agricultural economist,

Grain SA,

heleen@grainsa.co.za

13/06/2024

Agriculture – including the grain industry – works in cycles. Even down to the soil level, cycles are fundamental to the grain industry’s existence: the soil goes through cycles of cultivation; the crop goes through cycles of growth; the weather goes through cycles of hot and cold. Likewise, there are well-known market cycles in the grain industry.

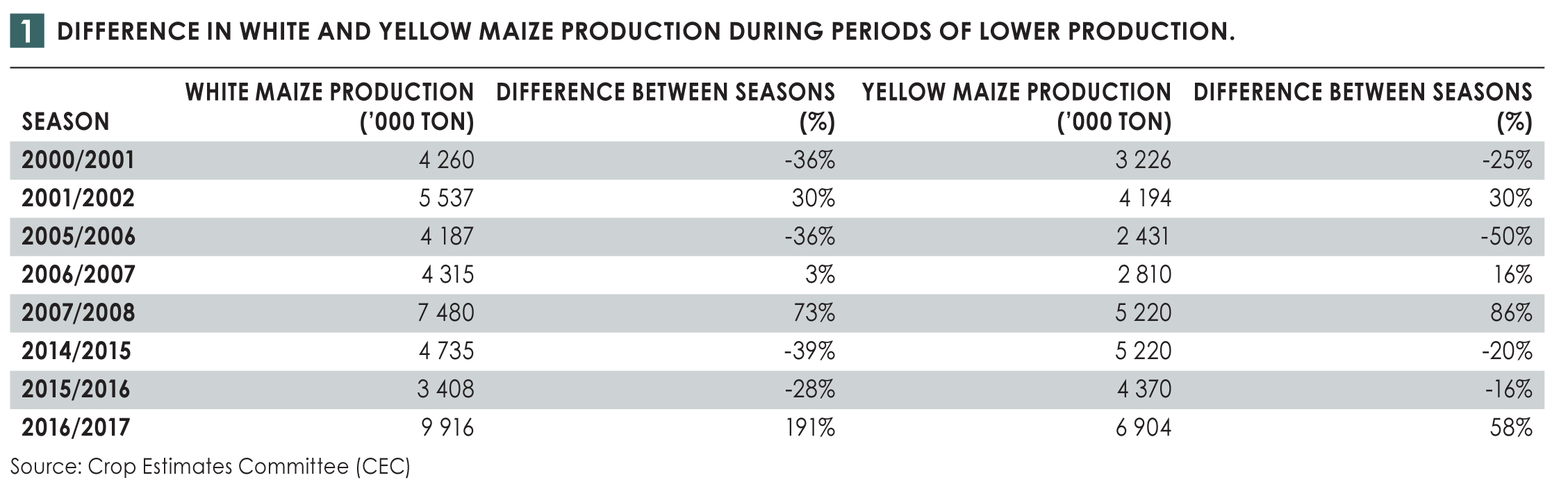

A cycle that is unique to the grain markets shows periods of higher production that follow periods of lower production, with prices that follow an inverse cycle. Table 1 shows the percentage difference between production years for both white and yellow maize. The periods shown in the table have been specifically chosen to reflect periods of historically low production. It is noticeable that periods of lower production are followed by a sharp increase in production. The 2014/2015 and 2015/2016 seasons were years of severe drought in which white maize production fell by 39% and 28% respectively, after which production rose by 191% in the following year.

Economics 101 teaches us that lower prices are accompanied by higher supply (in this case production), and vice versa. In the grain market, higher prices stimulate planting. As a result, the following season has a higher supply – and therefore lower prices.

Economics 101 teaches us that lower prices are accompanied by higher supply (in this case production), and vice versa. In the grain market, higher prices stimulate planting. As a result, the following season has a higher supply – and therefore lower prices.

SCENARIO 1: Increase in white maize hectares and soybean production

The first scenario that producers should be on the lookout for is a decrease in prices of soybean and maize, especially white maize, for the next season. The 2023/2024 season, according to the fourth crop estimate, already shows a 25% decrease in white maize production and a 35% decrease in soybean production – which brings to mind the teachings of Economics 101, with the evidence already visible in the prices.

