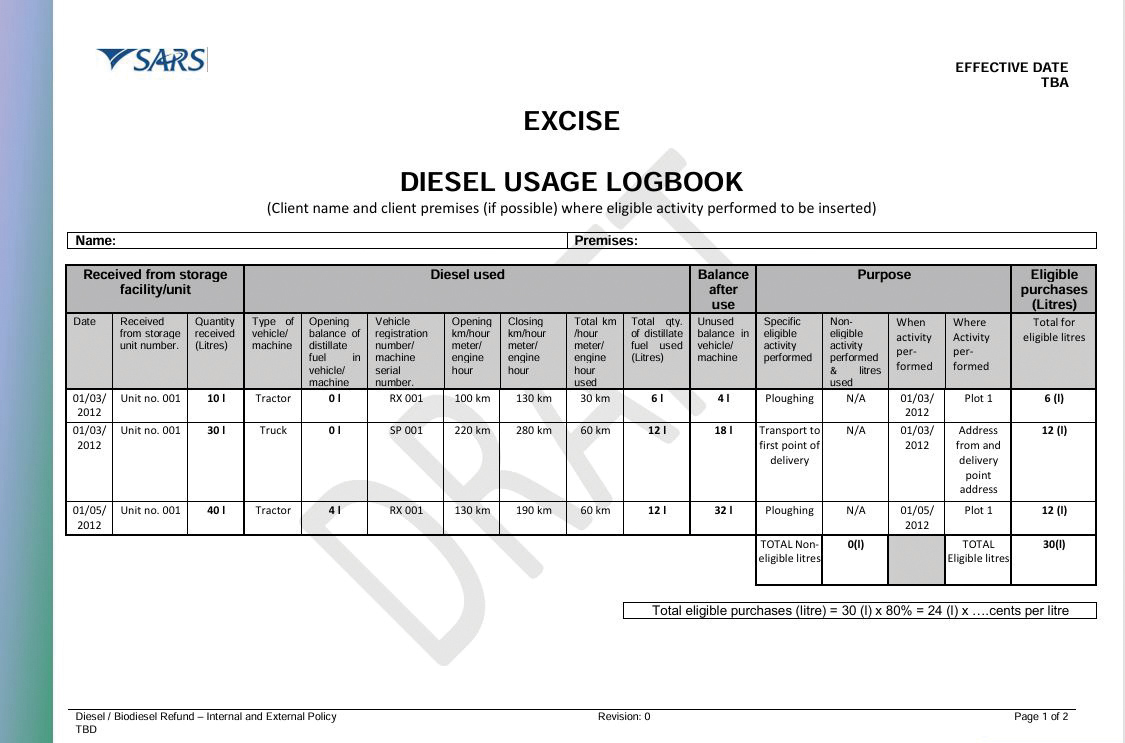

The role of logbooks in securing a refund

Maintaining a detailed logbook is important for producers claiming the diesel rebate. They should keep bulk diesel purchase receipts and record how the diesel is used on the farm. Regular entries in the logbook must document all activities related to the rebate claims to create a clear audit trail.

Common reasons for delays or rejections include non-qualifying activities and unclear logbook records. To ensure a successful claim, producers must review schedule 6 part 3 of the Customs and Excise Act and accurately log diesel usage, including:

- Date of dispensing

- Quantity dispensed

- Vehicle or equipment details (make, model, registration number)

- Odometer or hour meter readings

- Purpose of use, specifying qualifying activities and farm location

Claims should only be made for diesel that has been consumed, not for unused purchases, with complete records tracking fuel movement from distribution to final use on the farm.

For further details, producers can refer to the following documents:

Schedule 6 of the Customs and Excise Act:

https://www.sars.gov.za/wp-content/uploads/Legal/SCEA1964/Legal-LPrim-CE-Sch6-Schedule-No-6.pdf

Example of a SARS-compliant diesel usage logbook:

https://www.sars.gov.za/wp-content/uploads/Legal/Drafts/LAPD-LPrep-Draft-2013-17-Draft-Tariff-Amendment-Diesel-Usage-Logbook.pdf