Dr Godfrey Kgatle, research coordinator, Grain SA

The Protein Research Foundation (PRF) and the Oil and Protein Seeds Development Trust (OPDT) hosted a soybean symposium for South Africa’s soybean industry on 29 July at the CSIR Convention Centre in Pretoria. The purpose of the symposium was to share critical information on the development of the South African soybean industry and its future outlook. This event brought together researchers, producer organisations, input suppliers, agribusinesses, policymakers, and producers.

What made this symposium especially resonant was its dual lens: a close look at Brazil’s globally competitive soybean model and an assessment of South Africa’s own growth path, opportunities, and structural bottlenecks. From genetics to disease management, and from producer trust to infrastructural gaps, the discussions were honest, technical, and at times, challenging.

The Brazilian soybean industry

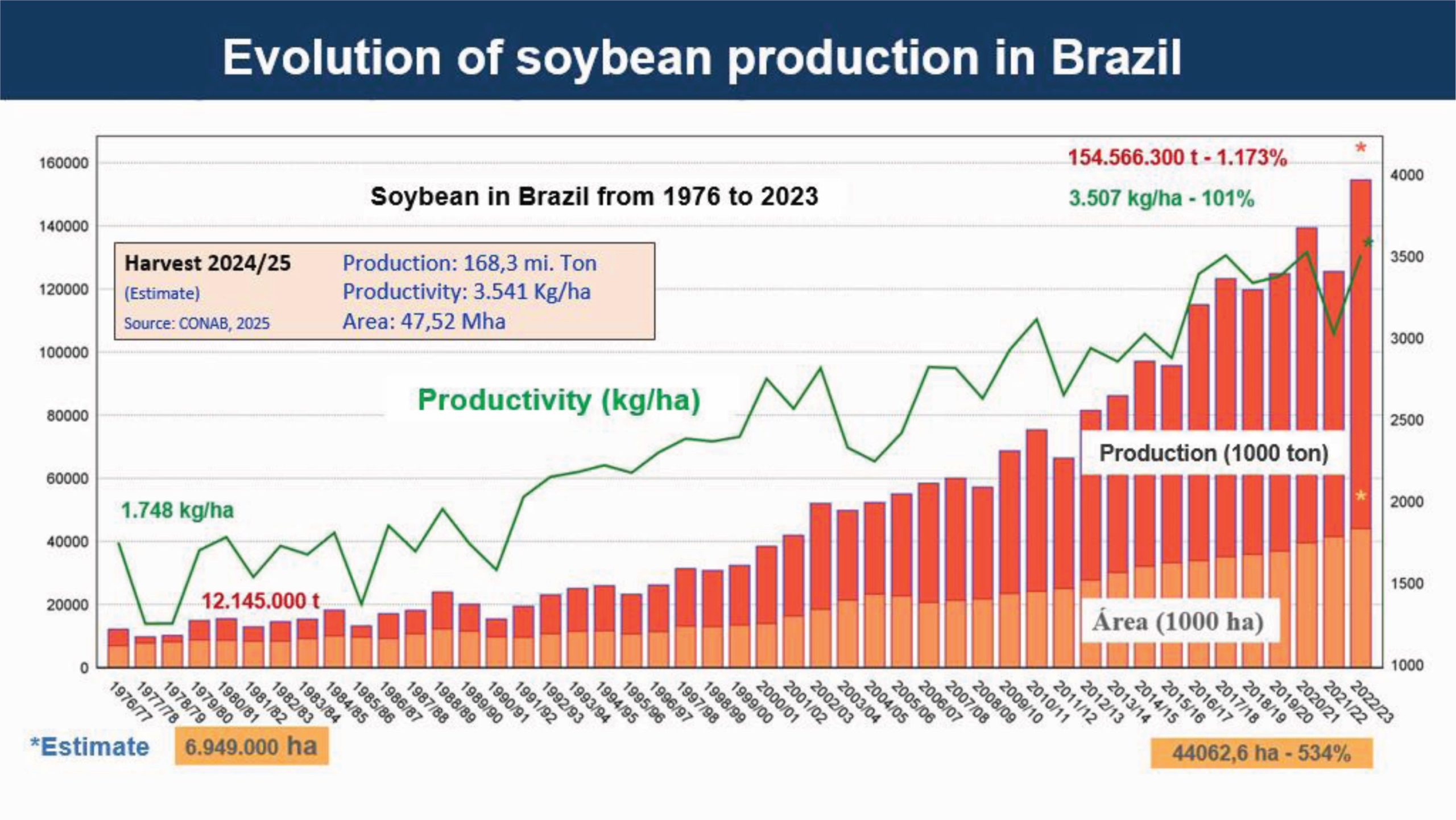

The keynote presentation by Dr Leandro Diniz, a plant geneticist and breeding specialist from Embrapa, Brazil, set the tone. The position of Brazil as a global leader in soybean production is not merely a story of increased area planted and output. Dr Diniz described Brazil’s soybean industry as the ‘soybean complex’ due to its interconnected institutions, ranging from research bodies to cooperatives, producers, and exporters.

Central to Brazil’s success is the cooperative system, which is equivalent to the organised agricultural systems of South Africa. These ‘farmer organisation’ structures started in the 1970s, enabling all the small and medium-scale producers across various commodities, mostly from the southern region of the country, by providing them access to inputs, machinery, training, trade facilitation, and financial services, including cooperative-owned banks. As of recently, approximately 200 000 producers operate within 59 cooperatives. This has led to increased soybean production from 12 million tons in the late 1970s to over 154 million tons in 2024, which led to a 101% increase in the yield.

Despite this progress, the soybean industry has experienced challenges. Logistical inefficiencies, especially a 65% dependency on road transport, cost the country billions of dollars annually. Brazil’s soybean production has increased beyond its storage capacity, so alternatively, producers use silo bags to temporarily store their beans, and some are forced to export their product directly from the farm. Soybean exports dominate Brazil’s trade, with 63% of production exported raw and 36% processed domestically into meal and oil.

