Adequate investment in South Africa’s agricultural research and development (R&D) is critical in enabling the sector to perform its multifunctional role within the economy effectively. This is the gist of a paper that was delivered at the 2nd Annual National Grain Research Programme that took place on 3 and 4 April in Stellenbosch.

Firstly, R&D is crucial to develop high-yielding crop varieties, livestock genetics, and improving farming techniques to increase agricultural productivity and production (for example see Adetutu et al., 2020). Secondly, R&D is crucial in developing sustainable farming practices that minimise environmental impacts, optimise resource utilisation, reduce input waste and preserve ecosystems.

Given the evidence of South Africa’s susceptibility to the impacts of climate change (for example see Tagwi, 2022), agricultural R&D is vital in developing climate-resilient crops and farming systems that can withstand harsh climatic challenges. Adequate support to the agricultural R&D system can trigger knowledge creation and accelerate innovation, granting producers access to new and improved drought-tolerant seeds, precision-farming technologies, and climate-smart practices. Evidence suggests that access to agricultural innovations better equip producers to adapt and mitigate the effects of climate change on agricultural productivity (for example see Kamara et al., 2023). Overall, R&D is critical to increasing efficiency, productivity, and competitiveness of the sector.

Institutional structure

The sector’s institutional structure plays a vital role in shaping the incentives, support mechanisms, and regulatory environment that ultimately influence the level of agricultural R&D investments. Over the last three decades, South African agriculture has undergone a significant structural transformation because of a series of institutional reforms that were used to respond to the changing political environment, changes in the agricultural economy, as well as the changing relationship of the sector to the overall economy (Liebenberg & Pardey, 2011).

This series of changes triggered both intended and unintended consequences on South Africa’s agricultural R&D system. In particular, the structural transformation of the sector has been parallel to changes in research activities as well as the level of agricultural R&D expenditure for different products/commodities. For this reason, it is imperative to track South Africa’s policy dynamics as they relate to R&D for a comprehensive understanding of the patterns in agricultural R&D and their possible implications for stakeholders.

1990 to 2000

This period was characterised by reforms that led to the democratisation, liberalisation and deregulation of various sectors of the South African economy. These structural changes addressed, in part, South Africa’s R&D system, which was primarily bureaucratic and relied on a top-down approach to technology transfer. Rationalisation of the agricultural sector led to the formation of the Agricultural Research Council (ARC) in 1992. At the time, the ARC was mandated by the national government to manage all agricultural R&D functions. The legal and operational framework for the establishment of the ARC was guided by the Agricultural Research Act of 1990. This statute outlined the framework for funding, coordinating and conducting agricultural R&D activities.

Initially, the ARC had considerable freedom and flexibility as it operated under the policy of framework autonomy, which had been introduced before its formation (Liebenberg & Pardey, 2011). At the time, the ARC’s funding was determined using a baseline formula and it was held accountable by parliament. The Science Advisory Council that reported to the president was formally tasked to oversee all science councils.

The adoption of the 1996 White Paper on Science and Technology (S&T) as policy reconfigured the mechanisms used to fund science councils (DACST, 1996). They were now funded through a parliamentary grant and a competitive innovation fund. In 1997, a comprehensive review of all science councils was conducted where it was noted that the ARC was not effective in competing for funding under this new funding mechanism (DACST, 1998). Consequently, it was criticised for its perceived lack of performance which was met with further budgetary cuts (Liebenberg & Pardey, 2011).

2000 to 2010

Several strategic science, technology and innovation (STI) initiatives were implemented by the government throughout this period to rationalise the national R&D system. Notable initiatives include the 2002 National Research and Development Strategy and the Ten-year Innovation Plan (2008-2018). The former proffered a framework to guide and coordinate R&D efforts at the national level (DST, 2002). More specifically, the strategy guided publicly funded S&T initiatives. It also complemented other strategies, such as the Strategic Plan for South African Agriculture (DoA, 2001).

The Ten-year Innovation Plan (2008-2018) was implemented to accelerate the growth of innovation across different sectors, agriculture included (DST, 2008). The plan provided a ten-year road map to guide South Africa’s innovation agenda. It sought to advance STI by encouraging the creation of a knowledge-based economy with a strong culture of innovation. Moreover, it underscored how harnessing the potential of R&D capabilities would enhance sectorial competitiveness, tackle socio-economic challenges, and ultimately foster economic growth. The plan recognised agriculture as a key priority sector and the necessity of institutional mandates to increase agricultural R&D.