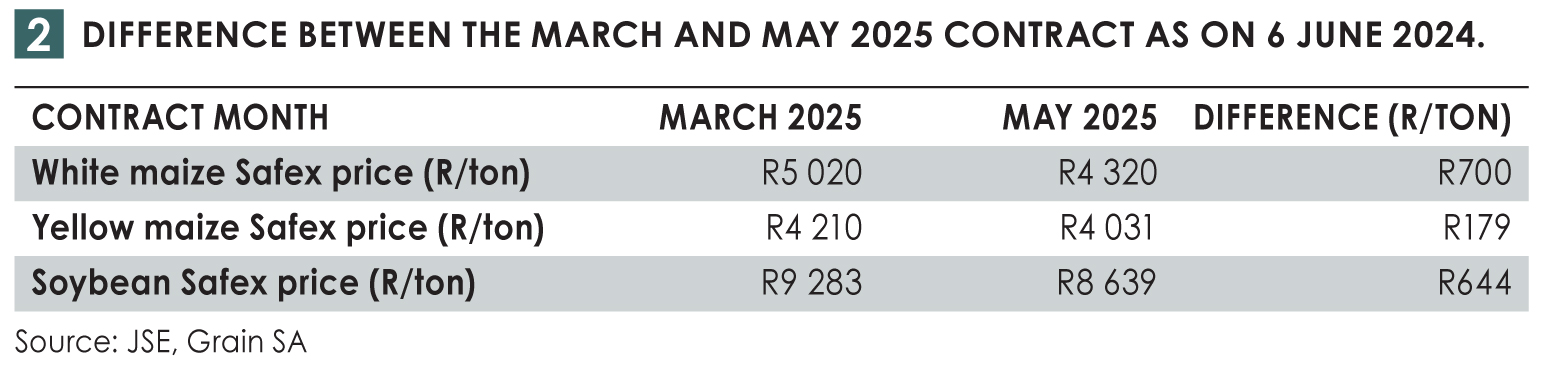

From Table 2 it can be clearly observed that the difference between the old-season price (March, when supply is low and demand high) and the new-season price (May, when producers harvest and increase supply) for white maize is already R700/ton and for soybeans approximately R644/ton.

An additional contribution to the possibility of scenario 1 is the significant increase in the number of sales of early planted white maize seed. It is also important to bear in mind that soybeans have already been adopted as a rotational crop in the western production areas, and therefore will not simply fall away.

An additional contribution to the possibility of scenario 1 is the significant increase in the number of sales of early planted white maize seed. It is also important to bear in mind that soybeans have already been adopted as a rotational crop in the western production areas, and therefore will not simply fall away.

SCENARIO 2: America’s summer grain crop

It is widely known that the corn (maize) and soybean harvests in the United States (US) have a big impact on both global and domestic grain prices.