The integrated approach of the cooperative system in Brazil has shown that yield improvement is not only influenced by the use of certified seed technology but also by how producers are supported, organised, and connected to functioning infrastructure and markets.

The future of the South African soybean industry and global competitiveness

The trajectory of soybean production has been one of South Africa’s most remarkable agricultural success stories in recent decades. Prof Ferdi Meyer of the Bureau for Food and Agricultural Policy (BFAP) traced this transformation from just 65 000 ha in 2007 to over 1 million ha planted today, supported by strong growth in the animal feed industry, policy incentives, and investment in domestic processing.

Current crushing capacity sits at 2,9 million tons, enough to meet local demand for soybean meal. However, as Prof Meyer noted, there are still key vulnerabilities within the value chain. Clear policy guidelines are important to promote increased investment in more crushing plants. Infrastructure also remains a persistent hurdle, particularly limited rail access to ports, which reduces export competitiveness.

Although the South African soybean industry has trailed behind leading global producers such as the United States, China, and Brazil, there have been improvements in yields and adoption of cutting-edge technology. With demand for feed now reaching a stagnation or a slowdown due to lower meat consumption and constrained consumer incomes, Prof Meyer argued that the industry must begin exploring export routes and regionally expanding production, including in underutilised areas such as the Eastern Cape.

Impact of new cultivars and technology on soybean production in South Africa

The panel discussion, moderated by Dr Lukeshni Chetty, general manager of the South African National Seed Organisation (SANSOR), tackled two of the most critical issues within the industry, namely cultivar performance and technology adoption. Speakers from leading seed companies, including Facundo Stella (GDM), Adriaan Jordaan (Bayer), Dr Derick van Staden (AST), and Antony Jarvie (Corteva), agreed that while genetic improvements have been significant, the on-farm results remain mixed.

Van Staden reminded the audience that although soybeans were introduced as early as 1925, it wasn’t until the maize price decrease in 2007 that the crop began gaining commercial relevance. He emphasised that limited producer confidence in new genetics and the current seed system is slowing yield progress to some extent due to the prevalence of farm-saved seed. He stressed that broader participation, stronger extension support, and transparent variety trials are essential to reverse current seed-saving trends.

