agricultural economist, Grain SA, christiaan@grainsa.co.za

Since 2020, the global economy has been hit by two unforeseen and unplanned events. The Covid-19 pandemic caused massive uncertainty in the market, creating situations never seen before, for example oil prices trading in the negative, followed by a strong bullish oil market. Just when a break from uncertainty was on the horizon, the Russia-Ukraine conflict started creating even more uncertainty, further pushing energy prices to record levels, above the previous record levels seen in the 2008 world financial crisis.

It seems that markets have become accustomed to the current geopolitical conflicts and uncertainties that accompany them. Luckily, the Israel-Hamas conflict does not directly affect South Africa as did the Russia-Ukraine conflict, but indirectly this conflict has had an effect on the energy market where prices found support. The rand has appreciated in the month of July due to less load shedding, but has since depreciated and is moving closer to the R19/$ mark. Even though markets have stabilised slightly, uncertainty remains high.

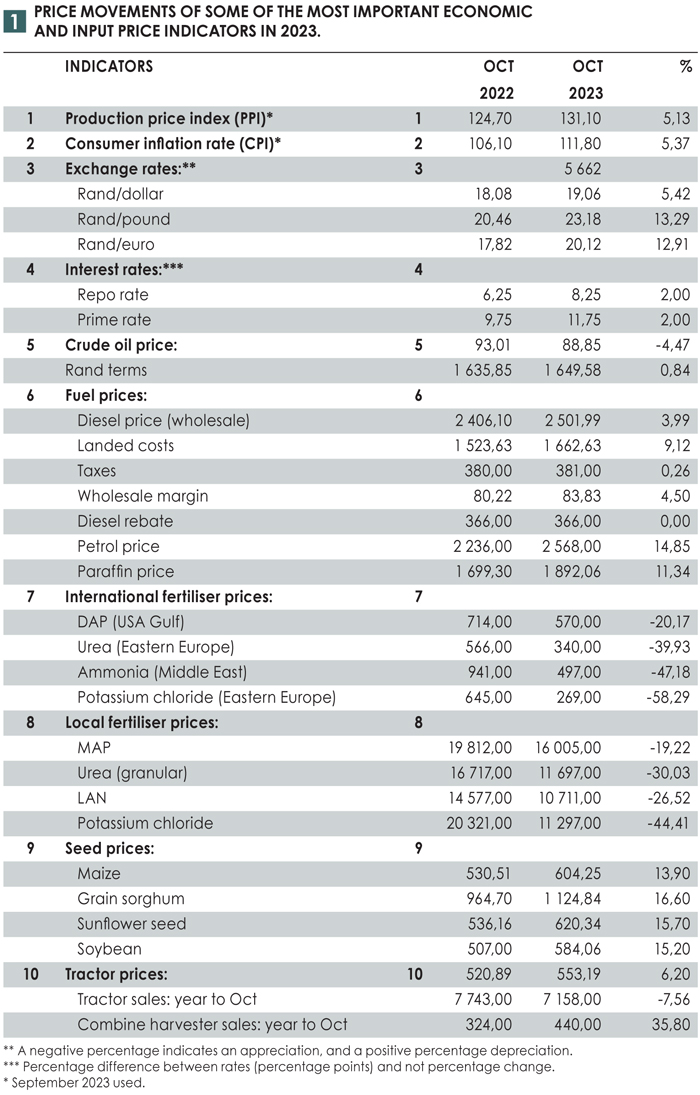

Table 1 shows the price movements of some of the most important economic and input price indicators in 2023.

Production price index

Production price index

The production price index (PPI) indicates the price increases of goods and services at the wholesale or manufacturing level in the economy. On an annual basis, the PPI rose by 5,1% until September 2023. The PPI for agriculture increased by 6,6% year on year, while the PPI for cereals and other crops decreased by 8,2%.

Consumer price index

The official inflation rate is calculated based on changes in the consumer price index (CPI) and indicates cost changes at the retail or consumer level. The inflation rate rose by 5,4% year on year in September 2023.

Food inflation rose by 8,1% over the same period. In this basket of food, bread and cereals increased by 9,2%, while meat increased by 3,8%. Oils and fats decreased by 7,7%, while vegetables increased by 15,3% over the same period and fruit increased by 6,7%.

Exchange rate

In Table 1, a strengthening of the value of the rand against other currencies is indicated as a negative change, while a weakening is shown as a positive percentage change. The rand weakened by 5,4% against the dollar and 12,9% against the euro and 13,3% against the pound from October 2022 to October 2023.

Because South Africa is so dependent on imports of inputs, a weakened rand causes sharper increases if international prices increase, but also smaller decreases in prices locally when international prices decrease.

Interest rates

Annually until October 2023, the Reserve Bank increased the repo rate to 8,25%, while commercial banks also increased the prime lending rate to 11,75% in efforts to battle inflation, especially food inflation. This policy put extra strain on all consumers alike, making borrowed money more expensive and the decision to expand more difficult.

International crude oil prices

The average Brent crude oil price increased, from very high levels, by 11,2% from $83,66/barrel to $93,01/barrel from October 2021 to October 2022. From October 2022 to October 2023, Brent crude oil prices further decreased by 4,5% to $88,85/barrel, leaving prices still at higher levels. Increased oil prices lead to higher energy prices, increasing the cost of production at each link in the value chain. These higher costs are somewhat absorbed by the value chain, but a large part of the extra cost is passed on to consumers.

The crude oil price in rand terms increased by 0,8% to R1 649,58/barrel on an annual basis until October 2023.

Fuel price

The local wholesale price of diesel in Gauteng increased by 4% from R24,06/per litre in October 2022 to R25,02/litre in October 2023.

Over the period of a year, the landed cost of diesel increased by 9,1%, while tax increased by 0,3% and the wholesale margin increased by 4,5%.

The diesel rebate is currently 366 cents/litre. The diesel rebate consists of the 218 cents/litre of the Road Accident Fund levy and 148 cents/litre of the tax component.

International fertiliser prices

The prices of DAP, ammonia, and potassium chloride increased by 20,2%, 47,2% and 58,3% respectively while urea prices declined by 39,9% from October 2022 to October 2023.

Local fertiliser prices

Due to South Africa importing more than 80% of its fertiliser needs, local fertiliser prices are exposed to the same factors as in the international market. The average prices of MAP and urea, LAN and potassium chloride increased by 19,2%, 30%, 26,5% and 44,4% respectively over a period of one year up to and including October 2023.

Seed prices

Seed accounts for about 12% to 17% of a grain and oilseed producer’s current production costs. For the 2023/2024 production season, maize seed increased by an average of 13,9%, grain sorghum seed by 16,6%, and sunflower seed by 15,7%. Soybean seed prices increased by 15,2% on an average basis.

Tractor prices

In October 2023, the prices of tractors were 6,2% higher than the corresponding period twelve months earlier.

Tractor sales

For 2023, tractor sales up to October decreased by 7,6% compared to the same period in 2022. Last year, 7 743 units were sold in this ten-month period, while tractor sales for 2023 stands at 7 158 units. In contrast, combine harvester purchases increased by 35,8% since October 2022 to October 2023.