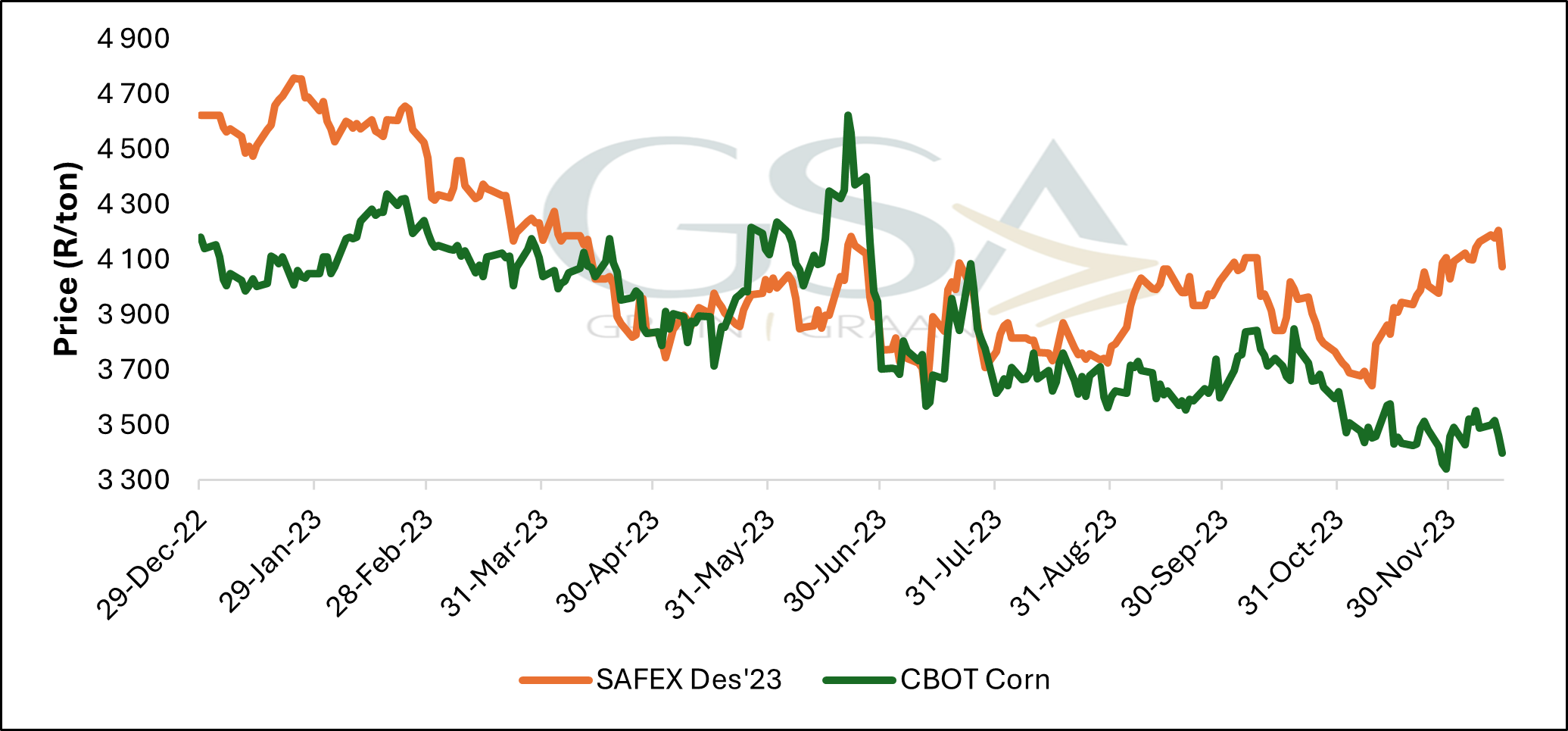

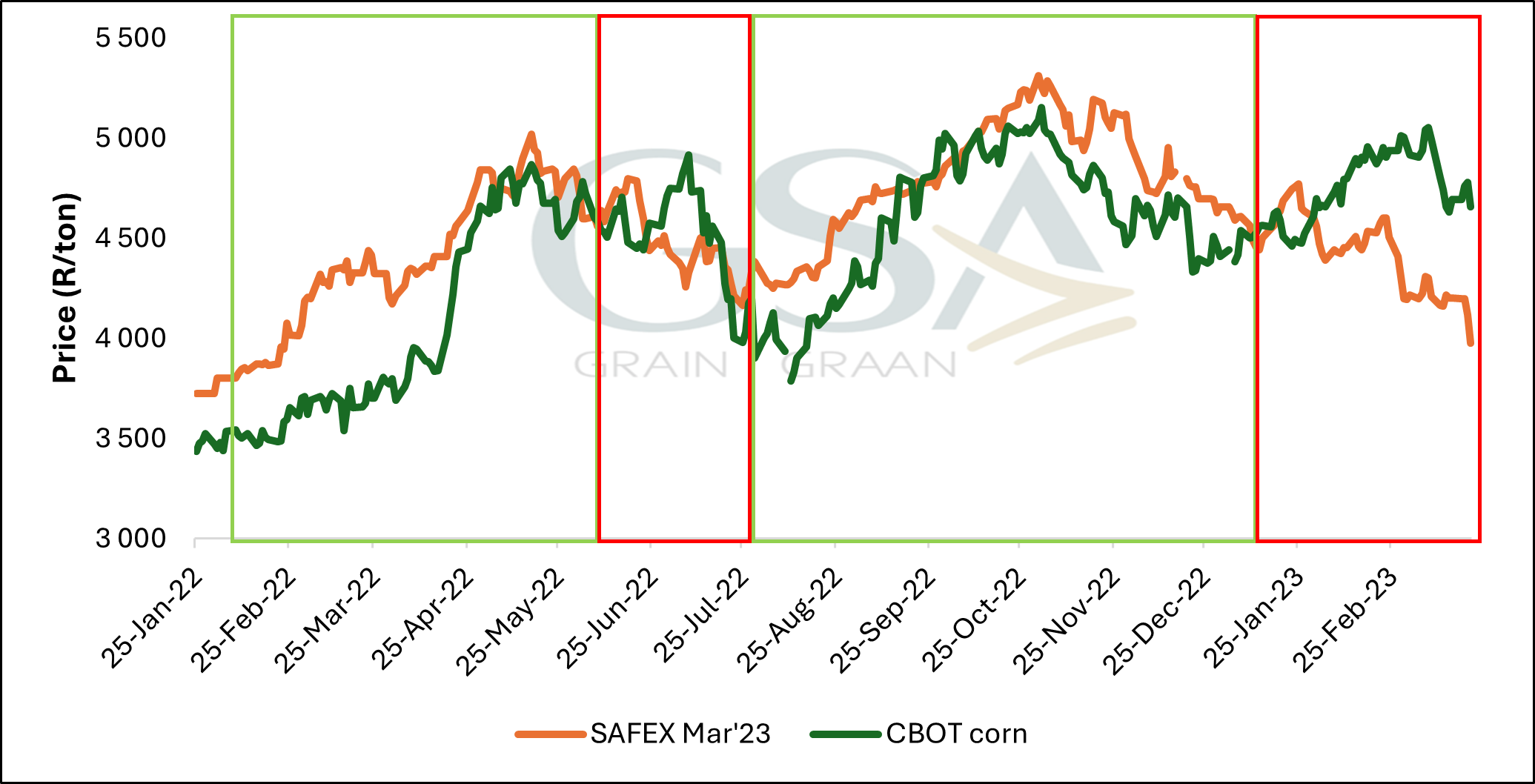

The US maize crop is planted between April and June, and then normally harvested between September and November. The opposite is true for South African markets: we plant when they harvest and harvest when they plant. This creates an inverse for market prices, which is depicted by Figures 1 & 2.

Source: Grain SA, CBOT, JSE

Source: Grain SA, CBOT, JSE

The world market got its first glimpse of US crop conditions at the beginning of June. Conditions for maize were classified as the best conditions in the last five years. As of 9 June, 74% were rated as good-to-excellent, compared to the previous season’s 61%. For soybeans, the same trend was observed. The US soybean crop was estimated as 70% good-to-excellent on June 9, compared to the five-year average of 66%.

There is still a lot that can happen in the US production season, but in the meantime, producers must keep in the back of their minds that an expected good harvest in America could put pressure on the South African market.

SCENARIO 3: Decrease in planted area of wheat

Like summer grains, winter grain producers must also be on the lookout for possible shifts in the market as the new marketing season gets closer.