2010 to present

The Department of Science and Technology (now Science and Innovation) introduced a new white paper on STI in 2019 that builds upon the foundations of the 1996 white paper (DST, 2019). It lays out a core policy for driving positive socio-economic outcomes through STI initiatives. It is guided by the National Development Plan (NDP) which recognises the role of STI in creating a competitive and sustainable economy. The white paper identifies and addresses challenges still prevalent in the National Systems of Innovation (NSI) since the adoption of the initial white paper in 1996. Amongst these, concern has been raised over plateauing performance in innovation (measured in terms of patents and products). This has been a symptom of a combination of factors which include inadequate and non-collaborative means of STI agenda setting for the country, insufficient policy coherence and coordination, weak partnerships between NSI actors, inadequate monitoring and evaluation and significant levels of underfunding (NACI, 2019).

In the context of the agricultural sector, the 2019 white paper emphasises the need for policy revisions to expand the role of STI in modernising and strengthening the sector. Moreover, it highlights how the public and private sectors can expand STI outputs through higher expenditure on agricultural R&D. While the white paper does propose a framework for policy actions regarding national STI, it is not an implementation plan. Instead, policy actions are implemented via decadal plans that are developed in collaboration with key stakeholders in industry, academia, civil society, and government. The core themes of the decadal plan (2021-2030) complement the policy intents of the white paper. For example, it focuses on discovering new economic avenues for a modernised and industrialised economy, particularly in existing industries such as agriculture.

Investments in agricultural R&D

Globally, total government expenditure has been on the rise, increasing from $11 trillion (2001) to $35 trillion in 2021 (an all-time high). Agriculture’s share in this increased spending has mostly oscillated between 1,4% and 2,2%, with considerable upticks during the 2008 global food crisis and the Covid-19 pandemic. Asia is the main driver of global public expenditures in agriculture. Between 2011 and 2021, Asia accounted for 73% of the global agricultural expenditure, while its share of global total expenditure was only 27% (FAO, 2022).

Regionally, Africa spends a relatively large share of government expenditure on the agricultural sector. Africa spent about 1,97% of total government expenditure on agriculture in 2021, with Asia dedicating 5,4% towards the same figure, whilst the Americas spent 0,62%, Europe 0,64% and Oceania 0,65%. In Southern Africa, 1,51% of government expenditure is spent on agriculture, thereby only besting Middle Africa (1,35%), with other African regions spending up to 3,03% of government expenditure on agriculture (Western Africa). South Africa, in particular, spent on average less than 2% of total government expenditure on the agricultural sector between 2020 and 2021 (FAO, 2022).

Compared to the rest of Africa, South Africa spends a fairly large amount on agricultural R&D specifically, but less than Egypt and Nigeria. In 2016, Egypt spent nearly $700 million on agricultural R&D, Nigeria nearly $450 million, and South Africa roughly $350 million (AU, 2022). Nigeria, Egypt, and South Africa are the largest African economies in that order (IMF, 2023). (The figures in this paragraph are reported in Purchasing Power Parity (PPP) with a base year of 2011 (AU, 2022)).

Globally, private-sector spending on agricultural R&D is catching up with public-sector spending. Meanwhile, the gap between spending in high-income and low-income countries is widening. Governments of middle-income nations are investing more than those of high-income ones for the first time in modern history (Pardey, Chan-Kang, Dehmer & Beddow, 2016).

With reference to South Africa’s investments in overall R&D (agricultural and other) as a percentage of total GDP when compared to countries such as China and the USA, South Africa spends less than 1% (0,83%) of the GDP on agricultural and other R&D (Our World in Data, 2023). Whereas for China and the USA the same figures are more than 2% and 3% respectively. Additionally, the number of researchers per 1 000 employed in South Africa is also relatively low. Per one million people in 2018, there were less than 1 000 researchers within South Africa. In countries such as Australia, the USA, Canada, and New Zealand, the same figure sits between 6 000 and 8 500 (Our World in Data, 2023).

