Agriculture is a vital sector of the South African economy, contributing significantly to employment and gross domestic product (GDP). However, producers often face numerous challenges, including climate change, market volatility, and regulatory requirements. One of the crucial decisions that producers need to make when starting a business is selecting the right legal structure.

Choosing the right business entity can have significant implications for liability, taxation, and management. In this article, the different types of business entities available to South African producers will be explored and the advantages and disadvantages of each option examined. By the end of this article, readers should have a better understanding of the ideal business entity for South African producers, depending on their specific circumstances and goals. This article is based on a segment from Finance and Farm Management, a textbook published by Standard Bank and edited by the author and Prof André Louw.

Grain SA photo competition – Martin Budgen, April 2021

According to Statistics South Africa, most farm businesses in South Africa are run as sole proprietorships. A sole proprietorship is owned by one person who runs the business intending to maximise profit. In the normal course of events, the sole proprietor will get capital either by using surplus capital (retained earnings) or foreign capital (borrowed money). As a sole proprietor, the producer accepts full responsibility for making all decisions and is personally liable for any farming losses or claims that could be brought against the farm business.

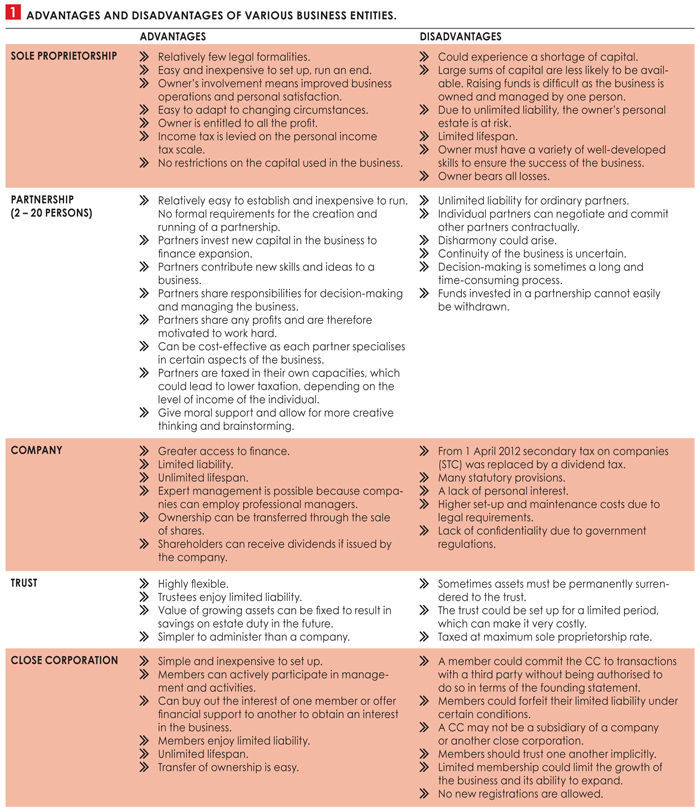

The most important advantages and disadvantages of the different business structures are set out in Table 1. To choose the most suitable structure for a specific situation, the following aspects should be considered: mobilisation of funds for ownership, capital requirements, liability, profit-sharing among owners, decision-making powers within the farm business as well as estate duty and income tax implications. Choosing the right business entity starts with proper estate planning. Poor estate planning can disrupt the continuation of the farming business – it can cause a shortage of available cash to continue farming, result in hefty income taxes as well as capital gains tax and be the cause of tension amongst heirs. It is necessary to consult lawyers, financial advisers, and tax experts to make sure that the best business structure is chosen.

When only focusing on tax savings, for example, producers bequeath their entire estate to their spouse to save capital gains tax and estate duties. That is only looking at the short-term benefits of tax savings. They may then fail to consider whether the spouse is in fact in a position to effectively manage the farm after the death of the first spouse and fail to consider the estate duty implications at the death of the second spouse.

When only focusing on tax savings, for example, producers bequeath their entire estate to their spouse to save capital gains tax and estate duties. That is only looking at the short-term benefits of tax savings. They may then fail to consider whether the spouse is in fact in a position to effectively manage the farm after the death of the first spouse and fail to consider the estate duty implications at the death of the second spouse.

