senior lecturer,

Department of Animal and Wildlife Science,

University of Pretoria

Pietman Botha,

Pietman Botha, SA Graan/Grain editorial team

Farming is all about making the best profit with the resources available. Producers must make the decision whether to sell their grain and weaner calves or add value to both by feeding the calves in a feedlot.

Self-produced calves or bought-incalves can be fattened in a feedlot or in pens or larger camps using commercially bought feed or home-grown feeds like maize, soybeans and hay. The profitability of the feeding calves will determine if it is possible to feed them or rather sell the grain and calves. Producers must not make the mistake to think inputs for the feedlot are for free – there is always a cost attached to inputs.

Four distinct factors that will influence the profitability of a feedlot are:

- the buying price of weaner calves or store cattle;

- cost of the feed;

- selling price of the finished cattle; and

- the performance of the cattle as influenced by management.

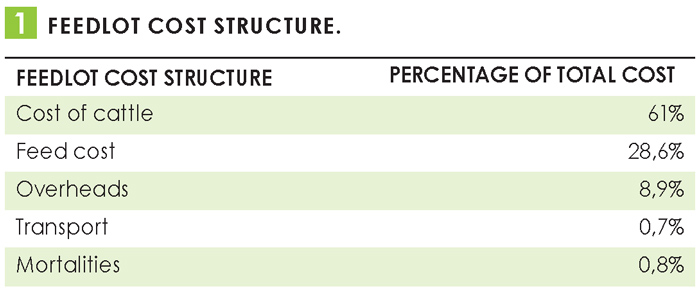

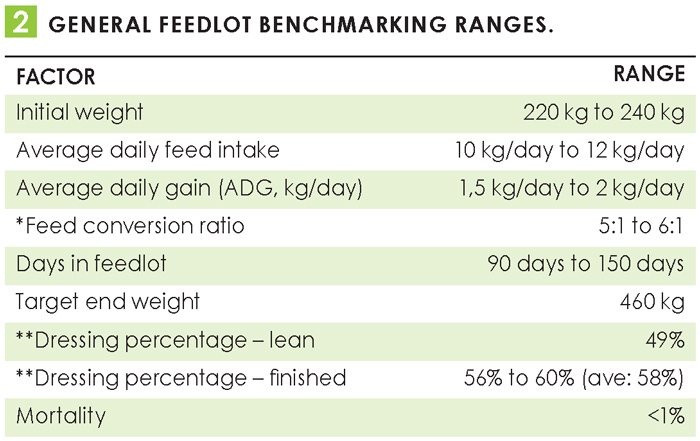

Table 1 shows the industry cost structure. Feedlot management influences the profitability and cattle performance through its effect on feed intake, weight gain and overall health. General feedlot production targets which will influence the profitability of a feedlot are presented in Table 2.

Basic feedlot economics

A feedlot operation’s profitability calculation is based on the price margin, the feed margin and other expenses. The price margin includes the difference between the purchase price and selling price of cattle, influenced by beef price fluctuations and improvement in carcass quality due to feeding. The feed margin is defined as the profit or loss made by a feedlot as a result of live mass gain in relation to the cost of feed consumed. Good management, the best quality feed at the best price and the use of growth stimulants can improve the feed margin by achieving optimal growth rates. Other expenses will include:

- abattoir costs and losses;

- transport;

- interest on capital;

- labour and operational costs;

- processing costs;

- healthcare; and

- mortalities.

Normally the feed needed for a feedlot calf will consist of 73% maize, 12% roughage and 15% beef fattening concentrate, for example Beef Fat 33 from Molatek or SB 100 from Voermol. Usually, a calf of 230 kg growing up to 460 kg will eat 1 380 kg feed in 150 days.

Pricing calculation example

Pricing calculation example

If a dressing percentage of 58% is assumed for a weaner calf of 230 kg at a price of R38,00/kg, it would mean that the producer actually could sell the carcass for R65,52/kg whilst the market price for an A2/A3 carcass is R50,00/kg. This will result in a negative price margin. The feed margin is calculated as the income from the added carcass weight above the costs to produce the added carcass weight. With a finalised weight of 451 kg, the added carcass weight during the 130 days in the feedlot will be 128,20 kg.

Using the A2/A3 carcass price of R50,00/kg, the income from the carcass will be R6 410,00. The feed cost to produce the added carcass weight is calculated by using the weight added during the growth period, feed conversion ratio and the cost of the feed. In this scenario the feed cost will be calculated as 221 kg (added weight) x 6 (FCR of 6:1) x R3,80 (feed cost/kg) = R5 038,80. This will result in a feed margin of R1 371,20.

