divisional manager:

Agriculture South,

Nedbank

John Hudson,

John Hudson, national head:

Agriculture, Nedbank

Ideally, every agribusiness wants to position itself to withstand tough environmental conditions, to be able to absorb the volatility of the commodity markets and to farm sustainably for generations to come. Economies of scale is not just a phrase that was learnt in the economics class, it is a reality that faces agribusinesses in South Africa.

Producers want to be able to expand – be it through planting more hectares, increasing the livestock herd or investing in land as well as technology to improve the efficiency of the overall business.

To be able to expand or increase capacity, it is important to understand the current position of the agribusiness. The question arises whether the business is strategically positioned, from a financial perspective, to support the growth path.

Current position

The past five production seasons were characterised by unforeseen and volatile environmental and economic challenges such as drought conditions and fluctuating product prices. Furthermore, the South African currency depreciated over the period, which increased the prices of imported inputs. The cost-price squeeze was fully at play. All the above-mentioned events have severely impacted the financial position of agribusinesses.

This resulted in carry-over debt from the previous season, increased debt levels on a year-on-year basis (to fund losses), the uptake of short-term credit or credit term extension agreements as well as depleting of buffers that were available both in terms of cash or livestock numbers.

On the path to the ideal position, it is important to understand the current position of the business. This comprises an exercise looking at historical financial figures of the business. This includes a stock-take – sitting back and asking hard questions to address the issue. Consultations with important stakeholders in the business are also advised.

Further to the above-mentioned, the following question arises, ‘What important ratios should be taken into account to strategically position the agribusiness for future growth?’

Transition and stress tests from current to ideal

Every agribusiness is unique in nature. Therefore, it is important to understand which growth-phase the agribusiness finds itself in and how the different dynamics operate throughout the life cycle.

As an initiator to the exercise, start with at least five years of historical financial information (normally in the form of annual financial statements). The turnover is underpinned by the historical hectares planted, yields and prices realised, indicating a certain level of volatility throughout the period. The exercise will enable the reader to establish actual five-year average hectares planted, yields obtained and prices realised. Furthermore, it will provide valuable insights into the actual cost-structure of the business – operational expenses, overheads and personal expenses (living costs). The nett income will provide a guideline in terms of the debt repayment of the agribusiness.

This long-term history (five-year average hectares, yields and prices) should dictate the amount of debt the agribusiness is able to service. Calculating the unique cash surplus that the agribusiness can pay towards annual obligations, should be the first direction indicator of whether expansion is viable or not. The surplus should be able to cover the annual debt obligations by a factor of 1,4. For example, if the annual debt obligations amount to R1 million, the cash surplus of the agribusiness must be R1,4 million.

The above-mentioned is based on long-term historical information and the exercise may seem fruitless given the fast-paced changes that occur daily. However, history does repeat itself and history should be the main driver that forms the opinion with regards to the future.

Cashflow is the next point to look at. Cashflow is a twelve-month projection of the agribusiness’ income, expenses and the overall effect thereof on the bank balance or production facility. The cashflow is an integral part of the agribusiness – there should be a working document to establish if the cashflow is performing as projected. Most important, the cashflow should be underpinned by the actual averages achieved during the last five years. Is the cashflow a ‘survival cashflow’ or a sustainable cashflow considering re-investing practices, repair, maintenance and replacement?

The cashflow identifies future cashflow shortages or surpluses, enabling the owner to make pro-active plans in addressing short-term scenarios. A cashflow is a short-term instrument to achieve the long-term plan of the agribusiness. It boils down to financial discipline to control what is controllable and to manage and mitigate risks associated with each enterprise.

Cashflow ratio (total income divided by total expenses including debt repayments and interest expense on the overdraft or production facility) provides an indication of the agribusiness’ ability to absorb short-term shocks. The higher the ratio, the better the shock absorption ability of the agribusiness. Ideally, a ratio of 110% is seen as the minimum industry norm. Although a forecast, the ratio strongly correlates with liquidity ratios such as the current ratio. The current ratio boils down to the short-term assets (crop on land) being able to cover the short-term liabilities (overdraft, production facility or debt obligations) within a twelve-month period.

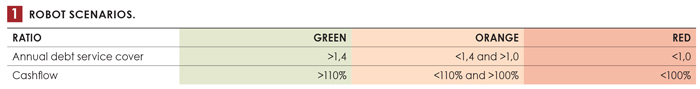

In Table 1 the following is summarised:

- An annual debt service cover ratio of above 1,4 indicates a financially strong and sustainable business.

- A debt service cover ratio of below 1,0 indicates that the business will likely not be able to be viable over the medium to long-term period, because there is no margin for error.

- If the cashflow ratio is below 110%, the orange light should go on.

- The red light should go on if the cashflow ratio is below 100%, as this indicates that expenses exceed the income.

Summary and conclusion

Summary and conclusion

The focus of this article is to estimate the ability of the agribusiness to grow or survive by taking into account long-term trends in terms of production (yields) and product prices. By using these actual assumptions in forecast models, the owner will be enabled to understand the green, orange and red scenarios of the business. In conclusion, the uniqueness of the individual agribusiness cannot be underestimated, and it is vital for the owner or management to understand the repayment ability of its own business.

For more information email Daneel Rossouw at daneelr@nedbank.co.za.