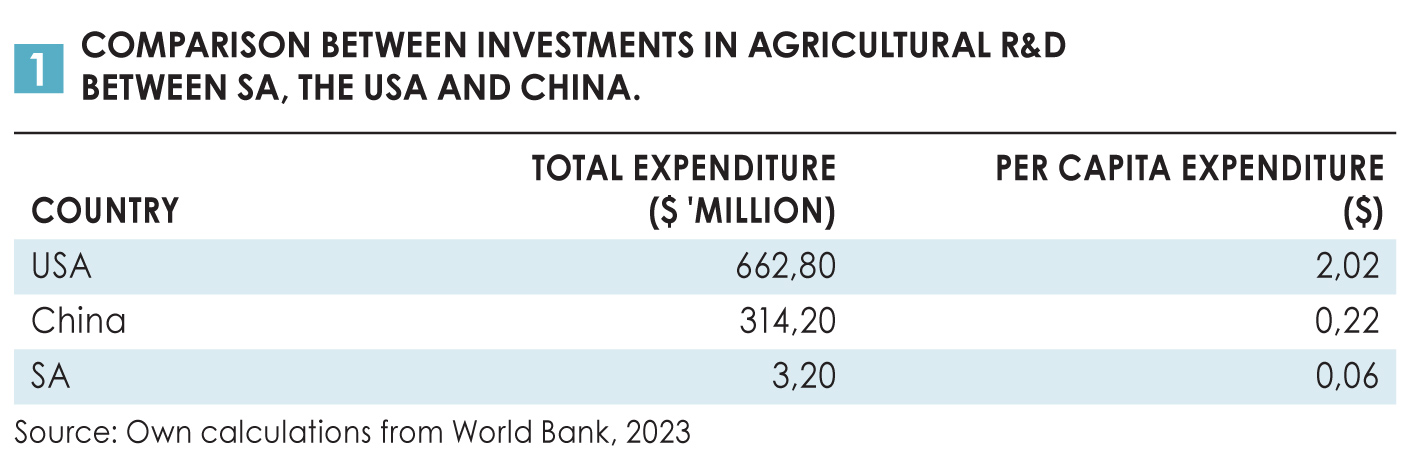

It is important to mention that the GDP figures for China and the USA were $17,73 trillion and $23,32 trillion, respectively, in 2021, whereas South Africa’s was only $0,42 trillion in the same year (World Bank, 2023). Therefore, compared to China and the USA, both large players in the global agricultural sector, South Africa is spending a smaller share of a far smaller GDP on agricultural R&D. Table 1 shows a quick illustration of the amount of money dedicated to agricultural R&D in the USA, China, and SA, in terms of overall investment as well as per capita investments.

Despite Africa almost doubling spending on the agricultural sector between 2000 and 2016, agricultural R&D spending has not increased at the same rate, increasing at less than half the pace of overall spending (AU, 2022). This pattern of spending raises questions about the seriousness of African policymakers towards improving their agricultural sectors through job creation, rural development, and other multipliers, and in essence using the agricultural sector as a driver for growth.

Despite Africa almost doubling spending on the agricultural sector between 2000 and 2016, agricultural R&D spending has not increased at the same rate, increasing at less than half the pace of overall spending (AU, 2022). This pattern of spending raises questions about the seriousness of African policymakers towards improving their agricultural sectors through job creation, rural development, and other multipliers, and in essence using the agricultural sector as a driver for growth.

South Africa’s investments in R&D

In real terms, public sector spending on the South African agricultural sector has been on a declining trend since 2008 (PPI, base year = 2015). In 2000/2001 expenditure on agricultural R&D in South Africa was roughly R14,6 billion. This value rapidly increased to about R23 billion by 2007/2008. Since then, public spending on the agricultural sector, in real terms, has decreased to roughly R17,9 billion by 2021/2022 (National Treasury, 2023; DALRRD, 2022). This represents a compound annual growth rate (CAGR) of 1,06% between 2000/2001 and 2021/2022. With public sector spending on the agricultural sector decreasing in real terms in the past decade and a half, agricultural productivity in South Africa can be assumed to have been maintained and improved in large by investments originating from the private sector in South Africa.