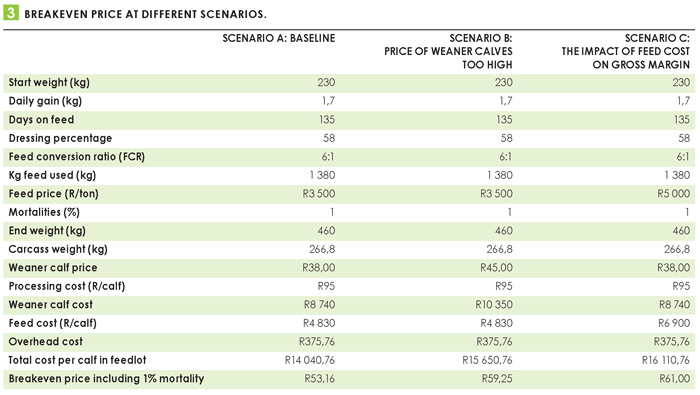

The total gross margin can then be calculated using the following equation: (price margin + feed margin) x the loss factor less other costs like dipping and dosing of about R100 per calf. The loss factor is calculated from the mortality percentage. (If the mortality is 1%, the loss factor will be 0,99.) In the above scenario, the total gross margin will be a loss of R829,78 per calf. To calculate the net margin, the other expenses including the income from the fifth quarter (skin and tripe) must be included in the calculation. Table 3 gives three examples with varying weaner prices and the effect of feed cost on breakeven prices.

These scenarios illustrate the sensitivity of a feedlot’s profit. According to information in Table 3 the breakeven prices for different scenarios fluctuate. It is important not to pay too much for weaner calves. Producers should also make sure that the price of the feed is not too high and they must focus on the consumer in order to get a better price. This will have a big impact on the gross margin.

These scenarios illustrate the sensitivity of a feedlot’s profit. According to information in Table 3 the breakeven prices for different scenarios fluctuate. It is important not to pay too much for weaner calves. Producers should also make sure that the price of the feed is not too high and they must focus on the consumer in order to get a better price. This will have a big impact on the gross margin.

Producers can do all this according to the book, but if the feeding calf does not have the potential to grow, the profit will be under pressure. The quality of a calf is important and plays a major role in the profitability of the feedlot – faster, efficient-growing cattle will require less feed and will spend fewer days in the feedlot to achieve the required final weight.

Carcass and weaner calf price projections

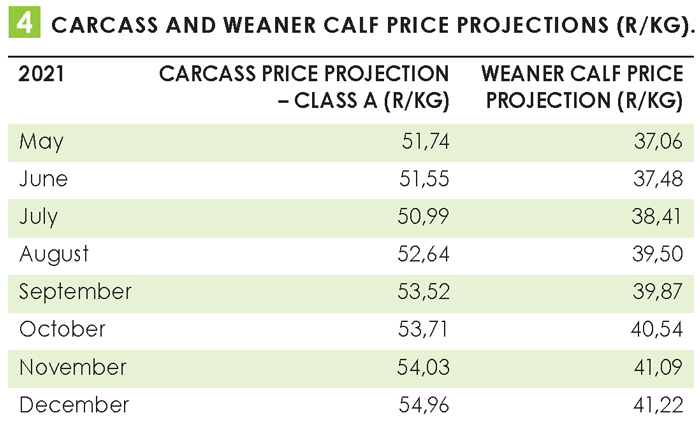

According to Table 3 the breakeven prices differ dramatically. It is important to understand that the price of beef is influenced by factors beyond the control of the producer. In Table 4 the expected carcass and weaner calf price projections done by Absa are shown. These prices can change, but still give an indication of what to expect.

Compare the breakeven prices with the expected prices and make a decision.

Other rules of thumb

- The weaner price must be less than 65% of the carcass price, with a calf price:beef price ratio of <0,55.

- To profitably finish a calf in a feedlot, 1 kg of carcass must be at least the value of 14 kg of maize. A maize:beef ration of 14:1 and higher is advantageous.

- The feed margin must be positive.

- A positive price margin is ideal, but it rarely happens in industry.

- Mortalities must be kept at a minimum, <0,8%.

For more information, contact Dr Linde du Toit at 083 741 3375 or Pietman Botha at 082 759 2991