The local soybean industry is one of South Africa’s biggest agricultural and agroprocessing success stories. With Grain SA at the forefront, various role-players have been involved in the expansion of the industry over the past 15 years through the establishment of more processing capacity, more hectares planted, a higher demand for local products and more exports.

Thanks to this approach, export markets for soybeans were recently opened for South African producers for the first time and the planted area and yield of soybeans have reached record highs year after year. This initiative is an excellent example of how public-private partnerships with government can be used to grow an industry.

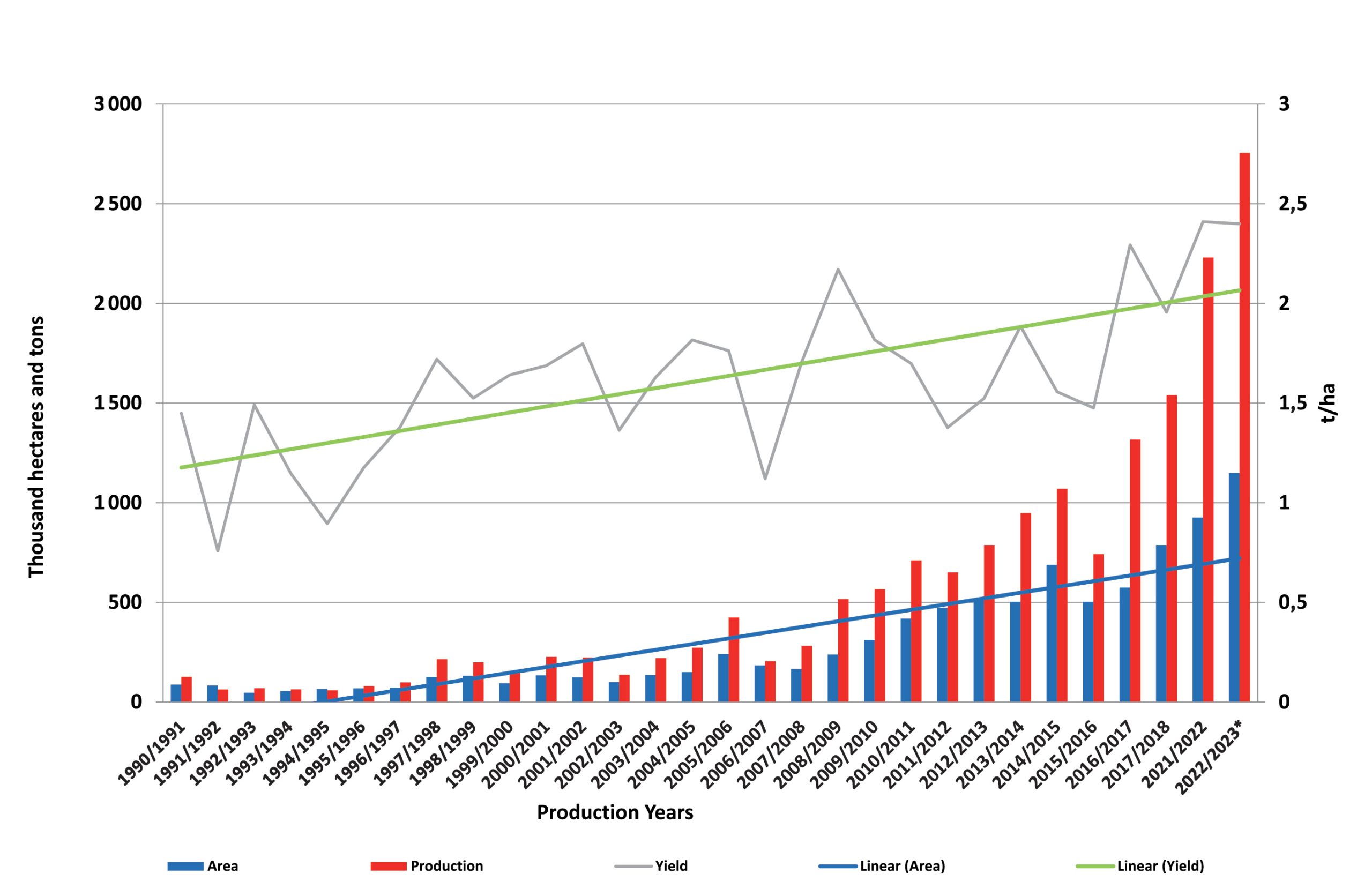

According to Dr Erhard Briedenhann, chairman of the Oilseeds Advisory Committee (OAC) and vice-chairman of the Protein Research Foundation (PRF), the total oilseed crop production in South Africa has increased from 1,32 million tons to 2,75 million tons in the past ten years. At the same time, imports of oilcake for animal feed production have decreased from 900 302 tons to an estimated 220 000 tons.

The soybean industry is at the forefront of this exceptional increase and in 2022/2023 a record of 1 148 300 ha soybeans were planted in South Africa with a record harvest of 2,75 million tons. In certain districts of the country soybeans have now become the main crop.

SA Graan/Grain contacted some of the role-players in the soybean industry to find out where the soybean success story had its origin.