The South African agricultural sector has had to wrestle with the global cost-price squeeze as a result of higher input costs and poor commodity prices, all the while trying to increase yields with less and less government expenditure on agricultural R&D. It is then notable that maize yields (t/ha) in South Africa have increased from around 2,5 t/ha in 2000 to over 5,0 t/ha in 2021 (DALRRD, 2022). This yield increase has been able to increase total maize production in South Africa despite the allocation of land dedicated to maize production in the country remaining fairly stable, and even decreasing slightly, since 2000.

Investments in R&D as a share of statutory income have varied over the past five years, with a low of 33,17% in 2020 and a high of 42,7% in 2022 (CAGR = 3,2% between 2018 and 2022). Statutory funding allocated to research/cultivar development in South Africa has increased from R215 million in 2018 to R421,32 million in 2022 (CAGR of 14,36%). The increase between 2021 and 2022 was nearly R153 million. However, in real terms expenditure increased from R185 million in 2018 to R200 million in 2021, representing a CAGR of 1,94%.

In 2022, the allocations of R&D expenditure to different industries were as follows: citrus (R153,5 million), soybeans (R67,2 million), deciduous fruit (R61,7 million), winter cereal (R56,4 million), macadamias (R20,9 million), wine and grapes (R16,4 million), potatoes (R12,1 million), table grapes (R12,1 million), red meat (R5,9 million), and dairy (R4,8 million). The levy allocations towards different functions within each industry in 2022 were as follows: research/cultivar development (R421,3 million), transformation (R179,2 million), export promotion/market access (R81,0 million), consumer education/promotion (R61,2 million), information (R60,1 million), administration (R48,8 million), quality control (R36,9 million), production development (R6,6 million), and plant improvement (R0,9 million) (NAMC, 2022).

The providers of agricultural R&D expenditure in South Africa comprise the government sector, different science councils, the business sector, higher education, and non-profit organisations (NPOs). (Councils include, amongst others, the ARC and the Council for Scientific and Industrial Research (CSIR) (DSI, 2022)). Between 2011/2012 and 2020/2021, R&D spending in South Africa by the science councils far outpaced the spending by any other agricultural R&D providers. This comes with the exception of the period between 2017/2018 to 2019/2020, where the business sector spent more on agricultural R&D than the science councils did (DSI, 2022).

Expenditure of the science councils has taken a downward trajectory starting from 2013/2014 where over R1,1 billion was spent, to 2020/2021 where roughly R0,6 billion was spent (DSI, 2022). There appears to be no significant change in the government and NPO sector’s agricultural R&D spending throughout the period. The business sector’s agricultural R&D expenditure trends upwards, before retracting down around 2019/2020, closing on a value of roughly R0,5 billion in 2020/2021 (DSI, 2022).

