Marguerite Pienaar, agricultural economist, Grain SA

The Agricultural and Agro-Processing Master Plan (AAMP) is a national initiative aimed at revitalising and transforming South Africa’s agriculture and agro-processing sectors. It serves as a collaborative framework bringing together government, industry, and civil society to promote growth, sustainability, and food security.

The AAMP seeks to unlock the full potential of agriculture as a key driver of job creation, rural development, and economic empowerment. By aligning public and private sector efforts, the plan provides a roadmap for investment, innovation, implementation, and coordination within the sector.

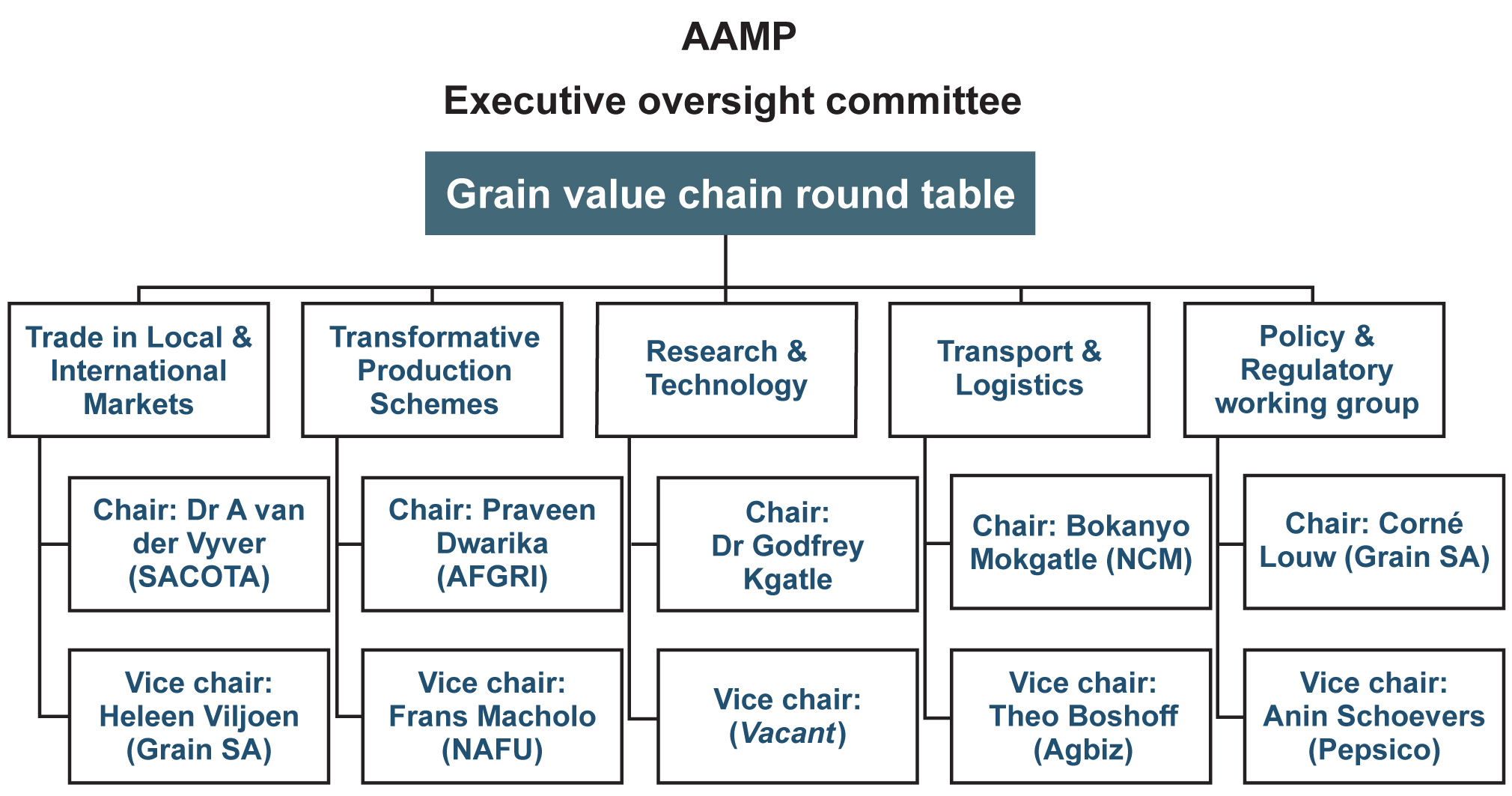

Working groups created to implement the different pillars of the AAMP

Interventions and reforms under the master plan can be divided into six pillars:

