agricultural economist, Grain SA, ikageng@grainsa.co.za

The price of crude oil has increased tremendously in the past few months. This was due to a steep fall in China’s refinery activity in July and unexpected outages during August, forcing a decline in supply for the first time in five months, extending the sharp decline in global oil stocks.

Hurricane Ida inflicted mayhem on the key Gulf Coast oil-producing region of the United States at the end of August, having a severe impact on production. Furthermore, the Organisation of Petroleum Exporting Countries and allies (OPEC+) decided to maintain their restraint on supply. This decision ignored calls from the United States and India to increase output as the economic recovery from COVID-19 continues.

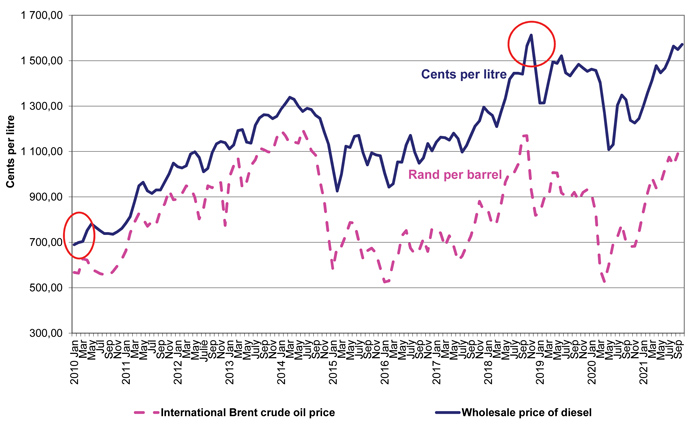

The crude oil price has increased by 78% from September 2020 to September 2021 – the last time prices were this high was in mid-2018. The rand strengthened by 12,6% against the dollar over the same period. Although the strengthening of the exchange rate has cushioned the increase in the crude oil price to some extent, the local wholesale price of diesel rose by 221 cents per litre (16,9%) in the period of a year and increased by 22,8 cents per litre (1,47%) month on month. Graph 1 shows what has happened to the Brent crude oil price since 2010. The diesel price reached a peak in November 2018 at R16,12 per litre, while the lowest point on the data under observation was in January 2010. Although the price has dipped in certain instances over the years, it has never reached that level since. The graph also shows a direct correlation between the price of Brent crude oil and fuel price movements.