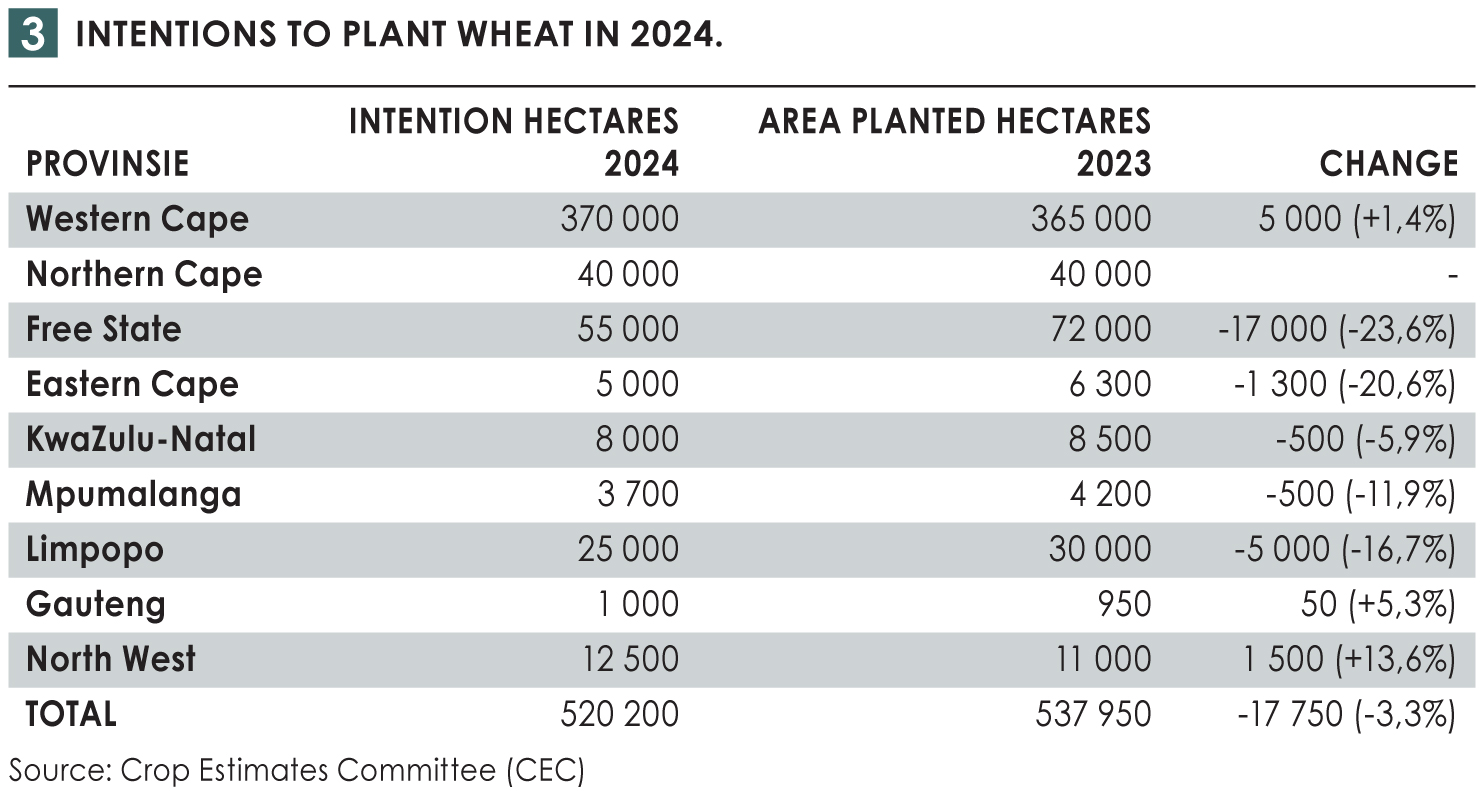

Grain SA’s 2024/2025 budgets show that profit margins in the three main winter grain production areas, namely the Swartland, Overberg and the Southern Cape, are getting tighter. The winter crops’ intentions to plant show that there is a shift in wheat and oat plantings and that some producers will plant canola instead. A possible correlation can be drawn between the profitability and the hectares planted if wheat and barley margins are compared with those of canola. The provisional area planted for winter crops was released by the CEC on 26 June, giving the market further insights into this season’s winter grain production. The national Crop Estimates Committee (CEC) released a report on 25 April in which the preliminary intention to plant wheat was announced. Table 3 presents the data visually. It is noticeable that producers in the Free State, Limpopo, Eastern Cape, KwaZulu-Natal and Mpumalanga expect to plant less wheat this season.

CONCLUSION

CONCLUSION

Marketing decisions are a challenging task, especially in times of uncertainty. This article has created three possible scenarios that both winter and summer grain producers should be on the lookout for as we prepare for the next production season. Grain SA’s economics team agrees to empower producers to make the best possible marketing decisions.