agricultural economist, Grain SA

The Poultry Sector Master Plan has been developed in close partnership between government and a number of stakeholders in the industry, including poultry producers, processors, exporters, importers and organised labour. It provides a framework for a determined effort to grow the output (and jobs) in the industry through different measures that will be implemented over a number of years.

Significantly, it sets out a new, joint vision across the value chain, identifies five pillars that underpin the vision and creates a Poultry Sector Master Plan Council to monitor and drive the implementation of the pillars.

Overview and background analysis

The poultry sector plays a key role in South Africa, providing an important affordable source of protein for millions of households. It adds value to the maize and soybean crops, serving as a key customer for the farming sector. This industry has low barriers to entry and is an important sector for food processing, value adding and job creation throughout the country.

Consumption of chicken meat in South Africa has grown substantially, although more slowly after 2008. Production has stagnated as imports have risen, with imports having increased fourfold over 20 years. This has happened because imported poultry has come into the economy in large quantities, displacing South African meat. Tariffs were increased substantially in 2013, but this has not halted the growth in imports.

Market conditions and trade agreements have brought significant quantities of low-priced chicken products into the local market. These have put pressure on local prices and reduced the market share of South African producers. While consumers have benefitted, there has been an inability to drive growth in the industry, with South African exports marginal at 2% of production, despite excellent access to a variety of markets.

If this trend is not reversed, the South African industry can be expected to stagnate and slowly decline, affecting jobs and livelihoods across the value chain from maize and soybean farming to food processing. It would also threaten food security in the longer term.

Urgent challenges facing the sector

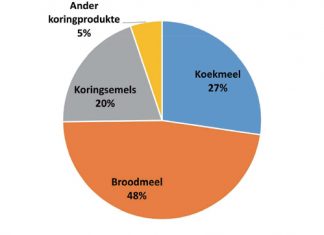

Cost of feed: The cost of feed makes up a large portion of the cost of chicken production. Maize and soybean prices are determined internationally, but tend to rise for South African producers in drought years. Many countries subsidise their primary farming sector, allowing cheaper inputs to their poultry sectors.

Scale of production: The relatively small scale of production in South Africa makes the country vulnerable to exporting countries which exploit economies of scale.

Segmenting production: In recent years, several large poultry-exporting countries have targeted South Africa’s market for brown meat.

Inability to export: Despite having tariff-free access to Europe, South Africa has not been able to export poultry to that market, largely because it has not met the sanitary and phytosanitary requirements of the European Union (EU).

Transformation: Although there has been some progress, transformation is not sufficient with regard to black ownership throughout the value chain.

Strategic objectives

Poultry farming offers important opportunities for economic development in South Africa including the following:

- Potential expansion of both maize and soybean production.

- Growing small scale poultry farming and local production networks.

- Commercial scale contract farming supplying large integrated producers.

- Growth in industrial-scale food processing, leading to increased employment and exports.

- The supply of affordable protein to South African households.

In line with these opportunities, South Africa needs to grow the poultry sector and protect it against potential loss of capacity. Indeed, there is substantial potential to expand the poultry industry across the value chain, especially if substantial export markets can be developed.

Strategic outlook on trade

With poultry increasingly traded globally, South Africa forms part of a large group of countries that produces at the scale of the domestic market, while a small number of countries produce at greater scale and maximise exports. Given the fact that South Africa has a large market for poultry and an open economy, it is likely to continue to receive attention from exporters.

Imports have an important role to play in balancing the poultry sector:

- Imports can help to keep local prices in check.

- There are certain poultry products that do not get produced in South Africa (such as mechanically deboned meat) that need to be imported.

- There are certain cuts that are produced locally, but where demand outstrips local supply – especially at certain times of the year.

At the same time, South Africa needs to expand its poultry sector and avoid losing local capacity. The aim is therefore to contain imports. In addition, there should be decisive action against unfair forms of trade and any attempts to dump poultry products in the market.

The strategic objectives aim to do the following:

- Continue to increase the consumption of chicken meat (as opposed to processed chicken products) in absolute terms, and on a per capita basis.

- Ensure that locally produced products make up an increasingly larger proportion of consumption over time.

- Export cooked and raw products to the SADC (Southern African Development Community) and other ACFTA (African Continental Free Trade Area) countries, the EU and the Middle East. The aim is to export at least 3% to 5% of production by 2023, 7% to 10% by 2028 and a growing proportion thereafter.

- Expand the industry by increasing capacity at all stages of the value chain – production of feed, farming of chickens and processing of poultry products – thereby increasing fixed investment, employment and the value of output. The output of poultry products should increase by around 10% within three years.

- Increase the level of black participation and particularly ownership across the value chain and increase employment and worker share ownership in the sector.

Required actions

- It will be critical to monitor the progress of this plan. This will be done through the Poultry Sector Master Plan Council, which will be led by the Ministers of Trade, Industry and Competition as well as Agriculture, Land Reform and Rural Development.

- Develop a concrete action plan to underpin each pillar and commitment in the master plan.

- Monitor implementation of the key actions agreed on and identify additional measures required to realise the agreed vision.

- Ensure expeditious implementation of the necessary sanitary and phytosanitary (SPS) measures required to expand into export markets.

- Analyse the trade in poultry, both imports and exports, to determine the impact of the master plan and to advise on measures to realise the vision and commitments in the plan.

- Identify and set out targets for advancement of ownership by black South Africans and workers across the poultry value chain, as well as inhibitors to achieve these.

- Consider practices and standards in the industry and their impact on development of smaller and/or black-owned poultry enterprises, with a view to addressing unnecessary inhibitors.

- Set up a forum of engagement with the finance sector.

The grain industry

Out of the five pillars identified in the master plan, pillar one relates to the grain sector and how grain producers can be involved in uplifting the poultry industry. This relates to the expansion of production in maize and soybeans. It involves a strategic partnership between the South African Poultry Association (SAPA) and Grain SA to increase the supply of maize and soybeans to the poultry sector and to reduce prices.

Requirements: Expand the consumption of poultry feed by 300 000 tons per annum. Explore mechanisms to use this higher level of demand to negotiate better prices.

Target commitments: Additional 300 000-ton consumption of soybeans/maize, supporting approximately 300 new jobs.

Oversight/responsibility: The Industrial Development Corporation (IDC) is to partner with Grain SA and SAPA to explore possible arrangements to increase supply in targeted areas, and to reduce costs. The council should identify additional steps to achieve this goal.