- resolving policy ambiguities and creating an investment-friendly environment

- investing in, and maintaining enabling infrastructure critical to industry, such as electricity, roads, rail and ports

- providing comprehensive farmer assistance, development finance, R&D and extension services

- improving food security, increasing production and employment, and ensuring decency and inclusivity

- facilitating market expansion, improving market access, and promoting trade

- improving localised food production, reducing imports, and expanding agro-processing exports

To operationalise and implement the goals of the AAMP, a series of thematic working groups have been established to implement the different pillars of the plan. These working groups serve as collaborative platforms where stakeholders engage in dialogue, share data and insights, and co-develop strategies to address critical issues affecting their respective value chains.

The working groups are composed of representatives from government departments, producer organisations, agribusinesses, NGOs, and research institutions.

Grain SA has fully committed to take part in the implementation of the AAMP through the working groups. Economist Heleen Viljoen serves as the vice chairperson for the Trade in Local and International Markets working group. Dr Godfrey Kgatle, who is a research coordinator at Grain SA, occupies the position of chairperson for the Research and Technology working group. Corné Louw, head of Applied Economics and Member Services at Grain SA, serves as the chairperson of the Policy and Regulatory working group, and Grain SA’s CEO, Dr Tobias Doyer, serves as co-chair of the Grain Value Chain Round Table alongside Dr Julian Jaftha from the Department of Agriculture (DoA). The Oversight Committee to which the Grain Value Chain Round Table reports, is chaired by the Minister of Agriculture, John Steenhuisen.

Progress made in the working groups

What do the different AAMP working groups want to achieve?

The primary aim of the AAMP working groups is to drive coordinated and evidence-based action within the agriculture and agro-processing sectors. Specifically, the aims are to:

- identify and address bottlenecks within specific value chains;

- develop targeted strategies to promote growth and transformation;

- enhance the participation of smallholder and black-owned enterprises;

- support policy alignment and regulatory reform;

- facilitate investment in infrastructure, research, and innovation; and

- strengthen partnerships between the public and private sectors.

With some of the groups having their seventh meeting since they were founded, the working groups and their participants are working together to revitalise and transform agriculture and agro-processing in South Africa.

The interventions and operations identified in the AAMP can be seen as ‘low-hanging fruit’ to implement first:

Policy and Regulatory working group:

Pillar 1: Resolving policy ambiguities and creating an investment-friendly environment:

- Act 36: Establish PPPs between the government, the Strategic Agricultural Inputs Forum (SAIF) and other role players to increase the capacity and eliminate the backlog of applications. The new draft of Act 36 is before parliament and is subject to discussions between the DoA and the National Agricultural Marketing Council (NAMC) with research findings on the chemical value chain to be included. (Also discussed in the commercial enabler cluster.)

- Develop a new application platform for the Registrar’s Office (Act 36) that provides clear information online about the date of the application, its progress, and the date of approval and rejection.

- Establish a web/app-based (paperless) system to monitor the application for the registrations of new technologies.

- Implement a PPP system for working on a backlog of 3 000 applications currently with the department to expedite the processing. Collaboration between public and private sectors to increase capacity.

- Provide internships and bursaries to eliminate backlogs in terms of capacity at the Registrar’s office.

- The government’s training of the private sector in terms of the required documents to be submitted.

Transport and Logistics working group:

Pillar 2: Creating enabling infrastructure:

Improve maintenance and development of new infrastructure in rural and production areas:

- Industry to identify potential roads for rehabilitation, then engage with department expansion of production, including roads – Public Works (infrastructure cluster).

- Infrastructure priorities should be linked to prioritised production areas (including data from BFAP, ARC farm assessments and the DoA to drive inclusive growth).