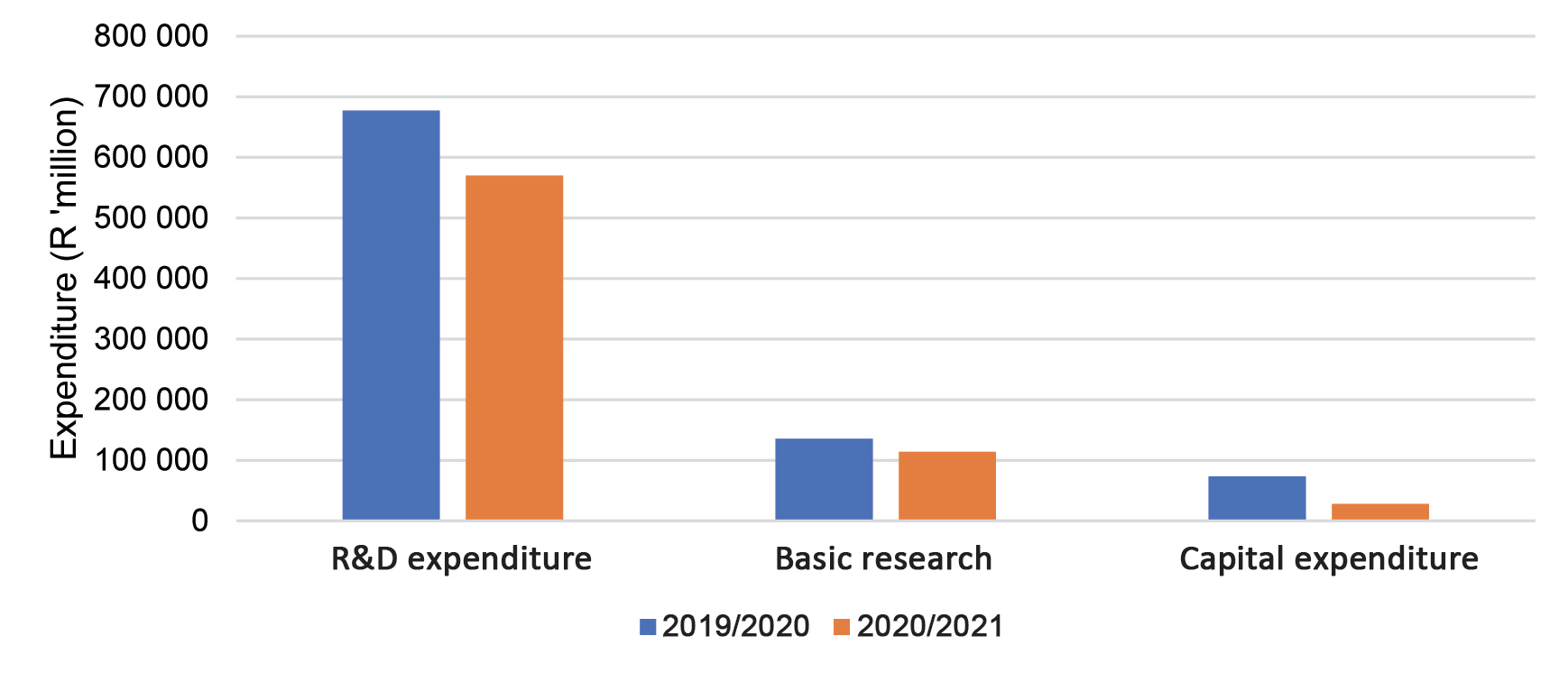

The science councils (the ARC specifically) currently account for the largest share of agricultural R&D spending. Graph 1 illustrates how the ARC allocated its funds in the 2019/2020 and 2020/2021 periods. Additionally, between 2015/2016 and 2020/2021, the ARC was responsible for 106 doctoral graduations (peaking at 28 in 2015/2016) and 240 masters graduations (peaking at 57 in 2017/2018) (ARC, 2022). On 4 April 2023, the national budget speech for 2023/2024 was delivered. The Minister of Agriculture, Land Reform and Rural Development, Thoko Didiza, announced an agricultural budget of over R17 billion. Of the R17 billion, approximately R74,7 million is being devoted towards research and technology development services (LDARD, 2023). This constitutes around 4,2% of the agricultural budget.

Source: Calculations based on data from DSI (2022)

Conclusion

Agriculture will continue to be a strategic sector for South Africa. Therefore, policymakers should prioritise spending in agricultural R&D, which will support the long-term productivity of the sector. The investments could also be paired with the private sector, which in the recent past, has already started intensifying investments in various commodities in the sector. The public and private sectors need to harness their capabilities through public-private partnerships (PPP) and through existing initiatives such as the National Grain Research Programme and Hortgro Research Forum.

These efforts should address the apparent lack of human resource capacity in agricultural R&D, which has caused slow progress, reduced capacity to effectively tackle emerging issues and an inadequate ability to leverage STI advances. These partnerships should also seek to eliminate the pro-innovation bias within the sector by ensuring that innovations are tailored to local agricultural systems.

Furthermore, all stakeholders should make joint efforts to make up-to-date data on agricultural R&D more accessible. This will contribute towards the formation of effective linkages between knowledge generators and users. Overall, emphasis needs to be placed on creating a national agricultural R&D system that is knowledge-driven, productive, resilient, sustainable and inclusive, all for supporting long-term growth of South Africa’s agriculture.

References

- Adetutu, MO & Ajayi, V. 2020. The impact of domestic and foreign R&D on agricultural productivity in sub-Saharan Africa. World Development, 125, p.104690.