Jozeph du Plessis – a former chairman of Grain SA’s soybean and sunflower working group and former chairman of the South African Cultivar and Technology Agency (SACTA) – was one of the first producers to plant soybeans in the North West Province. He said that the large maize surpluses and low maize prices in the early 2000s necessitated a shift to soybeans. The crisis reached a peak in 2005 when the producer price of maize fell from R2 000/ton to R400/ton. Grain SA immediately proposed reduced planting of maize. Producers let fields lie fallow or planted alternative crops – thus the crisis was temporarily averted. However, a long-term solution had to be found quickly.

A vision for self-sufficiency

At the Grain SA Congress in 2008 a motion was introduced by Schalk Stapelberg and his region to promote soybeans as an alternative to maize. Grain SA was requested to create market opportunities for locally grown soybeans. At this congress a vision was born for a South Africa that would be self-sufficient in its soybean requirements.

At that stage 165 000 ha soybeans were planted with a harvest of almost 300 000 tons. The general perception was that soybeans could not be grown successfully to the west of the N1 in the summer crop areas. Furthermore, the domestic demand for soybeans was very small, with little processing capacity. Grain SA’s leadership soon realised that the total value chain would have to be motivated to establish a strong soybean industry. According to Du Plessis, the plan was to present a win-win outcome for everyone.

The first major task was to create a market for locally grown soybeans in the interior of the country. For this they called in the help of the PRF and the Oilseeds Trust. Discussions were held with the government, animal feed manufacturers as well as end consumers in order to involve the entire value chain.

According to Corné Louw, Applied Economics and Member Services lead at Grain SA, the PRF and Grain SA did not agree on the initial route that had to be followed. ‘The PRF immediately wanted to encourage producers to plant more soybeans, while Grain SA first wanted to ensure that processing capacity was increased. However, this bottleneck did not prevent the two organisations from joining hands effectively to promote the industry.’

Research paves the way

Since 2006 the PRF had done a lot of research on the adaptability of soybeans and the availability of new cultivars and technology so that soybeans could be planted wherever maize is grown. According to Dr Briedenhann, the focus was placed on agronomy. ‘Large amounts were allocated for research on Rhizobium inoculants, fertilisation and pest and weed control. In this regard, we were very well assisted by the Oilseeds Trust and OAC,’ he recounted.

Not only did the PRF confer with major role-players in the international soybean industry, but they also invited some of them, such as the Brazilian Agricultural Research Corporation (Embrapa), to South Africa to share their knowledge with South African producers.

With funding from the PRF, the Bureau for Food and Agricultural Policy (BFAP) did the first soybean value chain and scenario study in 2009. In one of the scenarios that was developed in cooperation with the industry, BFAP’s ten-year projection models indicated that soybean production could increase from around 200 000 ha in 2009 to 750 000 ha by 2018. ‘It is interesting to see how this future scenario that was developed more than ten years ago, ultimately was realised with soybean production in 2018 that came to 787 000 ha,’ said Dr Ferdi Meyer, director of BFAP.

In 2011 the National Agricultural Marketing Council (NAMC) launched a study on the soybean value chain that led to the Industrial Development Corporation’s strategy to develop an import substitution programme. Grain SA’s negotiations with government resulted in the introduction of tariffs on imported soybean oilcake. Soft loans and tax breaks were granted to companies such as VKB, RussellStone and COFCO to set up processing plants and increase processing capacity. Large plants were erected in Standerton, Villiers and Bronkhorstspruit and capacity at Randfontein was increased.

According to Du Plessis, several soybean study groups were set up, with good cooperation between role-players in the input and production value chains from the outset. He specifically mentioned Patrys Lubbe from Newcastle, a seasoned soybean producer and breeder, who made a huge contribution in the Hoopstad and Schweizer-Reneke districts with adapted genetics and advice on production practices. Soybean production increased rapidly.

By 2015, South African producers had planted 687 000 ha of soybeans and harvested more than a million tons for the first time. The long-term strategy was working, but concerns about the availability of new cultivars and technology put the plan in second gear.

Both the PRF and Grain SA – with Frans Potgieter at the helm of Grain SA’s soybean working group – emphasised the need for a breeding and technology levy. To make the latest biotechnology and cultivars available in South Africa, international companies and biotechnology suppliers had to be convinced to invest money in the local industry and to release new cultivars and biotechnology here.

Impact of the levy

The levy on soybeans was introduced on 1 March 2019 and almost immediately after it was implemented, many new cultivars and biotechnology, including drought-tolerant genes (currently being tested locally), became available in South Africa.

Seed companies and breeders agree that the development of the soybean industry is strongly driven by new trait technology.

According to Dr Antony Jarvie from Corteva, the introduction of the breeding and technology levy made it possible for the South African soybean industry to share in the technology drive taking place in major international markets.

‘In countries where a large percentage of saved seed are used for soybean production, there is no incentive for the company developing transgenic traits to make new traits available to the market. A breeding and technology levy or end-point royalty enables the trait developer to earn a return on their substantial investment. Europe, Asia, the rest of Africa and Australia have chosen not to go the technology trait route and they will find it increasingly difficult to compete in the global market as the differences in research efforts increase over time,’ Dr Jarvie recounted.