Invest in new grain and oilseed storage and warehouse facilities in the country:

- Based on the opportunity created by the livestock AAMP cluster, the Eastern Cape and KwaZulu-Natal have an estimated 500 000 tons of storage capacity.

- Create opportunities for funding to expand cotton gins in the country.

- The DTIC and IDC should consider incentive schemes to attract the private sector to invest in the Eastern Cape and KwaZulu-Natal in storage capacity, milling plants and warehousing.

Improve rural municipalities’ capacity to provide basic services and infrastructure:

- There is a critical need for interventions in rural municipalities to ensure reliable water and electricity infrastructure, supplies, and resources for households and agro-processing – a critical investment to ensure successful, affordable and safe food production.

Revitalise the rail infrastructure to allow grain transport by rail instead of by road:

- Invest in and upgrade rail infrastructure to reduce transportation costs, noting that the proposal and target are subject to cabinet approval.

- Increase rail shares for imports and exports up to 30% from the current 15%.

- Focus on rail transport from inland to the Western Cape to replace coastal imports – align with the discussions between the government and the private sector.

Improve port facilities and operational efficiencies:

- Investment and reforms at port facilities, noting that the following proposals and targets are subject to cabinet approval.

- Consider upgrading the grain port facility at Richards Bay.

- Extend the lease agreements for port silos and facilities to 20 years for the private sector.

- Invest in facilities to handle larger ships and offer the private sector longer-term lease agreements for these investments.

- SABT: B-priority deepens to 16 m (currently 12,5 m) to handle 70 000 to 80 000-ton ships by 2030.

- RBT: A-priority deepens to 13 m (currently 9,6 m) to handle 50 000-ton ships by 2024/2025.

- Agri Port: A-priority deepens to 13 m (currently 10,5 m) to handle 50 000-ton ships by 2024/2025.

Transformative Production Schemes working group:

Pillar 3: Providing comprehensive farmer assistance, development finance,research and development (R&D) and extension services

- Create development finance solutions for all farmers:

- Provision of financing (both capital and production inputs) for comprehensive farmer assistance, extension services, equipment, and producer training. Based on proposed AAMP interventions, initial modelling work from researchers has determined that R8 billion is required in three to five years for field crops, where R1,5 billion will be for operational expenditure, R6,2 billion for maize, R1,8 billion for soybeans, and R500 million to R1 billion for cotton.

- The following issues should be considered by cluster 3 on development finance:

- Other private financial sources (CSI/Enterprise Development Programmes)

- Foreign direct investment (FDI)

- Blended finance

- Introduce subsidised crop insurance programmes to protect farmers against extreme weather conditions. Proposed category for insurance under blended finance.

- Partner with commodity associations to expand extension services.

- Enhance partnerships between commodity organisations and government on extension services.

- Increase specialised grain and oilseed extension officers in partnership with commodity associations.

- Commit the industry to the exact number of extension officers that can be seconded annually and the timeframes.

- Assign state extension officers to transformation projects managed by commodity organisations, seed companies and industry forums.

- Improve R&D to increase the sector’s competitiveness:

- Enhance PPP approach on research – R50 million per annum required for research on climate change and conservation agriculture. Government and private sector co-funding are required.

- Establish research priorities for conservation agriculture, climate change (including mitigation and resilience) and technology as farmers are commercialised.

- Seed companies must indicate when the seeds were manufactured and their expiration dates. Smallholder farmers need to be trained to identify labelling and its significance.

- Policy support is required to align on a shared vision and strategy around R&D and climate change.

Transformative Production Schemes working group:

Pillar 4: Improving food security, increasing production and employment and ensuring decency and inclusivity

- Promote inclusive value-chain growth and production capacity:

- At least by 2050, South Africa should aim to be in the top half of the food security index, which will be possible through better data capturing methods.

- In 2030, increase grain and oilseeds growth by R6,4 billion over baseline.

- over baseline.

- Identify and prioritise production areas (including all data sources – BFAP, ARC farm assessments of PLAS farms, DoA to drive inclusive growth). This category includes areas (low-hanging fruit) with existing infrastructure and markets (typically PLAS farmland) and areas in former homelands with considerable potential but lacking infrastructure.

