The failure of South Africa’s rail and port utility, Transnet, is costing the country a billion rand a day in economic output. That is equivalent to 4,9% of annual GDP or R353 billion. This was revealed in a study by the GAIN Group, a boutique consultancy focusing on contract research.

Professor Jan Havenga, director of GAIN and world-renowned market and macro logistics researcher, spoke at the Grain Handling Organisation of Southern Africa (GOSA) symposium in March this year about urgent reforms needed to turn Transnet around.

Highest on the priority list, according to him, is the input of at least R100 billion in capital expenditure to rehabilitate South Africa’s rail network and to ensure that Transnet does not go bankrupt. Prof Havenga, who is part of Operation Vulindlela that advises the presidency on matters related to macro logistics, is adamant that there can be no higher priority in South Africa than a functional rail and port system.

He said the South African treasury is reluctant to push capital into Transnet because of past failures and failing utilities such as SAA. ‘Transnet is not SAA. South Africa does not need an SAA, but it desperately needs the functions of Transnet to succeed,’ he told attendees at the symposium.

Light at the end of the tunnel

Prof Havenga said despite the growing debt of around R140 billion incurred during state capture and mismanagement following state capture, the current leadership team is more than capable of a turnaround – if supported by government. ‘Transnet has a competent new board and they have made great appointments, but they need support from treasury. There is a high level of intervention needed and if something is not done soon, Transnet will go bankrupt.’ He said the biggest concern is the more than one billion rand in interest that Transnet has to pay every month – which does not leave anything in the budget for upgrades and reform.

What makes the light at the end of the tunnel shine a bit brighter, is that there is political will from the very top to do what is necessary. ‘2023 was a disastrous year for freight rail, but also the best year in terms of reforms. President Cyril Ramaphosa announced during his state of the nation address in 2023 that a freight logistics roadmap would be drawn up and implemented. It took us a year to write and to get it approved by the cabinet and we are currently busy with the implementation which will enable urgent reforms in the freight logistics sector.’

The National Logistics Crisis Committee (NLCC) was established in June 2023, incorporating officials from the presidency and senior business people who participate in several work streams (See Figure 1). A new Transnet board was appointed in July and an inaugural board appointed to the Transnet National Ports Authority in October.

Source: GAIN

According to Prof Havenga, Transnet, led by new CEO Michelle Phillips, is working hard to fix the company’s underperforming freight rail and port operations. Coal exports in February 2024 were 20% more than in February 2023. In the same month the Cape corridor achieved its best volume since 2019. Transnet also recorded the highest volume of iron ore exports since 2020 (Figure 2).

Source: GAIN

The current state of rail in South Africa

In terms of landmass, South Africa is equal to Germany and France combined, while our GDP is 18 times smaller. ‘Countries in Europe think that we are crazy to haul 40 million tons on roads when we have such huge corridors. Worldwide rail is growing, but in South Africa we have had a huge downfall in rail volumes over the last couple of years. In 2022 we transported less volumes on our general freight business than during the Second World War,’ said Prof Havenga. Figure 3 and Figure 4 show how South Africa compares to the rest of the world in terms of indexed tons per kilometre.

Source: GAIN

How did we get here?

Looking at South Africa’s past sins in terms of rail, Prof Havenga stated that mistakes were made as far back as 1980 when deregulation and legal succession started. ‘We made the mistake to think that our rail network was big enough and that we did not need to invest further.’ He said the decision to focus and invest in roads and to keep an over-large network caused multi-level subsidisation that started the down-turn for rail (Figure 5).

Source: GAIN

According to him, the state capture legacy led to disjointed investment, challenged balance sheets, low maintenance and the non-renewal of systems. Add to this theft, vandalism, sabotage, floods, IT ransom and strikes and it is easy to see why Transnet reported a R5,7 billion loss in 2023.

The impact on agriculture

Transnet plays a crucial role in the country’s agriculture sector by providing essential transportation services for the movement of goods such as agricultural inputs, equipment, and products across the country. Inefficiencies have resulted in delays, increased costs and reduced competitiveness for South African producers and agribusinesses, ultimately affecting the country’s agricultural productivity and economic growth. Efforts to address these issues and improve Transnet’s operational performance are crucial to ensuring the continued success and sustainability of the agri sector in South Africa.

The inability to efficiently move goods from farms to markets not only results in financial losses but also creates a domino effect on various stakeholders within the supply chain. Producers are unable to access essential inputs on time, leading to decreased productivity, and consumers may face shortages or higher prices due to disrupted distribution channels. The disruption caused by Transnet’s failures highlights the critical role of logistics and transport infrastructure in ensuring the smooth functioning of the agricultural sector, ultimately affecting food security and economic stability in the region. According to GAIN’s agricultural flow chart, 85 million tons of agricultural commodities are moved annually at a cost of around R81 billion (Figure 6). According to Prof Havenga, the cost of logistics as percentage of the GDP for agriculture is 51%. That means that 51% of all agricultural inputs are affected by logistics or the lack thereof (Figure 7).

Source: GAIN

Source: GAIN

He highlighted the dire impact of Transnet’s inefficiencies on rural roads. ‘It is important to note that an interlink causes 125 000 times more damage to a road than a car. Rural roads were never intended to carry heavy loads and the effect is that farmers are struggling to get commodities to markets. If Transnet was working the way it should, we would be able to spend more money on our rural and provincial roads. They would not be as destroyed as they are and emerging farmers would be able to get their produce to market.’

