The International Grains Council (IGC) hosted its annual Grains Conference from 10 to 11 June 2025 in London under the theme ‘Trade and Innovation’. The event served as a vital platform for global agricultural stakeholders to deliberate on the intersection of trade policy, climate resilience, and digital transformation within the grains sector.

Juan-Pierre Kotzé form the South African Cereals and Oilseeds Traders Association (SACOTA) attended with support from the South African Winter Cereal Industry Trust (SAWCIT). He took part in dialogues that focused on the future growth of the global grain trade, innovations in biotechnology and data, and Africa’s expanding role in global food systems.

Trade and food security: a shared global priority

Speakers across the conference emphasised that import and export systems are fundamental to food security in an increasingly interdependent world. With grain production growing slowly and the global population rising (particularly in Africa) the importance of efficient, rule-based trade has never been greater.

Key trade insights included the following:

- The World Trade Organisation (WTO) and International Grain Trade Coalition (IGTC) underscored the role of transparent export policies and resilient logistics to maintain grain flows during crises.

- Discussions highlighted the importance of avoiding export restrictions, while supporting developing regions in strengthening their trade infrastructure.

- Grain trade already constitutes 10% of global merchandise trade, supporting 3,8 billion livelihoods globally.

Total factor productivity (TFP)

The conference highlighted TFP of grains as a key strategy to close yield gaps without simply increasing input use. The current TFP growth rate of 0,07% is insufficient as it was reported that a 2% growth rate is needed to meet sustainable production targets by 2050. Innovation must go beyond the lab; there is an urgent need to bridge the gap between research and development (R&D) and the distribution of information to producers as well as the implementation of the developments on farms.

Digital transformation and artificial intelligence (AI)

From drones and Internet of Things (IoT) to AI and blockchain, the digital transformation of agriculture is well underway. However, adoption and integration remain uneven. AI is already being used to predict yields, detect crop stress, and automate documentation and logistics across some global supply chains. Experts predict that the next seven to ten years will be a crucial time for further development in this aspect of growth. It is expected that AI will begin handling more trade-related decisions, allowing skilled human oversight to focus on more strategic areas.

Digital platforms like ePhyto, now adopted by 135 countries, show how versatile and efficient certification systems can be. These systems can reduce delays and fraud, enhancing trust in international trade. South Africa is also well underway in the digitisation of documentation for trade, with the country being one of the leading African countries using the ePhyto system.

Data are increasingly seen as the ‘new soil’ of agriculture, essential to growth and sustainability. The big question remains: If AI can be used for agriculture, will agriculture have the capital outlay to enable the best technology to be used for the industry, or will the industry fall behind?

Source: US Wheat Association

Grains and oilseeds

- Maize: The maize market is currently in a state of oversupply, with international prices falling below the average cost of production ($4,5 versus $4,8/bushel), creating economic strain for many producers. It is, however, expected that future demand will shift towards the expansion of ethanol and biofuel industries. Countries like Poland are leading in biofuel output, setting an example of how energy policy can absorb agricultural surplus. Additionally, the rapidly growing population in Africa and changing dietary patterns will likely increase maize consumption across the continent. While global red meat consumption may stabilise, the demand for maize in energy and other feed industries is expected to rise steadily, securing its relevance in the global grains economy despite current pricing challenges.

- Wheat: The wheat outlook presented at the conference was cautiously optimistic. Europe is experiencing favourable conditions, supported by improved vegetation indices, while Russia and the United States are expecting stable or slightly improved yields due to favourable planting and weather trends. However, China’s wheat production may decline, as prolonged dry conditions and heat stress threaten yields in several key regions. Globally, wheat stocks are trending upward, offering some market stability, although Argentina remains an outlier with relatively tighter supplies. Despite this balanced outlook, wheat markets are facing increased pressure from oilseeds due to their higher economic returns and biofuel potential.