- Increase the percentage of black farmers in production (in value at constant prices):

- Maize: from 4,7% to 20% by 2030

- Soybean: from 3,1% to 12% by 2030

- Cotton: from 11% to 20% by 2030

- Sunflower: to 7% by 2030

- Canola: to 3% by 2030

- Malting: to 15% by 2030

- Provide statutory declarations of what has been delivered in silos and mills for monitoring and evaluation (M&E) purposes, primarily to track the progress of smallholder farmers. (Already declared at the South African Grain Information Service (SAGIS), to be monitored).

- M&E – what percentage of seed multiplication is going to emerging farmers.

- Improve the efficiency and effectiveness of state-owned enterprises (i.e., Foskor and Sasol) in producing and distributing fertiliser, chemical components, and lime.

- The goal is to replace 30% of fertiliser imports by 2030.

- Promote the use of more affordable sources in fertiliser production and their benefits.

- Create a M&E framework to track progress on the redistribution and productivity of 700 000 ha and others.

- Implement a PPP approach to land procurement, with industry advising on which land to procure.

- Increase the creation of decent jobs in the field crops value chain:

- Drive skills development programmes in grain and oilseed trading, handling and storage. AgriSETA is not functioning optimally.

- Conduct an audit of the number and skill set of graduates from institutions of higher learning and measure their absorption rate into the industry. The audit should also include an analysis of skill gaps in agriculture and agro-processing. Adopt a PPP approach for revitalising agricultural colleges and aligning their curriculum.

- The private sector should report on the number of internships it can create each year to address the issue of youth unemployment.

- Enhance skills development around mechanisation skills/tractor driving operations (South African Agricultural Machinery Association [SAAMA]).

- Estimated potential for employment creation:

- Maize: 6 236 jobs & 16 000 livelihoods

- Soybeans: 2 664 jobs & 2 000 livelihoods

- Cotton: 6 373 jobs and 6 450 livelihoods

- Sunflower: 4 082 jobs and 12 400 livelihoods

- Canola: 1 448 jobs and 4 400 livelihoods

- Malting barley: 362 jobs and 1 100 livelihoods

Trade in Local and International Markets working group: Pillar 5: Facilitating market expansion, improving market access, and promoting trade

Increase market access opportunities:

- Align field crop interventions with the livestock cluster to create additional demand for feed in formal and informal markets to promote the growth of inclusive feed markets. Based on initial modelling estimates, feed markets could grow by 600 000 tons above the baseline, especially in rural areas lacking infrastructure investments and underutilising natural resources.

- Government and private sector representatives should discuss targeted investment plans in collaboration with the Infrastructure and Investment Office of the Presidency.

- Provide immediate access to market information and crop quality reports.

Increase trade opportunities and trade facilitation capacity:

- Increase state capacity and capability to negotiate trade agreements (tariffs, NTM, SPS protocols, and SPS monitoring and accreditation).

- Develop a regional value chain concept for strategic markets in Africa and new deep-sea markets. Accurate research is required to understand the potential positive and negative impacts of the African Continental Free Trade Area (AfCFTA).

- SPS – to protect biosecurity for grains in South Africa.

Expand agro-processing capacities to enhance the industrialisation of field crops:

- Grow SMME capabilities and participation through retailer-supplier development programmes.

- Align with the Clothing, Textile and Retail Master Plan for import substitution of cotton.

- A target for market access for black businesses, including export markets and local markets (beyond primary production).

Trade in Local and International Markets working group: Pillar 6: Improving local food production, reducing imports and expanding agro-processing exports

- Increase processing capacity for 65 000 tons of maize meal and 489 000 tons of feed required in localised rural economies by 2030 – growth is dependent on the successful implementation of the livestock cluster commitments.

- Focus on processed and semi-processed goods in African markets as part of the new AfCFTA (support value chain concept agro-processing DTIC).

- Focus on value-added products exports (agro-processing cluster).

- Expand oats production in South Africa for local cereals.

- Expand sorghum production to meet school nutrition requirements.

- Increase gin capacity in rural areas where cotton is produced.

- Consider a cost-effective rail/road transport system from the inland to the Western Cape to replace imported soybean meal in coastal areas.