The future

In March 2024 a draft Transnet network statement was published for public consultation. According to Prof Havenga, the aim is to get the private sector involved not only in operating locomotives on Transnet’s rail lines, but also to put terminals in private hands. One of the suggestions he made to this report is that export lines be sold to mines and that an entity similar to the South African National Roads Agency (SANRAL) be established for rail and ports. In other words, a parastatal responsible for the management, maintenance and development of South Africa’s rail and port network.

In announcing the publication of the draft statement, Michelle Phillips had the following to say: ‘Transnet is committed to the creation of a financially viable core network, which will culminate in the successful introduction of competition in freight rail operations. Through this rail reform process, we are going to witness a significant transformation in the sector which will see Transnet become both a provider of world-class infrastructure and a user of the infrastructure.’

She said the network statement will be finalised in the 2024/2025 financial year, and it is expected that the process for third-party access will then commence in the second half of the year.

However, Prof Havenga is concerned that the tariff proposed in the network statement is too high. ‘Some will say it is two or three times too high, but I am of the opinion that the tariff is four times higher than what it should be. Companies will continue using road where they pay no access apart from the toll fees.’

The problem according to him is that the debt incurred during the state capture years has been calculated in the new tariff. ‘Why should private companies foot this bill? The shareholders and government should pay off that debt in order to lower the tariffs. If the entire cost of network upgrading was to be assumed by users, access charges would need to be set at a level too high for most users to sustain,’ he added.

For Transnet to be sustainable, it needs to achieve rail volumes of 178 million tons a year. ‘We were on our way to 139 million tons, but by taking the necessary steps in the right direction, we might reach 151 million tons this year.’

Necessary steps according to Prof Havenga include the following:

- Increasing the market share of freight rail.

- Establishing a financial model with physical asset accounting and refinancing of Transnet’s debt.

- Rehabilitating the core rail network.

- Establishing regulatory capacity for reform.

‘These are the most important enablers to get coal and iron ore to the ports for export. We missed a huge opportunity in 2022 when the price of coal shot up from R2 000/ton to R5 000/ton due to the Russian/Ukrainian war. South Africa stood to benefit from the spiralling coal price as European states turned to alternative import sources outside of Russia, but we could not get the coal to the ports and subsequently lost R50 billion in tax revenue, while mining companies lost an estimated R150 billion in revenue.’

A typical strategy according to him would be to:

- get export and domestic minerals off rural roads;

- connect beneficiation centres with restored sidings;

- develop intermodal solutions for main routes; and

- reinvest excess main route funds into rural access.

Right-sizing the rail network

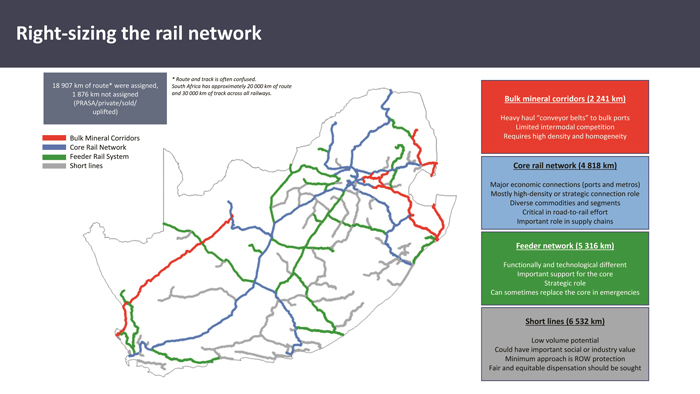

South Africa has approximately 20 000 km of route and 30 000 km of track across all railways. Through a detailed modelling exercise by GAIN, four categories were identified based principally on potential rather than current densities.

In Figure 8 the four categories include: the bulk mineral corridors (2 241 km) which serve as conveyor belts for bulk commodities to the ports; the core rail network (4 818 km) which connects ports and major urban centres and serves diverse products and segments; the feeder network (5 316 km) on which many goods originate; and a number of short lines (6 532 km) with low volume potential. The bulk mineral corridors are only 12% of route length, but represent 61% of freight potential. In contrast the short lines are 35% of route length, but represent only 1% of freight potential. The feeder network provides additional origin and termination points to the core network, which increases network density, but is not independently viable.

Source: GAIN

A crucial factor according to Prof Havenga is that the core line (blue) must be rehabilitated and that Transnet should step away from the short lines (grey). He said the total system density of the core line should be sufficient to keep costs within a viable range and that a technical audit of the core line should be prioritised.

Role of government

Overarchingly, government should establish a supply chain approach. This boils down to an integrated freight system that operates as a network with nodes and links. Prof Havenga said this would require the development of a terminal network strategy for all transport modes (Figure 9). ‘It is important that government focuses on establishing policies that are integrated on all levels. In terms of infrastructure, modal challenges and terminal issues should be prioritised. Government is further responsible for spatial planning and here we need shorter transport distances, consolidation, and focus. Even though we are seeing glimpses of a turnaround, there is still no coordinated approach to address policy, infrastructure, and spatial issues on the part of government,’ he added.

Source: GAIN

Conclusion

The South African government has set measures in place for a turnaround strategy for its failing transport group, Transnet. With a crisis committee, a roadmap and a network statement in place it seems that Transnet and government are serious about finding solutions to the staggering losses faced recently. The bottom line is that Transnet needs to move more goods to make more money. This will only be achieved with the upgrading of ageing freight rail equipment and ensuring that there are enough locomotives for its clientele.

Transnet, however, has a major debt problem and is struggling with large amounts of debt repayments, making it difficult to attain the goals it has set for reform. It desperately needs government to institute some form of debt relief. Prof Havenga believes that without this Transnet will go under and with it South Africa’s economy.