- Pulses: The global pulses industry is under pressure to scale up, both in terms of production and productivity. Current global output stands at approximately 92 million tons, which is well below the estimated 119 million tons required to meet basic global nutritional needs. Despite growing demand, yield improvements in pulses remain modest, with a compound annual growth rate of just 0,66% since 1961. The European Union in particular remains heavily reliant on pulse imports, with self-sufficiency often falling below 60%, especially for lentils and chickpeas. This dependency creates potential trade opportunities for developing nations but also reflects the broader need for innovation and investment in pulse cultivation systems.

- Oilseeds: Soybeans and other oilseeds continue to attract significant interest across global markets because of their versatility and profitability. A key factor driving this trend is rising demand for soybean oil in biofuel production, especially in the Americas, where investment in renewable energy is increasing. The increase of soybean production for oils also increases the supply of soybean meal. The demand for soybean meal has also seen an increase, making the increased availability of this by-product beneficial for the livestock industry. China remains the world’s largest soybean importer, sourcing 70% of its supply from Brazil, but new demand growth is emerging in markets such as Egypt, India, and Southeast Asia. As a result, oilseeds are becoming a preferred crop choice for many producers, with profitability and demand making this an attractive product for expansion.

The African continent

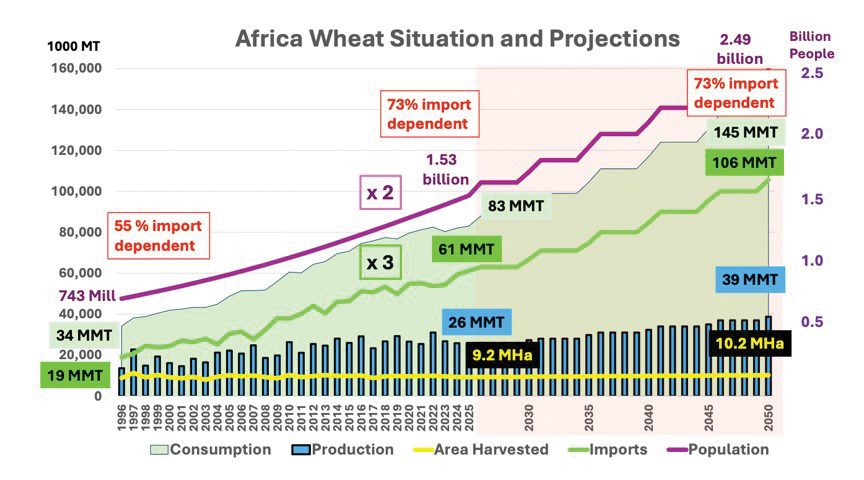

Africa was a major focus at the conference, both as a powerful driver of future demand and as a region facing deep structural challenges in trade and agricultural development. The continent’s population is projected to double by 2050, a demographic shift that will be accompanied by significant changes in dietary preferences, most notably a transition toward more protein-rich and processed foods. Among the grains, wheat demand is expected to surge, with Africa forecasted to lead the growth in global wheat imports over the next 25 years.

Despite this strong demand outlook, many African countries, including South Africa, continue to struggle with logistical and infrastructural limitations. Port congestion, slow discharge times, and inadequate storage capacity were repeatedly cited as major obstacles. For instance, the decreased use of the rail network in South Africa is forcing the industry to make use of the more expensive alternative, namely truck transport.

Conference participants stressed that Africa should not attempt to achieve full self-sufficiency in every grain but instead should focus on specialising in economically viable crops, supported by improved trade infrastructure and storage systems. Strengthening intra-African trade routes, enhancing logistics efficiency, and maintaining strong international partnerships will be essential to safeguarding the region’s food security and cushioning it from global market volatility.

The IGC Grains Conference 2025 highlighted that the global grains sector is entering a new era, one shaped by innovation, shifting consumer dynamics, climate change, and geopolitical pressures.

It also made clear that old models of production and trade are no longer sufficient and agriculture needs to adapt to the changing environment in terms of technology and innovation.

Key takeaways for South Africa and the wider region include:

- investing in smart infrastructure and digital tools;

- strengthening public-private partnerships;

- focusing production on competitive, climate-suitable crops; and

- engaging actively in international trade and regulatory platforms.