- ARC, 2022. Annual Report 2020-2021 [Online]. Available:

https://www.arc.agric.za/Documents/Annual%20Reports/AR2021-low%20res-OCT%202021.pdf [2023, March 25]. - AU, 2022. Boosting investment in agriculture research in Africa: Building a case for increased investment in agricultural research in Africa [Online]. Available:

https://au.int/sites/default/files/documents/42434-doc- - BOOSTING_INVESTMENT_IN_AGRICULTURE_RESEARCH_IN_AFRICA_-_Final_14.pdf [2023,March 29].

- DACST, 1996. White Paper on Science and Technology. Pretoria: Department of Arts, Culture, Science and Technology.

- DALRRD, 2022. Abstract of Agricultural Statistics [Online]. Available:

http://www.dalrrd.gov.za/index.php/publications/45-statistics-and-economic-analysis/66-statisticalinformation [2023, March 23]. - DoA, 2001. The Strategic Plan for South African Agriculture. Pretoria: Department of Agriculture, Directorate Agricultural Information Services.

- DSI, 2022. Statistical Report 2020/21 [Online]. Available:

https://www.dst.gov.za/index.php/documents/r-d-reports/13-rd-statistical-report-2020-21/file [2023, April 12]. - DST, 2002. National research & development strategy 2002. Pretoria: Department of Science and Technology.

- DST, 2008. The Ten-year Innovation Plan (2008-2018). Pretoria: Department of Science and Technology.

- DST, 2019. White Paper on Science, Technology and Innovation: Science, technology and innovation enabling inclusive and sustainable South African development in a changing world.

Pretoria: Department of Science and Technology. - FAO, 2022. Government expenditures in agriculture 2001-2021: Global and regional trends [Online].

Available: https://www.fao.org/3/cc3749en/cc3749en.pdf [2023, March 25]. - IMF, 2023. World Economic Outlook Database [Online]. Available:

https://www.imf.org/en/Publications/WEO/weo-database/2022/October/weoreport?c=612,614,638,616,748,618,624,622,626,628,632,636,634,662,611,469,642,643,734,644,646,648,652,656,654,664,666,668,672,674,676,678,682,684,686,688,728,692,694,714,716,722,718,724,726,199,733,732,738,742,744,746,754,698,&s=NGDPD,NGDPDPC,LP,&sy=2022&ey=2022&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1 [2023, March 25]. - Kamara, AY, Oyinbo, O, Manda, J, Kamara, A, Idowu, EO & Mbavai, JJ. 2023. Beyond average: are the yield and income impacts of adopting drought-tolerant maize varieties heterogeneous?. Climate and Development, pp.1-10.

Liebenberg, F & Pardey, PG. 2011. South African agricultural R&D: Policies and public institutions, 1880–2007. Agrekon, 50(1), pp.1-15. - LDARD, 2023. 2023/24 Financial Year Budget Vote Speech [Online]. Available:

https://www.ldard.gov.za/images/documents/Speeches/2023-2024%20LIMPOPO%20BUDGET%20SPEECH%20DEPARTMENT%20OF%20AGRICULTURE%20AND%20RURAL%20DEVELOPMENT.pdf [2023, May 18]. - NACI, 2019. Framework for the Science Technology and Innovation Decadal Plan. Pretoria: National Advisory Council on Innovation.

- National Treasury, 2023. National Budget [Online]. Available:

https://www.treasury.gov.za/documents/national%20budget/default.aspx [2023, March 23]. - NAMC, 2022. Annual Report 2021/22 [Online]. Available: https://www.namc.co.za/ [2023, April 12].

Our World in Data, 2023. Number of researchers per million people, 2018 [Online]. Available:

https://ourworldindata.org/grapher/researchers-in-rd-per-million-people [2023, March 29]. - Pardey, PG, Chan-Kang, C, Dehmer, SP & Beddow, JM. 2016. Agricultural R&D is in the move. Nature. Vol. 537. 301-303.

- Tagwi, A. 2022. The Impacts of Climate Change, Carbon Dioxide Emissions (CO2) and Renewable Energy Consumption on Agricultural Economic Growth in South Africa: ARDL Approach. Sustainability, 14(24), p.16468.

- World Bank, 2023. Research and Development Expenditure [Online]. Available:

https://data.worldbank.org/indicator/GB.XPD.RSDV.GD.ZS [2023, April 15].