Source: Grain SA

Price of diesel

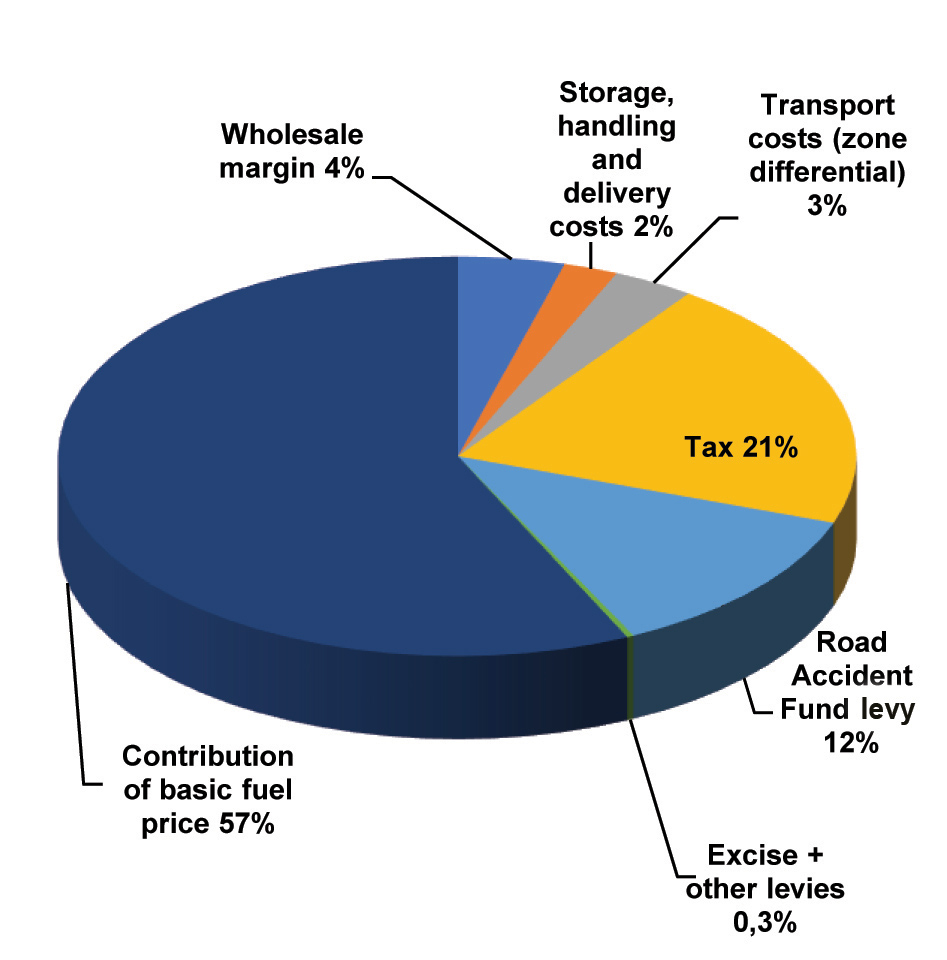

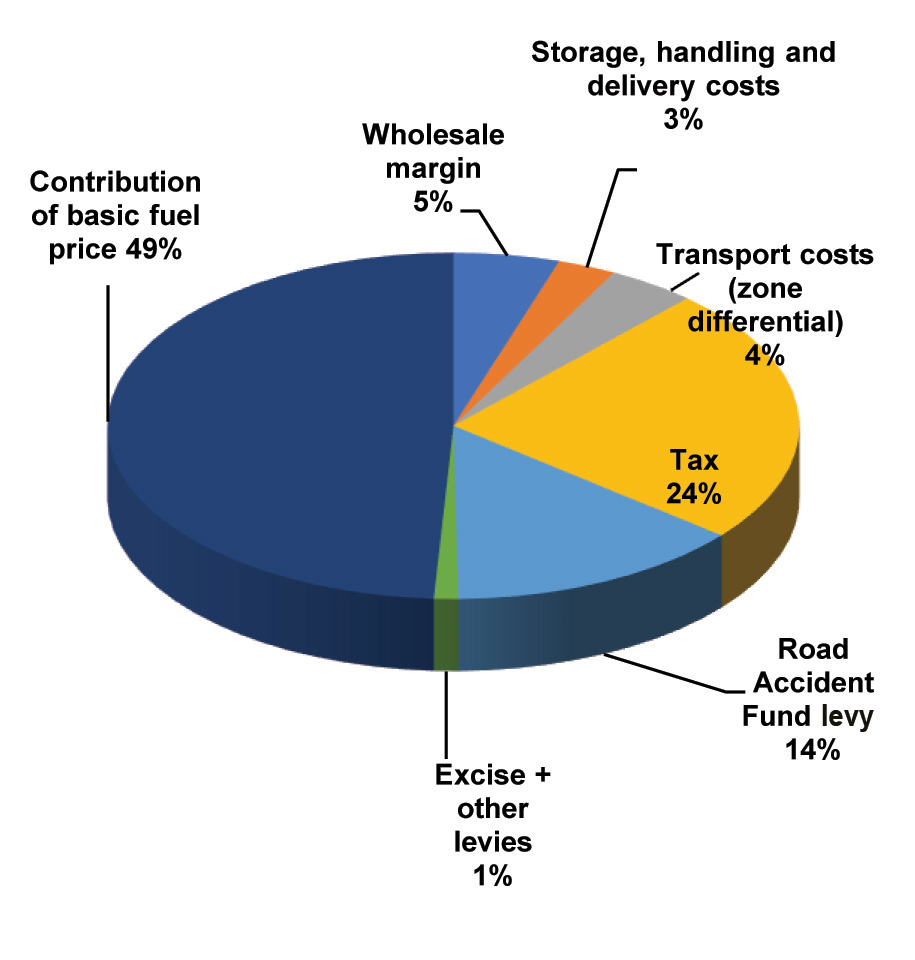

Graph 2 and Graph 3 show the composition of the wholesale price of diesel, with a comparison between October 2018 and October 2021. The year 2018 was one of the most volatile years for crude oil and fuel price movements and 2021 has similar tendencies. The price of diesel was R15,64 in October 2018 and is currently R15,72 in October 2021.

Source: Grain SA

Source: Grain SA

Compared to October 2018, the composition of the diesel price has remained constant for most categories, except for taxes which increased by 3% and the Road Accident Fund levy by 2%. While the contribution of the basic fuel price decreased by 10%, it remains the biggest portion of the costs. The contribution of the basic fuel price was 57% in 2018 and only 49% in 2021, meaning that the percentage of levies and taxes increased in weight for the local diesel price.

Since diesel accounts for about 13% of a grain and oilseed producer’s current production costs, this increase in the price can have a major impact during planting time in the summer grain production areas and harvesting in the winter production areas. Should the current trend of fuel increases continue, this will essentially reduce profit margins for the producer as input costs increase over the long run. This is against the backdrop of significant increases in agrochemical and fertiliser prices and would therefore add to the increased production costs for grain and oilseed producers.

Conclusion

With diesel contributing about 13% to a grain and oilseed producer’s variable production costs, an increase of 22,8 cents per litre (1,47%) for October and a depreciating exchange rate, local margins are under severe pressure. An increase in supply is expected to resume in October as OPEC+ continues to ease production cuts, outages are resolved and other major producers are also expected to increase production. This should see the market shifting closer to balance. However, it is only by early 2022 that supply will be high enough to allow oil stocks to be replenished. In the meantime, strategic oil stocks from the United States and China may go some way to help plug the gap currently in the market.