Agricol’s soybean crop manager, GJ Janse van Rensburg, said that since the introduction of the soybean levy, giant leaps have been made in terms of development in the local soybean industry. ‘This has certainly created opportunities for Agricol that would not have been possible before. The pace and quality of development have accelerated remarkably.’

Since 2021, Agricol has already tested 20 new varieties of the Don Mario soybean range – 14 of these are the Intacta Roundup Ready 2 varieties. ‘To ensure that the producer receives value for the levy, thorough research and development are carried out on the new varieties,’ he added.

Exports

According to Louw, Grain SA was at the forefront of getting soybeans on the government’s priority list for export promotion. Here Dr Marinda Visser, who was at the head of research at Grain SA at the time, played an important role. Currently, around 200 000 tons of soybeans are being exported, mainly to East Asian markets.

Grain SA, in cooperation with the Department of Agriculture, Land Reform and Rural Development (DALRRD) and supported by the South African Cereals and Oilseeds Trade Association (SACOTA) also worked for the opening of the export market to China, who is currently the largest importer of soybeans worldwide (100 million tons per year). In September 2022 it was announced that the export protocols had been signed by the respective ministers of both countries and that the way was now open for South Africa to export soybeans to China.

A stalwart in tough circumstances

Annelie de Beer, researcher at the Agricultural Research Council, believes that a combination of improved yield together with favourable soybean prices, as well as the benefit of increased soil health in a crop rotation system, are the most important drivers for the rapid expansion of soybean production. She is of the opinion that the additional increased input costs have also contributed to the expansion of soybeans to drier and non-traditional soybean production areas.

Dr Briedenhann agrees that rising input costs are supporting the shift from maize to soybeans. ‘In most parts of the country, profitability calculations are increasingly in favour of soybeans.’

Du Plessis, who started planting soybeans in 2011, said this decision carried him through difficult climatic conditions. During the exceptionally dry years – 2012 to 2019 – he twice suffered major losses with maize. However, he was able to harvest a profitable soybean crop every year during the same period. ‘When the wet season arrived, producers in the west were geared to plant soybeans, with resultant large harvests and rapid economic recovery.’ He added that soybeans also did well during the overly wet conditions of the past season.

‘Looking back today, it is such a fantastic success story,’ said Du Plessis. ‘Personally, I hoped more soybeans would have led to less hectares planted to maize and smaller surpluses, but soybean hectares replaced wheat fields instead. With the benefit of hindsight, we can see that soybean hectares were increased at the expense of wheat and sunflower hectares in the Free State.’ According to him, the crop rotation impact of soybeans resulted in record maize yields in recent years. ‘Fortunately, we are currently in a situation where maize prices are quite high and export opportunities are available.’

What does the future hold?

Dr Meyer believes that the overall competitiveness of the soybean value chain will be improved with the further introduction of new seed technology and germplasm. He reckons that a constant pursuit of improved farming practices and efficiency in the handling and processing of soybeans will support further successes in the industry. However, attention must be paid to infrastructure and logistics, especially when transporting soybean meal to the coastal areas where almost one third of it is consumed.

Dr André van der Vyver, executive director of SACOTA, is of the opinion that the growth in soybean production over the last few years, and the likelihood that production will further increase, indicate that production will soon exceed demand on an ongoing basis. He told SA Graan/Grain: ‘If further opportunities for export are not created, there will be a build-up of stock. Together with Grain SA, the DALRRD and various institutions, SACOTA and its export members are working hard to create opportunities.’

However, he added that logistical constraints could hamper exports. ‘Durban’s port is currently filled to capacity. The East London port has recently opened, but it also has its challenges. The port of Maputo is another alternative that is being explored by various agricultural industries. It has always been a natural choice for export from Mpumalanga, but had its own limitations. Actually, two of the nine ships exporting soybeans departed from the Maputo port this season.

‘Given the positive outlook for soybean exports, the contribution that these exports can make to rural employment and development, and the need for an efficient and functional export value chain, it is important that we have an efficient rail and road transport system in future as well as sufficient capacity at our ports.’

For Du Plessis the vision for the future is a soybean export market surpassing that of maize. ‘With our struggling and neglected infrastructure, it makes sense to export soybeans. A hectare of soybeans produces a 2,5-ton yield, while a hectare of maize yields 6,5 tons of grain. That is less than half the load to be transported and offers high value for less tons.’

Grateful hearts

According to Du Plessis the soybean success story is an example for the economic sectors in the rest of the country. ‘This is what can happen if producers, business and government work together. Over the years, thousands of jobs have been created and with fewer imports, billions of rands worth of foreign exchange have been saved.’

Although the expansion of the soybean industry benefits all in the value chain, Du Plessis thinks producers are the most grateful. ‘On behalf of soybean producers, I would like to thank everyone who have contributed to this success story. Thank you to the leadership and staff of Grain SA for your vision, perseverance, and willingness to join hands. It kept us on our farms in difficult times.’