The ideal business structure

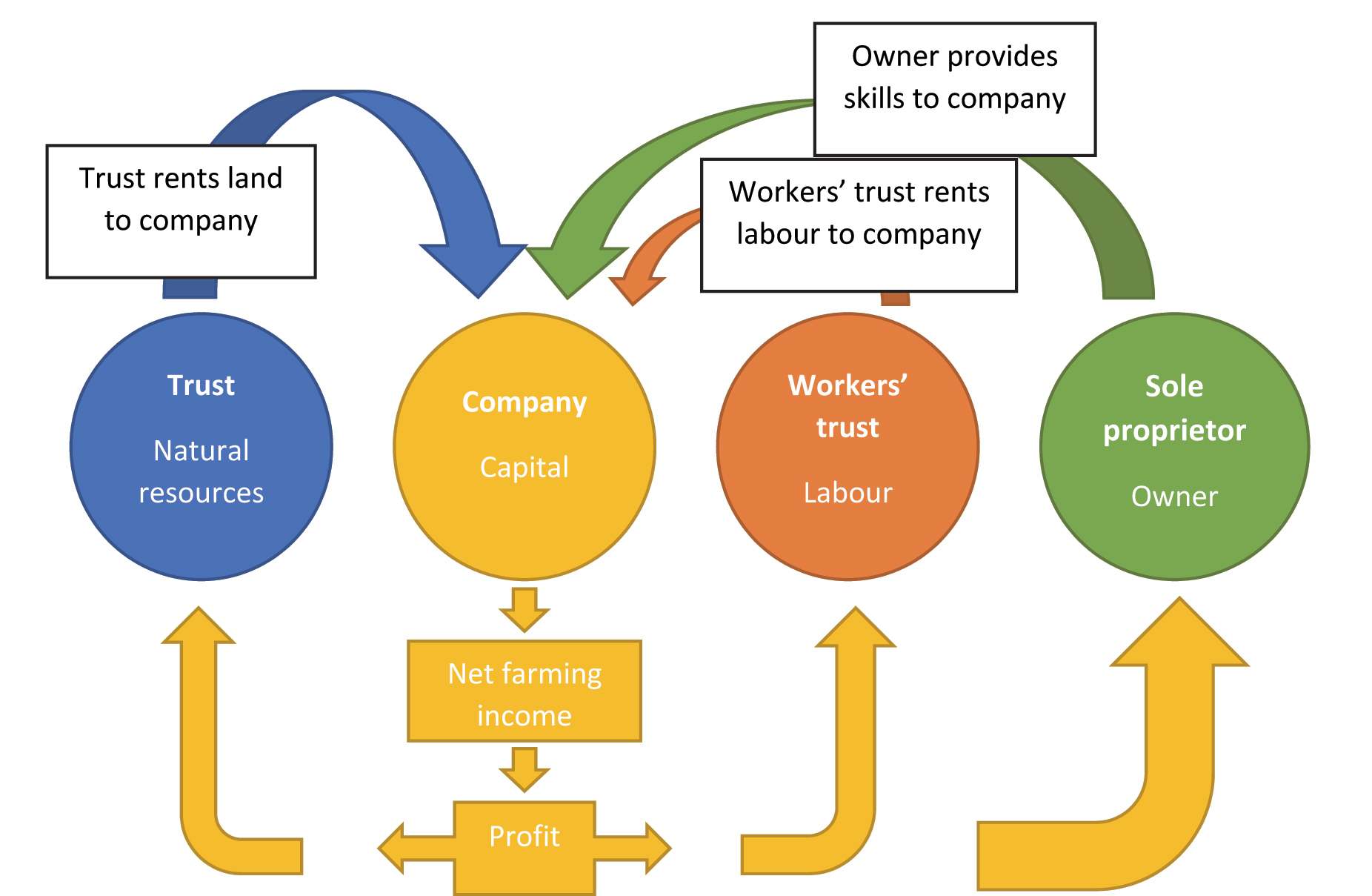

All farming units consist of four production elements: labour, capital, resources, and the owner. The ideal is to make use of a business entity (or combinations thereof) that keeps the production elements separate. The production functions can become so intertwined in a sole proprietorship that it could be nearly impossible to differentiate between the various elements. To overcome these challenges a farm business can consider the business structure shown in Figure 1.

Source: Theunissen (2005)

The operational section of the farm business consists of the company. This is where the capital that is used to produce and market the various farming products is invested. The capital consists of vehicles, equipment, and livestock, but not land. The company rents the land from the trust that owns all the natural resources. This is necessary to protect the farm from future liability claims and the growth of land value is vested in the trust which does not dissolve at the death of the producer. To have the operational part of the farming enterprise vested in a company, has the advantage that continuity is ensured at the death of the owner. It is difficult to ensure continuity if the farm business was run as a sole proprietorship.

Farm activities do not stop at the death of the owner – it might be in the middle of harvest or lambing season – and the day-to-day activities must continue. The executor does not always have the necessary skills to take over and run a complex farming business, which can harm the continuity and profitability of the operation. No bank transactions can take place without a letter of executorship, which can take months to obtain.

That is why the sole proprietor is seen as a separate entity with the producer only providing knowledge and skills to the farming operation. The forming of a separate trust to manage labour is beneficial, especially in light of future worker claims. This will allow the labourers to also share in the net farming income of the farm business. The profit that remains after that is used to pay the owner and to maintain and/or expand the assets of the farm business. This structure makes estate planning easier and keeps the production functions separate. The biggest disadvantage of this structure is the initial cost of creating the various business forms and the tax implications for each business form.