intern: Applied

Economics, Grain SA

Christiaan Vercueil, intern: Applied

Christiaan Vercueil, intern: AppliedEconomics, Grain SA

Maize meal and sunflower oil are two of the most common items found in the pantry of a South African consumer. The consumer price index (CPI), which refers to a weighted average basket of consumer goods and services purchased, includes both these items.

In the current economic climate, retail prices of these goods inevitably had to rise following the Russia/Ukraine conflict, together with production pressure for raw material producers and other international turmoil. These production pressures include steep increases in input costs that are highly correlated with the total production cost of raw materials such as maize and sunflower. But to what extent do these production pressures influence the price that a consumer pays for household items?

Value chain for common household goods

The value chain of producing a retail product from raw commodities has many links. A value chain starts off with the raw product and each link in the value chain adds value until an end-consumer product is finalised.

Participants in the value chain include the following:

- Input suppliers: These include companies that supply inputs, like fertiliser, seed and agro-chemicals needed to produce the raw commodities. Input price hikes have a direct impact on the cost of production a producer experiences. A producer is a price taker, therefore his ability to give through higher input prices to the rest of the value chain is limited.

- Grain producers: The grain producers form the second link of this value chain. Once the soil has been prepared and the necessary inputs have been acquired, production can start. Production processes differ according to the needs of each grain type and cultivar. The days until harvest and weather conditions are specific to each commodity.

- Storage facilities: Once the commodity is ready for harvest, producers transport the raw material to the nearest silo or miller. The miller then processes and refines the raw material into products as per consumer preference.

- Processors: After the raw material has been refined into the respective products, the miller either distributes the product under their own brand or sells the refined product to established brands.

- Retail: The respective brands distribute the product to retailers and wholesalers.

- Customer distribution: The retailers and wholesalers then distribute the product to the end consumer.Each link in the value chain incurs a cost for producing their respective output product, which directly leads to value added to the final retail product. Following the Russia/Ukraine conflict, global energy prices have increased significantly. The war had multiple spill-over effects, especially into fuel and energy prices. The cost of production for a maize miller, was thus affected twofold. Millers have to pay more for the electricity to produce products, as well as pay more to transport products to specific locations. In the current environment, each link in the value chain is subjected to energy price increases. Thus, at each value chain link, the effect of increased energy prices will end up contributing to the value added to the final product.

Influence of the white maize price on maize meal

The derived producer price is calculated by using the average annual Safex price for each marketing year, then deducting the relevant location differential as well as handling and storage costs. Figure 1 visualises the derived percentage contribution of producers to the retail price of maize meal.

From Figure 1 it can be concluded that the price of white maize contributes up to 50% of the retail price a consumer pays for a 2,5 kg bag of maize meal. The remaining percentages are contributed by value added through the value chain – this includes packaging, processing, and milling – all of which require energy.

Influence of the sunflower price on sunflower oil

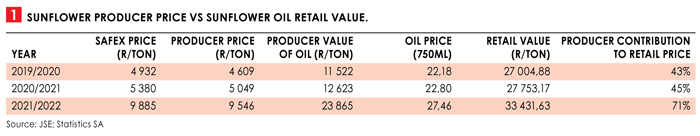

Table 1 represents the data used to derive the percentage contribution of producers to the retail price of sunflower oil.

The derived producer price is calculated by using the average annual Safex price for each marketing year, then deducting the relevant location differential as well as handling and storage costs. Figure 2 visualises the derived percentage contribution of producers to the retail price of sunflower oil. For the purpose of this illustration, prices from 2020/2021 was used. This is due to the significant sunflower price increases during 2021/2022 that may give an inaccurate representation of the producer’s contribution to the sunflower price.

Conclusion

Consumers often believe that high prices of household goods are attributed to raw material producers which, as shown above, is not always the case. Raw material producers are not solely responsiblefor the retail price of goods. Value is added by the different links in the value chain, each contributing to the final price of the product. Moreover, following the Russia/Ukraine conflict, each link in the value chain is affected by increased energy prices, which will end up contributing to the value added – and the price – of the final consumer product.