manager: Grain Economy and

Marketing, Grain SA

In the grain and oilseed markets one of the biggest role-players within the demand spectrum is animal feed. The question is always what the demand will look like in the future. How much grain and oilseed can still be planted and utilised within the local market?

One does not have to be an animal feed scientist to know that feed conversion ratio (FCR) is the name of the game. From the view of an economist this makes sense. The less one needs to feed the animal to achieve the target weight, the more economically viable the model will be due to the fact that feed is the largest cost component. The FCR in especially the broiler industry constantly improves on a linear basis in South Africa and is expected to further improve in the future. In the grain and oilseed industry the question is what the impact will be on the demand.

Current animal feed demand

To analyse the animal feed demand the Agricultural Product Requirement (APR) feed simulation model, developed by Dr Erhard Briedenhann, was used. This model determines the animal feed demand based on the population, per capita consumption of products, product import and export and a feed matrix for each species.

Based on the model, the total feed demand was 11,9 million tons in 2020 – with the largest consumer of feed being broilers at 28% (3,3 million tons), beef cattle at 24% (2,9 million tons) and dairy cattle at 21% (2,6 million tons). In terms of this article the focus will be on broiler production and the effect of the FCR projection on feed demand.

Source: APR Model

Feed demand of broilers

Broiler animal feed consumption can be divided into two different diet categories, standard broilers and broiler breeders. Standards (broilers for slaughter) consume most of the animal feed – 2,8 million tons, which is 85% of the total broiler consumption.

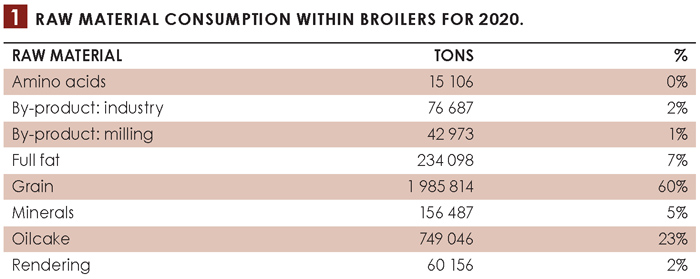

The dominant raw materials consumed by broilers are grain at 60% and oilcake at 23%.

Projection of broiler feed and the impact of FCR

Annually the Protein Research Foundation (PRF) utilises the APR model to do future protein animal feed consumption projections. Data and analyses from the Bureau for Food and Agricultural Policy (BFAP) are used to determine the macro-economic factors, price and availabilities of the raw materials. The APR model is used to determine the feed rations for all the different species.

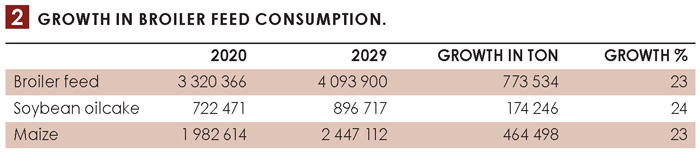

In terms of the projections based on the BFAP data, the total animal feed consumption could increase to 14 554 087 tons in 2029. The broiler feed consumption could increase with 23% from 3 320 366 in 2020 to 4 093 900 in 2029. The two main raw materials in the broiler diet, soybeans and maize, could increase with 24% and 23% respectively.

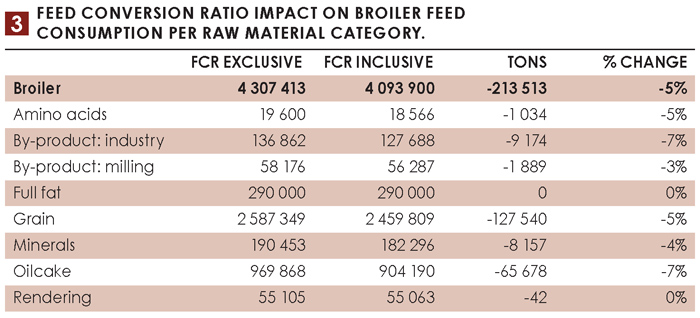

The FCR for broilers was 1,38 in 2020. If the historical trends in terms of efficiency are utilised the FCR in the year 2029 will be at a level of 1,30. What will the impact be on consumption levels in terms of this efficiency? To compare the improvement efficiency effect, the FCR efficiency will be removed from the model in order to test the net effect.

