The Johannesburg Stock Exchange (JSE) commodities market, still commonly referred to as Safex by many market participants, has been processing physical deliveries in completion of its grain derivative contracts for 25 years.

Price risk management is clearly the key role of the derivatives market. However, it is integral to the integrity of the derivatives prices that when the futures contract expires there is price convergence with the physical market. To achieve this, derivative exchanges across the globe continuously focus on ensuring that the rules and design of the physical delivery process remain robust and connected with the underlying physical market.

It is not uncommon for exchanges to introduce enhancements to its processes. Concerns raised by the market in early 2020 around accessibility to physical grain held on JSE silo receipts, prompted an independent investigation, performed by Chris Sturgess for the JSE. This resulted in an extensive consultation process with grain storage operators, traders, millers and producer organisations. The outcome of this process was updated agricultural contract specifications published in the first half of 2021.

The independent investigation highlighted a very practical risk for owners of physical stock: When physical stock levels in the country are at reduced levels, it naturally results in a bottleneck at the remaining storage points as owners of grain scramble to secure out-loading slots. This also triggered a number of allegations against storage operators for abusing the JSE-prescribed out-loading tempos at their infrastructure to only keep to the minimum out-loading criteria.

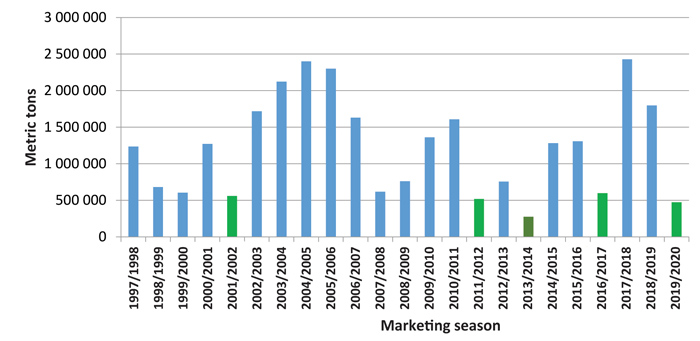

Graph 1 indicates the white maize ending stocks per marketing season, highlighting the white maize stock levels in 2019/2020 (information sourced from the South African Grain Information Service [SAGIS]) – implying the pressure to access the remaining white maize stock in the country.

The reality is that the market must have the necessary confidence that JSE silo receipts, when issued, represent the physical product in the required quantity and quality and that the product is in the location as represented on the receipt. Unfortunately, the JSE did identify an issue with a storage operator last year where JSE silo receipts were issued representing stock in Bloemhof silo whilst the physical stock was stored elsewhere.

It is understandable that when this type of incident occurs, extra effort is required to rebuild trust in JSE silo receipts and to ensure JSE-approved storage operators fully comprehend the responsibilities that go with issuing a JSE silo receipt.

To achieve this, the JSE continuously engages its approved storage operators to ensure compliance – not only on an annual basis as before, but it has also increased the number of independent inspections to over ten sites per month. In the past this was typically around 24 to 30 sites per year. The independent inspections are relied on to validate the infrastructure of the registered JSE delivery point and also to confirm the total quantity and quality of stock. This stock confirmation is then reconciled with the monthly stock reports supplied by the storage operator to assist the JSE in validating the overall stock situation at the storage site. It is important to note that the JSE does not only validate stock on JSE silo receipts, but also has insights into stock held on folio accounts and the storage operator’s own branded silo receipts. This oversight of all physical stock held at the storage site does strengthen the JSE’s ability to identify potential breaches by the storage operator of their JSE contractual obligations.

The JSE detailed agricultural contract specifications document provides the overarching framework for market participants including storage operators who participate on the JSE. As mentioned earlier, this document was amended in the first half of 2021 and is available on the JSE webpage or by clicking on the QR code.

Take note of some of the key enhancements in the contract specifications used to build trust and confidence in the JSE physical delivery process involving JSE silo receipts and approved storage operators:

- No JSE silo receipt may be issued if the required quantity and quality of product are not available at the delivery point recorded and indicated on the face of the electronic receipt.

- As clearly indicated on the face of the receipt and in the detailed contract specifications, a JSE silo receipt may not be issued if there is any lien or encumbrance on the stock, except for the storage operator’s common law lien for payment of outstanding storage. Apart from this lien, the storage operator does not have any other right or title to the product.

- Section 4.2 of appendix C records the various remedies that the JSE may invoke if a JSE-approved storage operator fails to comply with any of its obligations and/or responsibilities as set out in the applicable contract specifications, including deregistration of the storage operator and all of its delivery points.

- The JSE has adopted and implemented various measures to augment its procedures in monitoring storage operators’ compliance with the applicable requirements. The JSE has significantly increased the number of individual audit inspections performed on registered storage entities and has also instituted a number of processes to identify and select registered storage sites for auditing.

- The obligation of a short position holder (seller) to transfer possession of stock to the buyer (good delivery) is a foundational cornerstone of the South African law of purchase and sale of goods and has been applied uniformly since Roman times. The requirements of good delivery as encapsulated in the contract specifications are no more than a recordal of these well-established legal principles and remain of critical importance to ensure that a seller’s obligations are clearly set out. It is an important element of a fair, efficient and transparent market in the securities listed and traded on the JSE.

- If a short position holder is unable to make ‘good delivery’ due to a storage operator’s inability or failure to comply with its obligations as set out in the contract specifications, the short position holder will have a claim against a storage operator to recover any and all damages that it may have suffered as a result of the storage operator’s non-compliance.

- Participants are reminded that the JSE now publishes on its webpage a list of all sites it has independently audited, together with confirmation of the annual review process of each JSE-registered storage operator.

- Section 9 of appendix C is entirely new and goes on to describe a process that will assist stock holders in securing 25% of the storage operators’ out-loading capabilities via booking slots that have been reserved for JSE receipt holders, especially for the five main hedging months. There is a specific window period to process out-loading requests that will need to be followed by the owner of the JSE silo receipts.

The amended agricultural contract specifications came into effect on 25 May 2021, achieved through significant effort from many industry stakeholders who provided constructive feedback and various proposals throughout the review process.

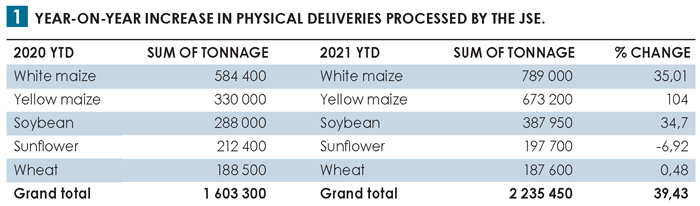

Moving forward, considering the 39% year-on-year increase in physical deliveries processed by the JSE as per Table 1, it is evident that the market has adopted the improvements in a very positive manner. At the end of August, the JSE had processed physical deliveries of just over 2,2 million tons versus 1,6 million tons for the same period last year.

The JSE acknowledges that the opportunity to improve is always a given and is grateful for the support from the agricultural market to ensure South Africa continues to have access to a vibrant and robust commodity derivatives platform.

The JSE acknowledges that the opportunity to improve is always a given and is grateful for the support from the agricultural market to ensure South Africa continues to have access to a vibrant and robust commodity derivatives platform.