In agricultural circles much has been written about the warm El Niño weather pattern and the drought that it has caused at farm level. On 25 April 2024, the Crop Estimates Committee (CEC) estimated the South African maize crop to be at 13,4 million tons – down 19% from the year before.

However, not nearly enough has been said about rising prices and the impact on food and feed. While the global supply of white maize is limited and comes at a price, yellow maize is freely available to import and equally important to combat rising prices. It serves as the primary input for feed rations to among others the broiler industry which, in turn, provides the cheapest animal protein for many low-income households.

While the price of bread and cereals have increased by 6,1% over the last twelve months, the prices of some food items relying on the grain industry for inputs, like dairy and eggs, have seen an increase of 12% year on year. Further increases are expected to filter through those industries depending on grains and oilseed products as their main input.

The Western Cape, specifically the broader Cape Town area, has a strong feed manufacturing and broiler industry. Ironically no maize is produced in the Western Cape, but has to be transported from the Northern Cape irrigation areas or the southwestern Free State. Because of high inland transportation costs, it is usually more cost-effective to import yellow maize via the Port of Cape Town than to transport it from inland areas in years of potential shortages. Some private market analysts are forecasting yellow maize imports to be as high as 400 000 tons this year. South Africa hardly ever imports maize except in times of crisis.

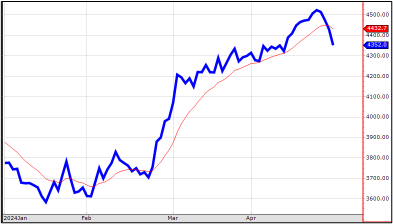

From February 2024 the JSE-traded yellow July 2024 maize price increased sharply by 22% to around R4 420,00 in April 2024. The result was that imported Argentinian yellow maize entering through Cape Town was R300 to R400 per ton cheaper compared to the inland product. (The gap has since shrunk given that harvesting is now in full swing.)

Importing maize to Cape Town would not only put a hold on rising prices but ensure that local supplies will be sufficient for inland demand as well as cross-border demand into Africa.

COFCO, a multinational grain trading company and member of SACOTA, led the initiative to book the first yellow maize import vessel from Argentina in five years. The Lila Casablanca completed off-loading its cargo of approximately 33 000 tons of yellow maize at the end of April. Their next vessel has already been loaded and is on its way. Another SACOTA member, Seaboard Trading, is also importing a vessel with a combined cargo of yellow maize, soybean oil cake, sunflower pellets and soybean hulls. More vessels can be expected to follow while prices for imported products in the broader Cape Town area remain less expensive than local maize and related products.

Note that the price difference between local and imported yellow maize is a moving target. Many factors continuously impact this comparison, such as global prices, exchange rates, seasonal trends, harvesting price pressures, on-farm loading, transport costs including diesel prices, and availability of road trucks or rail wagons, to mention a few.

Data source: SAGIS & SACOTA

Source: JSE