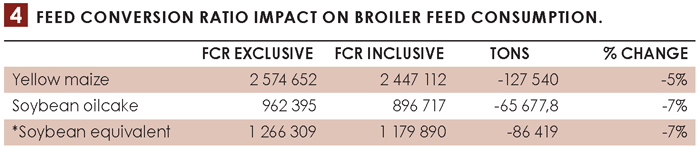

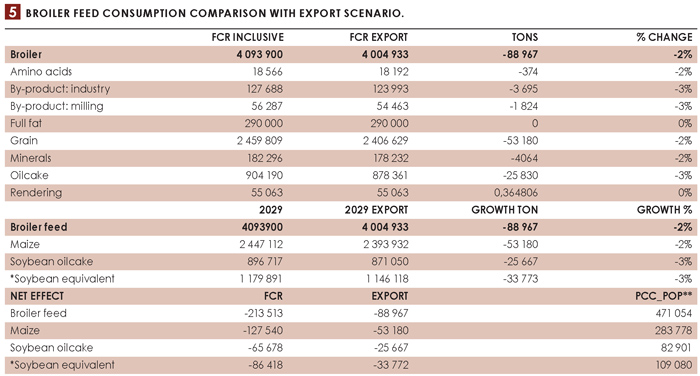

In terms of the total feed demand with the improvement of FCR, the total feed consumption within broilers is 4 093 900 tons. With the exclusion of the FCR improvement the total broiler feed increased to 4 307 413 tons. This is a total of 213 513 tons that is removed from the consumption due to increases in efficiency. The demand decrease effect on total grains used is 127 540 tons and on oilcakes used it is 65 678 tons.

The largest movements within raw materials were in terms of maize and soybeans. The maize consumption decreased with 127 540 tons and the soybean oilcake consumption decreased with 65 677 tons, an equivalent of 86 419 tons of soybeans.

In summary, although the improvement of efficiencies is needed and very important for the broiler industry, it has a considerable effect on the demand figures. By just evaluating the FCR improvements, the demand for maize and soybeans decreases with 209 637 tons from 2020 to 2029. Although the total net growth is positive, it means that there is a lot of pressure on factors such as export of animal products to keep up with the growth in local production and yield increases.

Effect of broiler product exports

Currently the focus within the poultry industry is to expand and grow exports. BFAP incorporated this into their projections and data that were used within the model. BFAP forecasted that 106 000 tons of poultry meat will be exported in 2029. This is double the current number of exports. If the growth in exports do not materialise and is removed from the model, what will the overall effect on consumption of broiler feed be?

If the exports are kept constant from 2020 to 2029 without growth, the effect is a decrease in broiler feed of 2%, which amounts to 88 967 tons of feed. With reference to the two main raw materials, maize and soybean oilcake, there is a decrease of 53 180 tons and 25 667 tons respectively. In terms of soybean equivalent, this is a decrease in demand of 33 772 tons.

Conclusion

Soybean production is growing and the projection for the future is that this will increase even more based on all the effort to get yields more constant and higher in South Africa. The per capita consumption and population growth assist in terms of demand growth for broiler feed, however, this alone is not sufficient. With the analysis, the FCR improvements are eliminating some of the demand, a total of 213 513 tons of broiler feed. This improvement in FCR is important for the broiler industry to keep it economically viable and to be competitive against imports.

The counter to this decrease can to some extent be exports of broiler meat. Based on the scenarios, the growth in exports can add 88 967 tons of feed in terms of demand. However, the difficult scenario is when the FCR improves and the growth in exports do not materialise. This will mean there is a total loss in potential demand of 302 480 tons of animal feed. For maize this is a loss of 180 720 tons and for soybeans a loss of 120 190 tons in the projection period. The good news is that the net effect will remain positive due to the increase in population and per capita consumption of 471 054 tons of animal feed.

For producers this is important to monitor and be proactive. One of the key factors in feasibility is the increase in yields. When yields increase, markets are needed for the produce. Strategically this is one of the reasons why it is very important to make sure that export markets for broiler meat are expanded and that growth takes place. Equally important is to make sure that current export markets for maize and soybeans are maintained and expanded where possible. The last factor that was explained and examined in a previous article in SA Graan/Grain, ‘Importance of the poultry industry within the grain and oilseeds value chain’ – and one that most probably will have the biggest impact – is the substitution of poultry imports. In this article imports were kept at a constant.

The APR model is maintained and updated with support from the Protein Research Foundation annually.