Jarvie pointed out the positive evolution in maturity groups (from 5-6 to 4,5-7,5) and plant architecture, which now favours compact, high-density systems suited for mechanisation. He noted the rise of no-till and minimum-till agricultural practices as a promising solution for soil health and efficiency, while herbicide-tolerant (HT) technologies have enhanced crop rotation flexibility and weed control.

On stewardship, Jordaan warned that managing resistance (especially to BT traits) requires stricter adherence to refuge protocols. Although BT soybeans are not yet widely adopted in South Africa, the infrastructure to support proper stewardship is gradually improving. He called for consistent enforcement to prevent long-term resistance

build-up.

Stella brought a crucial perspective: the success of a cultivar is not solely in its genetics, but in how it is used. ‘It’s not just what you plant, it’s when, where, and how,’ he stressed, urging deeper producer-company collaboration to match seed traits with specific regional conditions.

During the Q&A session, a producer raised concerns about underperforming cultivars (especially if one looks at the results in the cooler, eastern areas of soybean production), referring to yield data presented by Annelie de Beer during the soybean breakaway session at the Grain SA Congress earlier this year. He explained that this has led many producers to revert to on-farm seed saving. The panel acknowledged the issue and reiterated that cultivar performance is often region-specific. Corné Louw from Grain SA echoed the call for improved collaboration between producers and seed companies, especially regarding the relationship between high seed prices and farm-saved seed. He said the price level of seed companies and the price and risk of farm-saved seed should meet somewhere for a more sustainable approach.

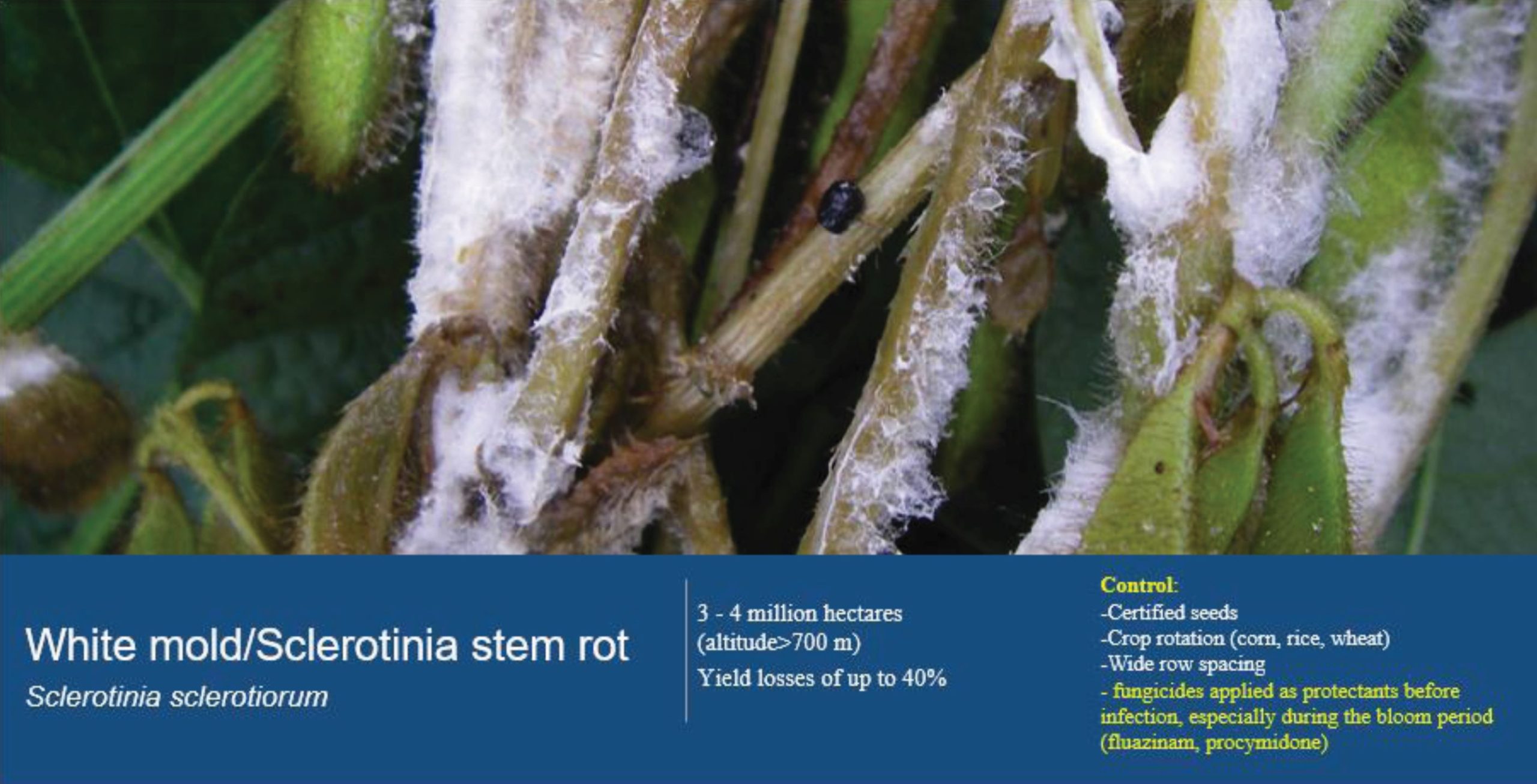

Progress in Sclerotinia management and control in South Africa

Dr Lisa Rothmann gave a presentation on the growing risk of Sclerotinia, which is severely impacting broadleaf crops such as sunflowers and soybeans. Yield losses of up to 80% have already led some producers to exclude sunflowers from their crop rotations, threatening diversity and soil health.

Dr Rothmann’s work includes fungicide evaluation trials across three climatic zones to identify chemical and biocontrol alternatives to benomyl, which may soon be unavailable. She also highlighted the role of the South African Sclerotinia Research Network (SASRN), a collaborative platform that links researchers, extension workers, and producers to improve surveillance, diagnostics, and disease response.

SASRN is also engaging with producers directly through outreach, articles, and its community of practice, aiming to build resilience in disease-prone regions while supporting emerging farmers who are particularly vulnerable to input and knowledge gaps.

Improving nitrogen fixation through better inoculation

Nadine Loubser from MBFi focused on the foundational role of nitrogen in soybean productivity. She explained that effective nodulation, driven by rhizobia bacteria, is essential for nitrogen fixation, and that application rates in South Africa (300 ml/100 kg of seed) tend to be higher than in countries such as Argentina and Brazil.

Her presentation stressed that inoculation strategies must be tailored to local soil health and existing nodulation levels. MBFi’s formulation addresses several issues, such as strain quality, seed compatibility, and storage conditions, and it aims to provide more consistent field results. With increased bacterial concentrations needed in poor soils, she highlighted the importance of producer training on rhizobia use and biological input handling.

Integrated pest and weed management: Brazil’s sustainable approach

Dr Diniz returned in the final session to discuss Brazil’s integrated pest management (IPM) strategies, especially in the context of resistance. He explained that IPM must prioritise cultural and agronomic practices such as crop rotation with monocots, proper sowing windows, no-till systems, balanced soil nutrition, and removal of volunteer plants before resorting to chemical control.

Brazil’s soybean industry faces a variety of pests and diseases, from Asian soybean rust to resistant weeds such as pigweed. He warned against overreliance on fungicides and herbicides, noting that successful disease control in Brazil rests on certified seed use, disease monitoring, and ‘calendarisation’ to avoid peak infection periods. The same principles could be applied in South Africa to strengthen long-term resilience and reduce chemical resistance.

Conclusion

The symposium closed on a reflective note. While South Africa has made impressive strides in soybean expansion and processing capacity, the next phase of growth will require more than hectares; it will demand trust, systems thinking, and better collaboration between all players in the value chain.

Whether it’s adopting appropriate cultivars, managing pests more sustainably, or rebuilding confidence in the seed system, the messages from this year’s symposium were clear: we need to move beyond isolated interventions and towards a more aligned, responsive, and innovative soybean industry. Learning from Brazil’s experience, while fine-tuning our approach, could provide the roadmap we need to capitalise on the growth of the industry.